AlgoTrendTraders Weekly Report - When the Leaders Stumble, the Rest can Shine

Disciplined, Rules-Based Trading

Thomas Meyer, Editor | January 19, 2026

Email: algotrendtraders@gmail.com | X: @AlgoTrendTrade1

AlgoTrendTraders Weekly Report - When the Leaders Stumble, the Rest can Shine

Welcome to this week’s AlgoTrendTraders report. We hope you’re enjoying and learning something that helps you in these newsletters. We want you to understand how you can control your risk more effectively.

The data and charts shown in this report are not meant to be recommendations and no buy/sell information is inferred. Please read the disclaimer underneath the charts.

Tom’s Musings

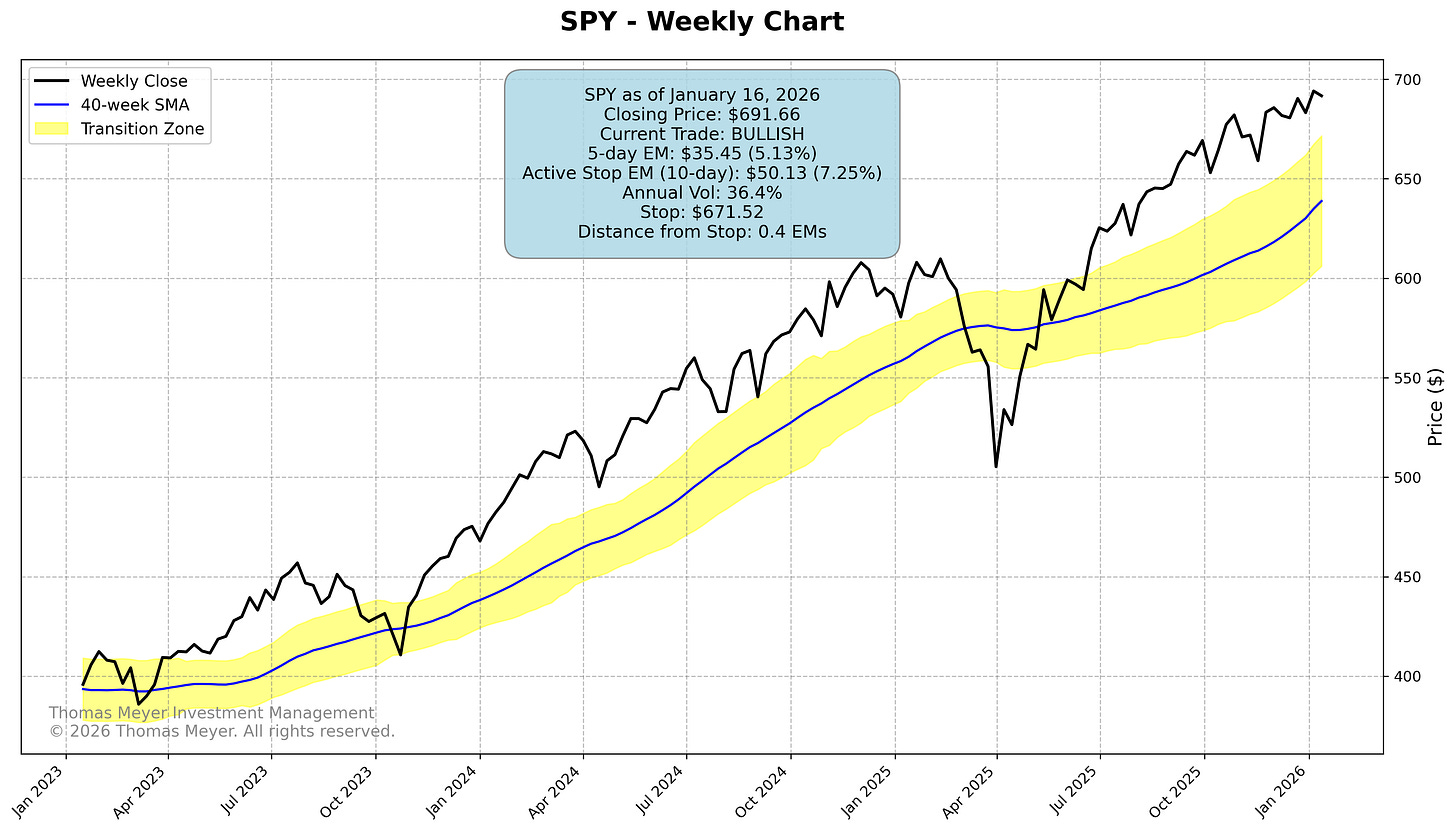

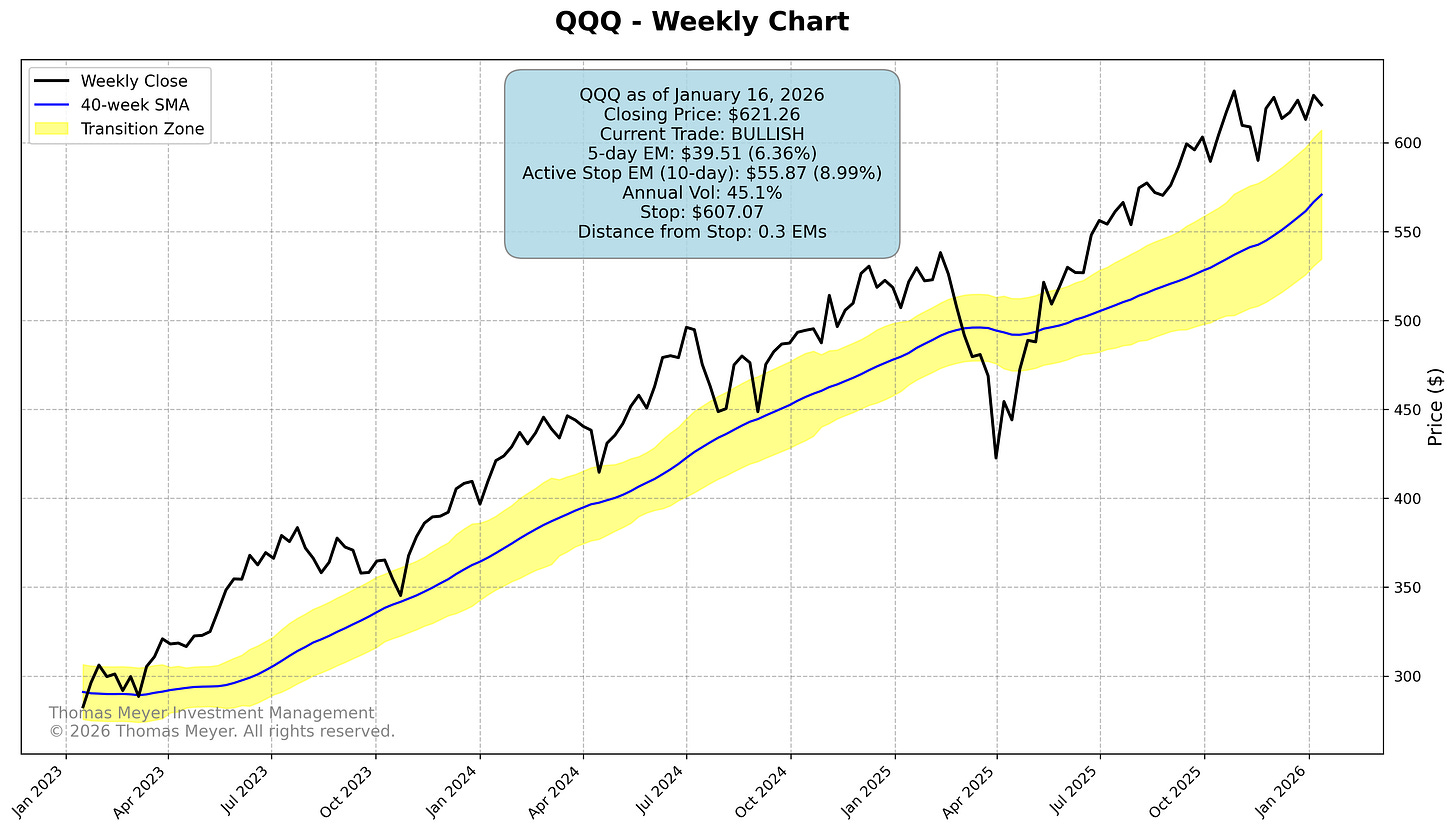

It’s natural for us to focus on the major averages when looking at our investments. We look at the S&P 500 and the Nasdaq 100 and use those averages to determine how the market is doing. Right now, if you look at SPY and QQQ, you can see that they’re leveling off and, in our trend-following world, close to hitting their exits.

If the major averages are slowing down, then the market must not be doing all that well. Though SPY hit an all-time high recently, QQQ’s all-time high was back at the end of October.

