AlgoTrendTraders Weekly Report - When $1 Million Become $600,000

Disciplined, Rules-Based Trading

Thomas Meyer, Editor

January 5, 2026

Email: algotrendtraders@gmail.com

Welcome to this week’s AlgoTrendTraders report. We’re mixing things up a little bit this year. Our goal is to help you understand the “big picture” of investing and how you can control your risk more effectively.

The data and charts shown in this report are not meant to be recommendations and no buy/sell information is inferred. Please read the disclaimer underneath the charts.

Tom’s Musings

In the year 2000, I met a man who was absolutely distraught. He had just retired from a refinery where he’d worked his entire adult life—decades at the same place. The refinery had changed hands over the years, but he and most of the workers remained.

And he did the right things. He put money into his 401(k) and savings. He didn’t live a lavish lifestyle, and a year before retiring, he had accumulated almost $1 million in his retirement.

Unfortunately, he had moved the majority of his 401(k) monies into technology funds. He did it and all his buddies did the same. What could go wrong?

By the middle of 2000, his $1 million retirement had dropped to $600,000. And he was distressed. He had already decided to retire. He couldn’t go back to his job. And what kind of job could a 65-year old blue collar worker get.

He had to make the painful choice to live on less income for the rest of his life. There was nothing any of us could do to help him. It was heartbreaking. There had to have been tens of thousands, probably more, in the same situation.

This is the reason you have to have an exit strategy on every position you own! Ask yourself, how much am I willing to lose on this investment if it moves against me? Make that decision now, while the markets are near all-time highs and the emotions of losing money aren’t part of the decision-making process. It’s difficult to make a rational decision when your investments are dropping 30% and it feels like you’re getting punched in the stomach.

I use trend-following as my favorite investment process because it forces you to know your exit strategy before you get into a trade. And that exit strategy acts as its own discipline. There are a lot of successful investment strategies, what makes them successful is knowing how to get out of a position.

Thomas Meyer Investment Management

Exiting a trade is the hardest part of investing. If you’re not comfortable doing this on your own, and you’d like some help, there’s a simple solution. Let me do it for you! Anyone wanting to learn more about my investment management can check out the website for more information. Be sure to click on the “Let’s Connect” tab, fill it out, and we can discuss the next steps for me to manage a portion of your investable assets. By the way, I never actually hold your monies, they remain in your name, and the funds are custodied at Charles Schwab on the institutional side. Here’s my website: tminvestmentmanagement.com

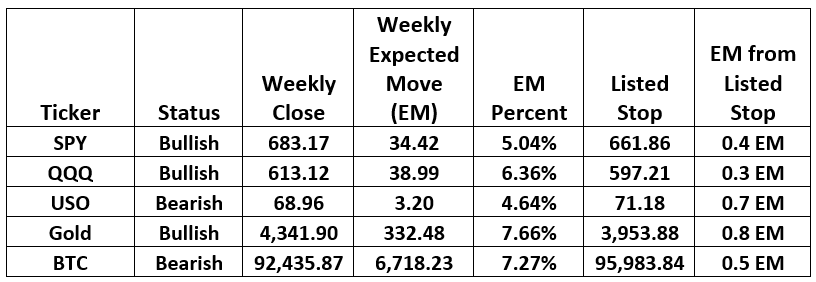

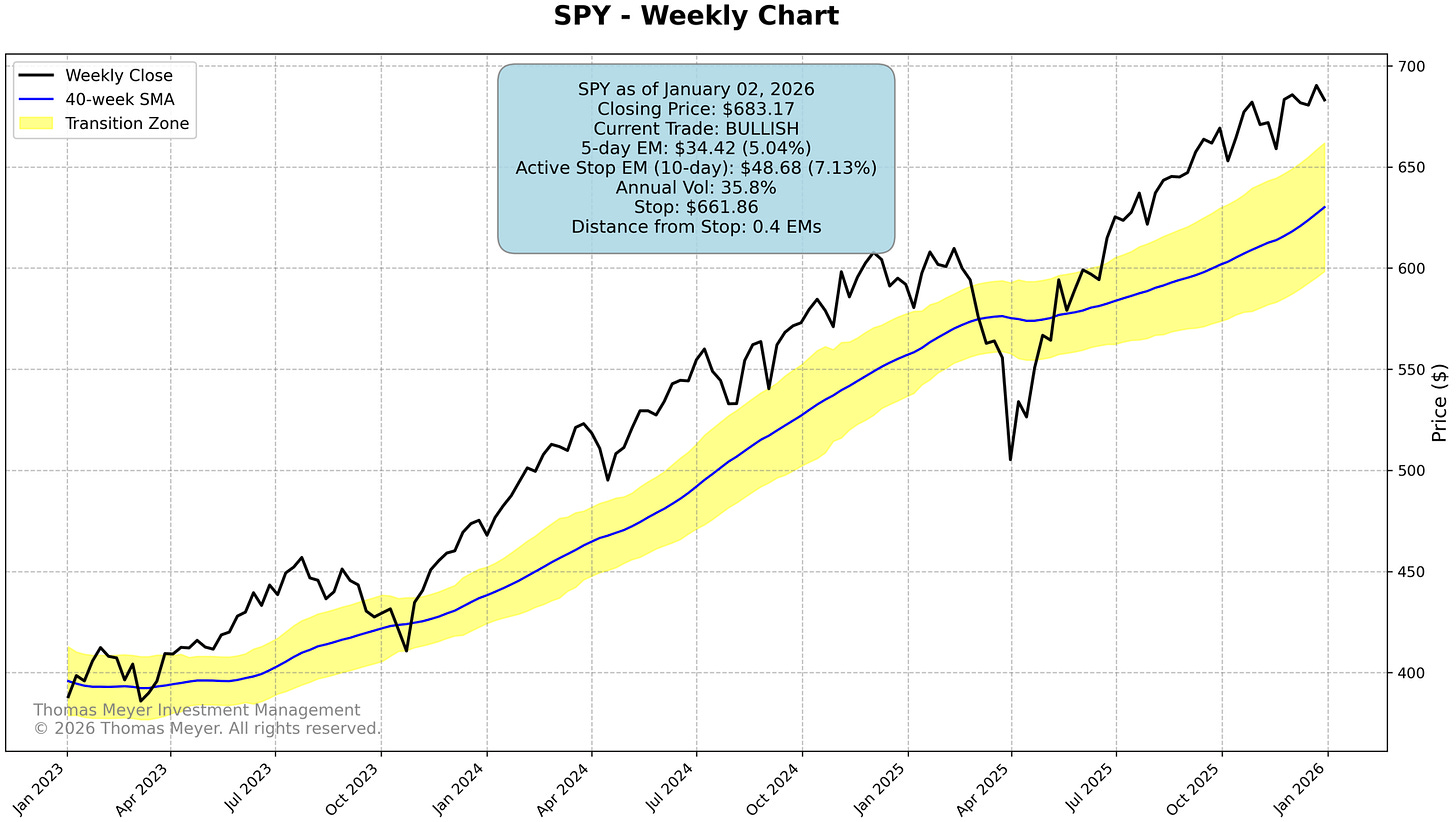