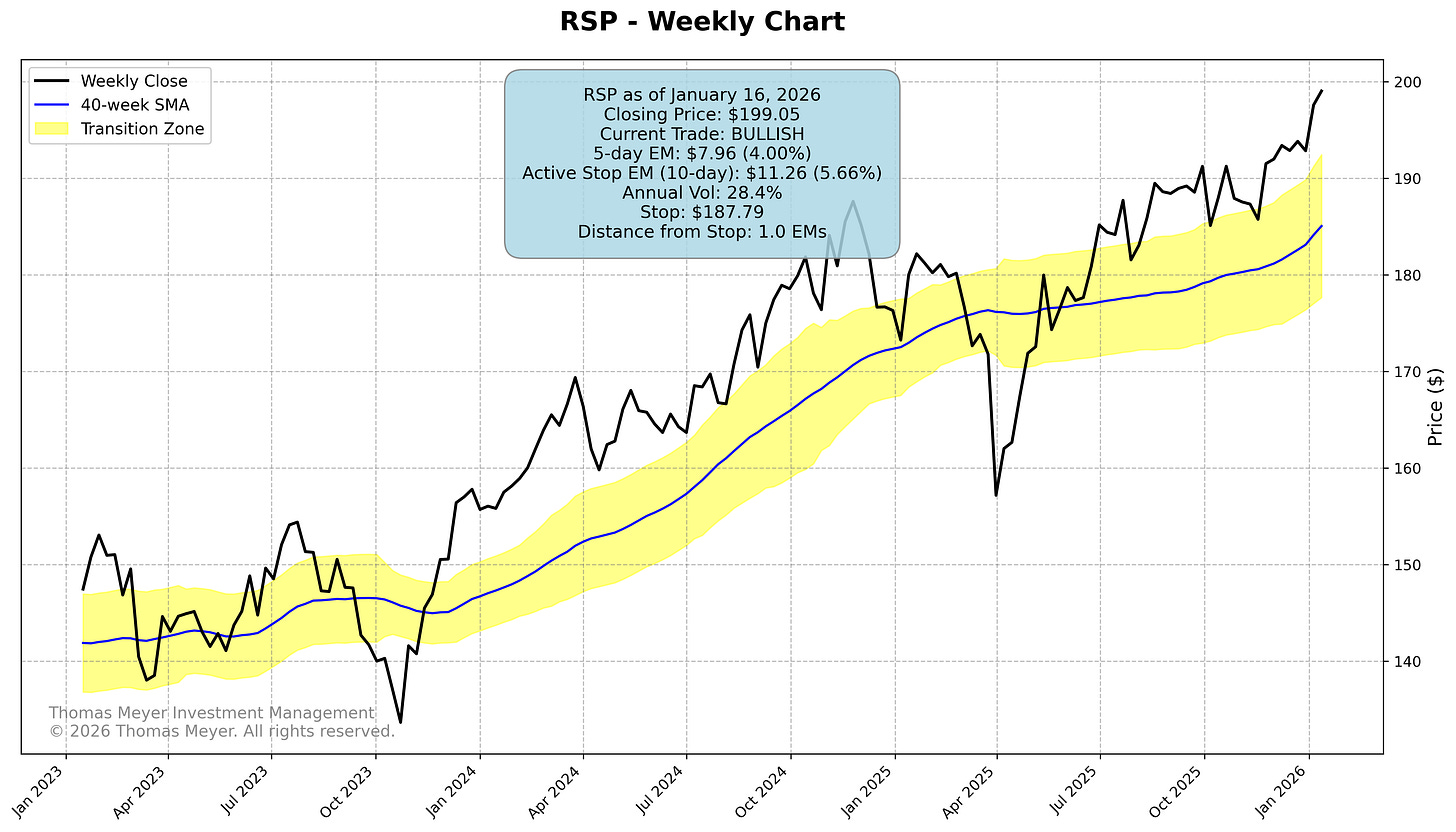

One of the charts I follow is that of the Invesco S&P 500 Equal Weight ETF (RSP). In this ETF, a company named Huntington Ingalls Industries (HII) has the same weighting in the ETF as does NVDA. There’s no “Magnificent Seven” in this index.

Why do I care about RSP? Because looking at this chart gives us more information as to what the majority of listed stocks are doing. And right now, those stocks are doing quite well. Here’s the most recent chart on RSP:

You can see that it’s trading solidly at all-time highs. It hasn’t had the spectacular uptrend over the past few years as has SPY or QQQ, but it’s outperforming the better-known indexes right now.

What does this tell us? It seems to be saying that you might want to look at something other than AI and technology stocks for a stock that has strong upward momentum.

Historically, the majority of the gain in the indexes is concentrated in just a handful of stocks. But not always. This is a time that the other stocks could be better fits for your portfolios.

Thomas Meyer Investment Management

If you’re not comfortable doing this on your own, and you’d like some help, there’s a simple solution. Let me do it for you! Anyone wanting to learn more about my investment management can check out the website for more information. Be sure to click on the “Let’s Connect” tab, fill it out, and we can discuss the next steps for me to manage a portion of your investable assets. By the way, I never actually hold your monies, they remain in your name, and the funds are custodied at Charles Schwab on the institutional side. Here’s my website: www.tminvestmentmanagement.com

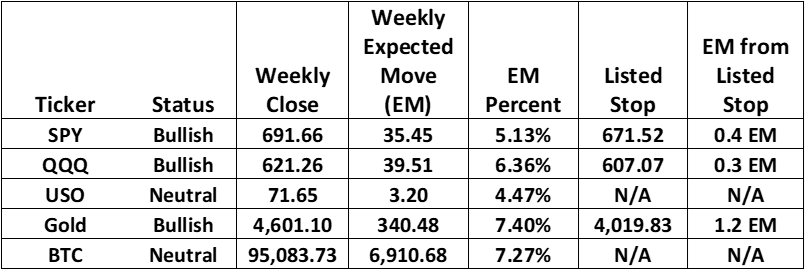

Market Overview

Both SPY and QQQ closed lower this week and are now dangerously close to their exits—SPY at 0.4 Expected Moves away, QQQ at just 0.3 Expected Moves. With markets looking to open sharply lower Monday morning, these stops could easily get hit. If you’re following these trades, make absolutely certain your exit orders are in place before the open.