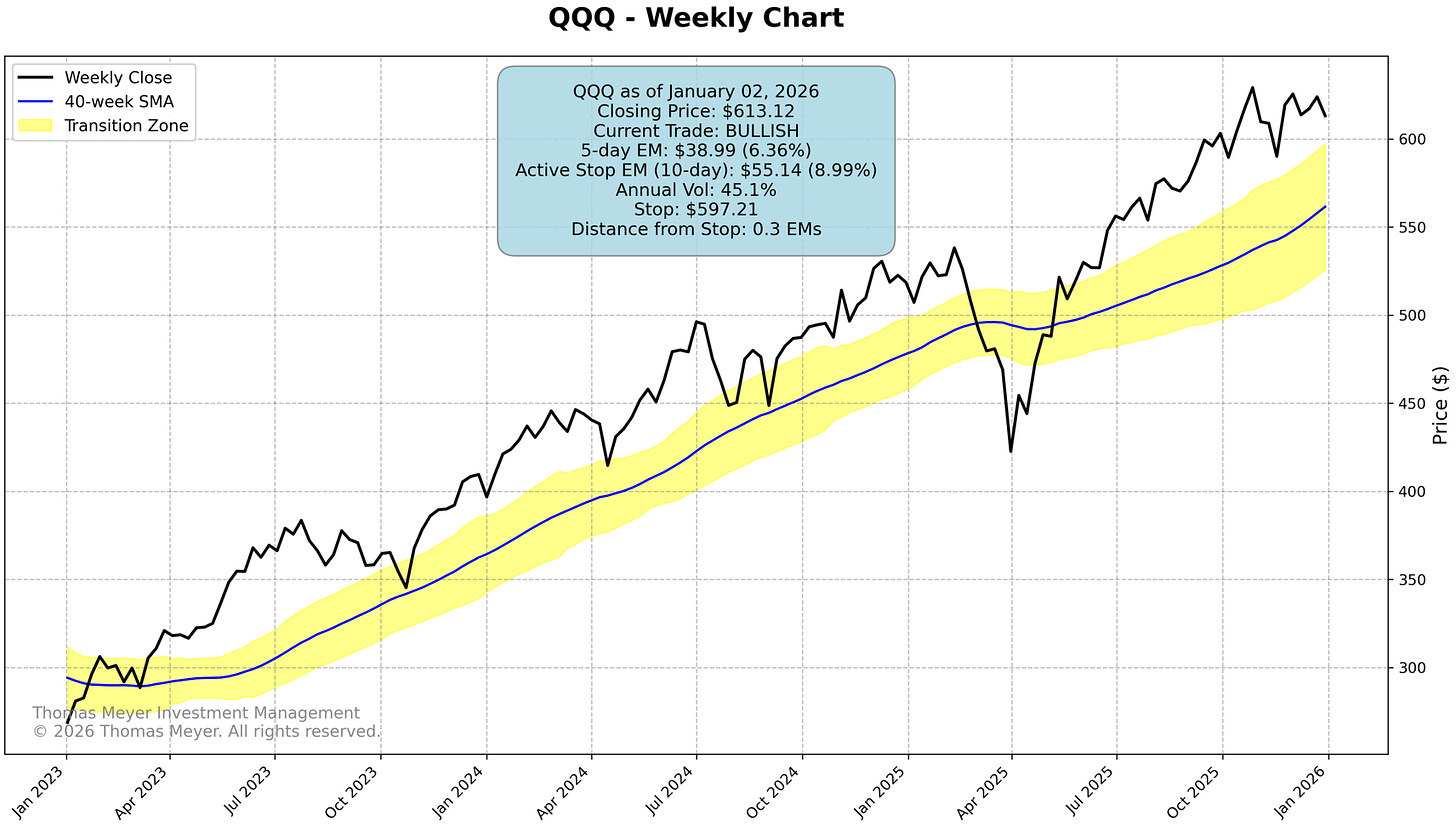

Market Overview