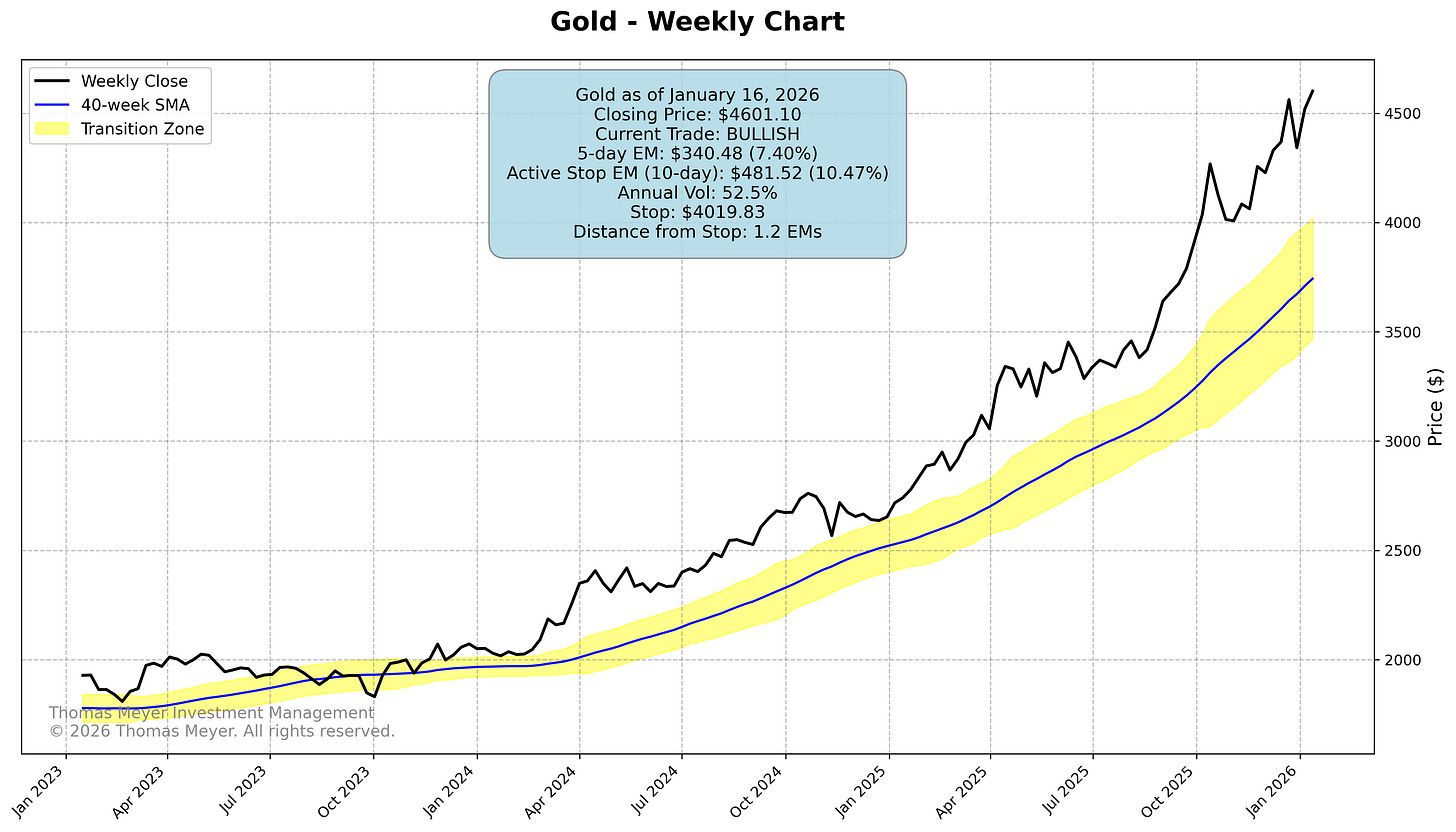

Gold had another exceptional week, pushing to new all-time highs and now sitting at 1.2 Expected Moves from its stop. This trade continues to demonstrate what ‘letting winners run’ looks like—we’re now up over 73% since entering last January.

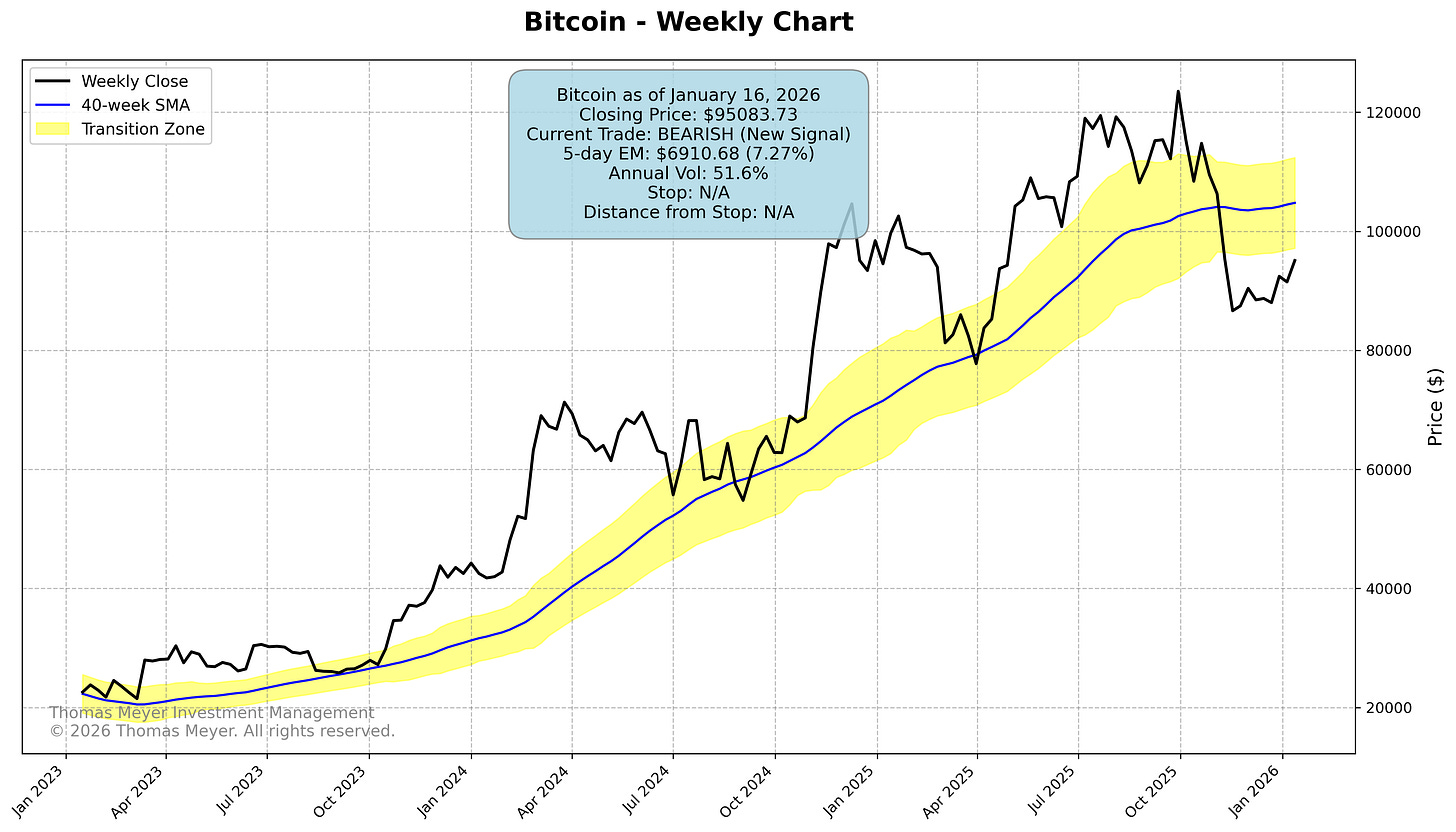

Bitcoin hit its bearish exit last week and is now sitting in neutral territory below the Transition Zone. No trade this week—we’ll wait for the next clear signal.

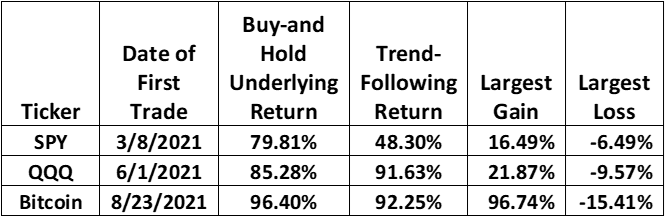

Historical Results For SPY, QQQ, Bitcoin

The trend-following approach I use has a decade-long track record across multiple newsletters in three countries. Here are the results for SPY, QQQ, and Bitcoin since I started publishing on Substack:

Always have your exit strategies prepared before you enter into any trade.

Current Condition for January 19, 2026

Be Sure to Read the Disclaimer at the End of This Report

Here are the latest charts…

SPY (SPDR S&P 500 ETF)

QQQ (Invesco NASDAQ 100 ETF)

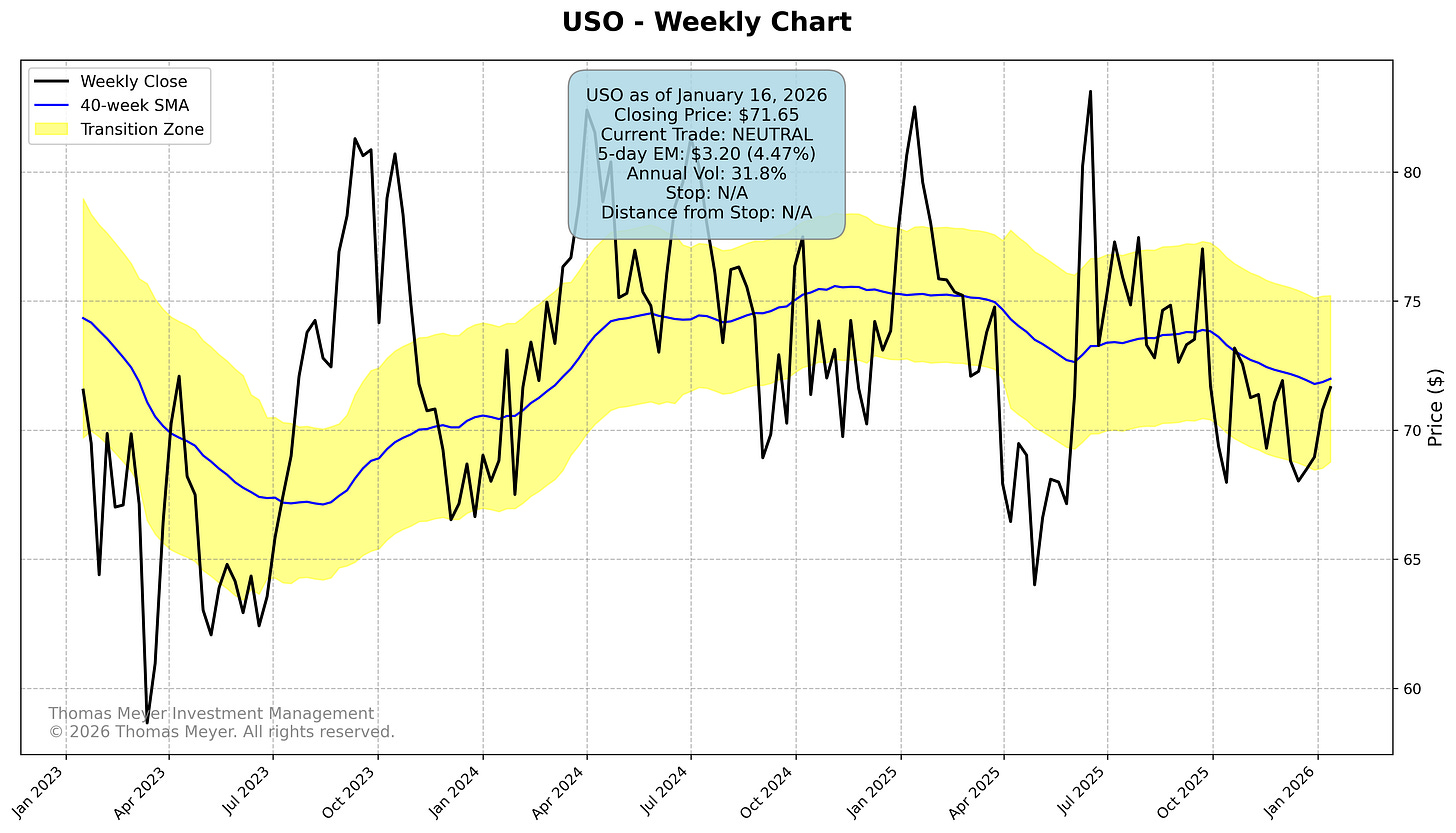

USO (USCF Crude Oil ETF)

Gold (Current Futures Contract)

BTC (Bitcoin)

Disclaimer

The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.