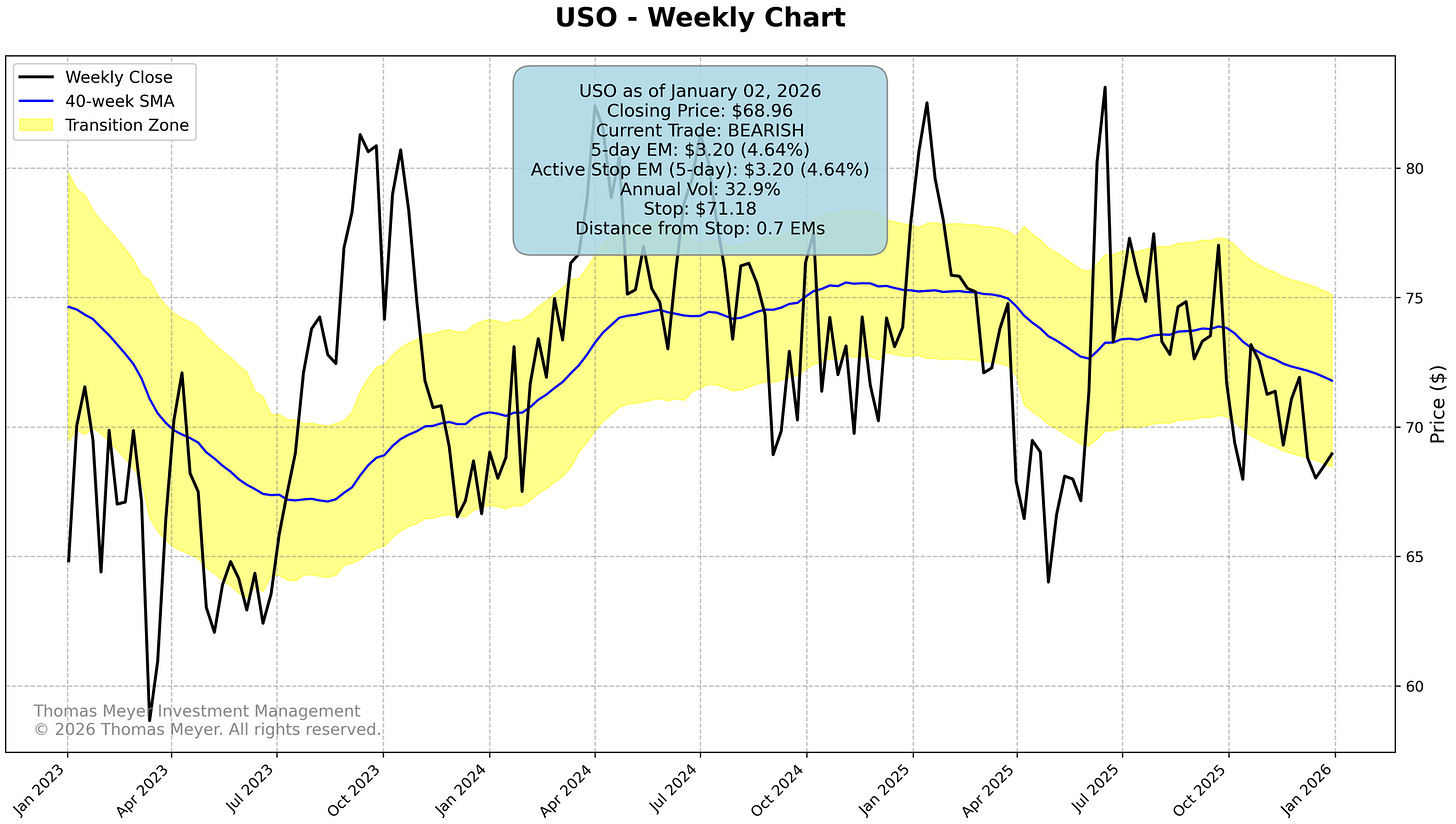

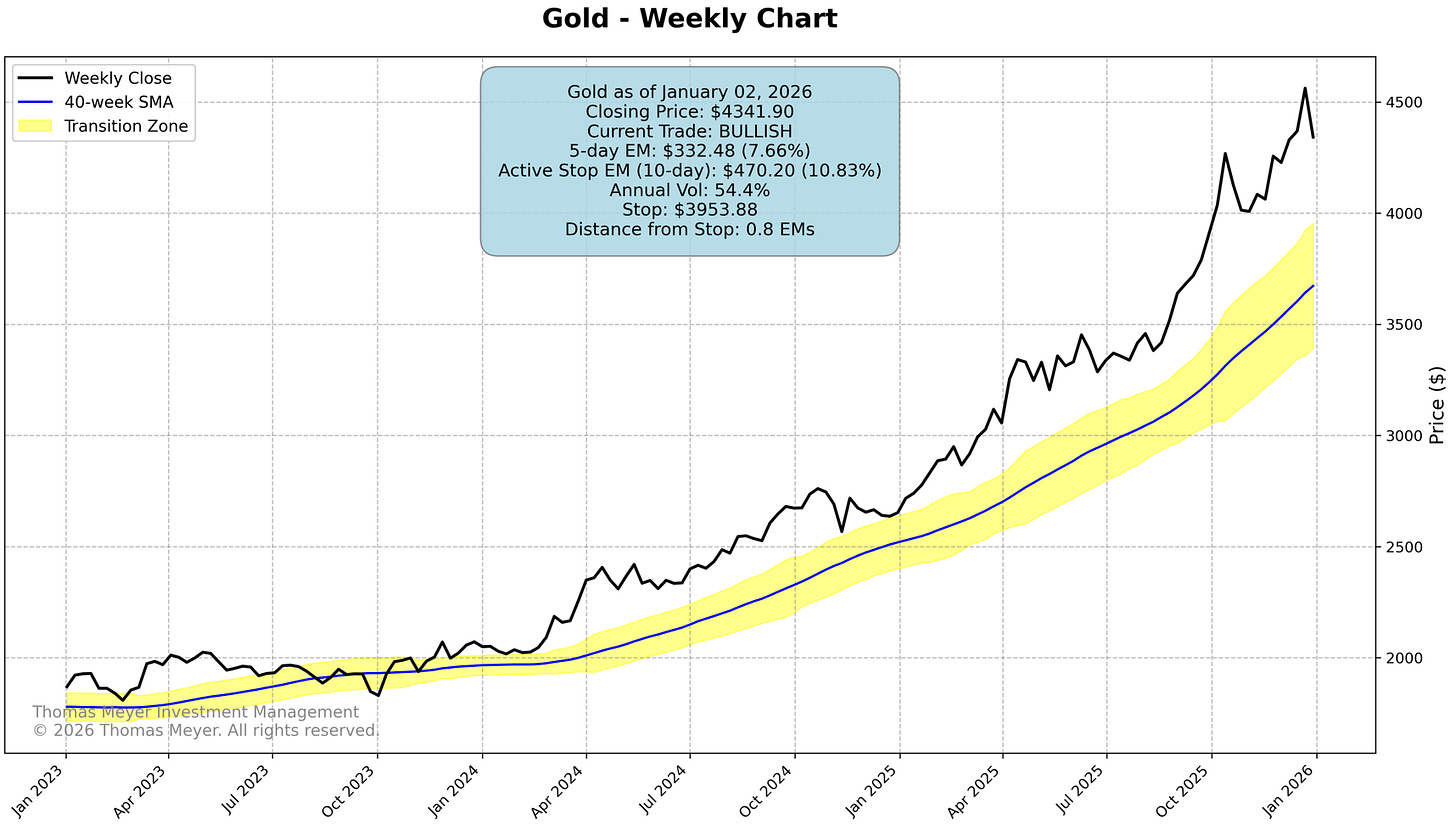

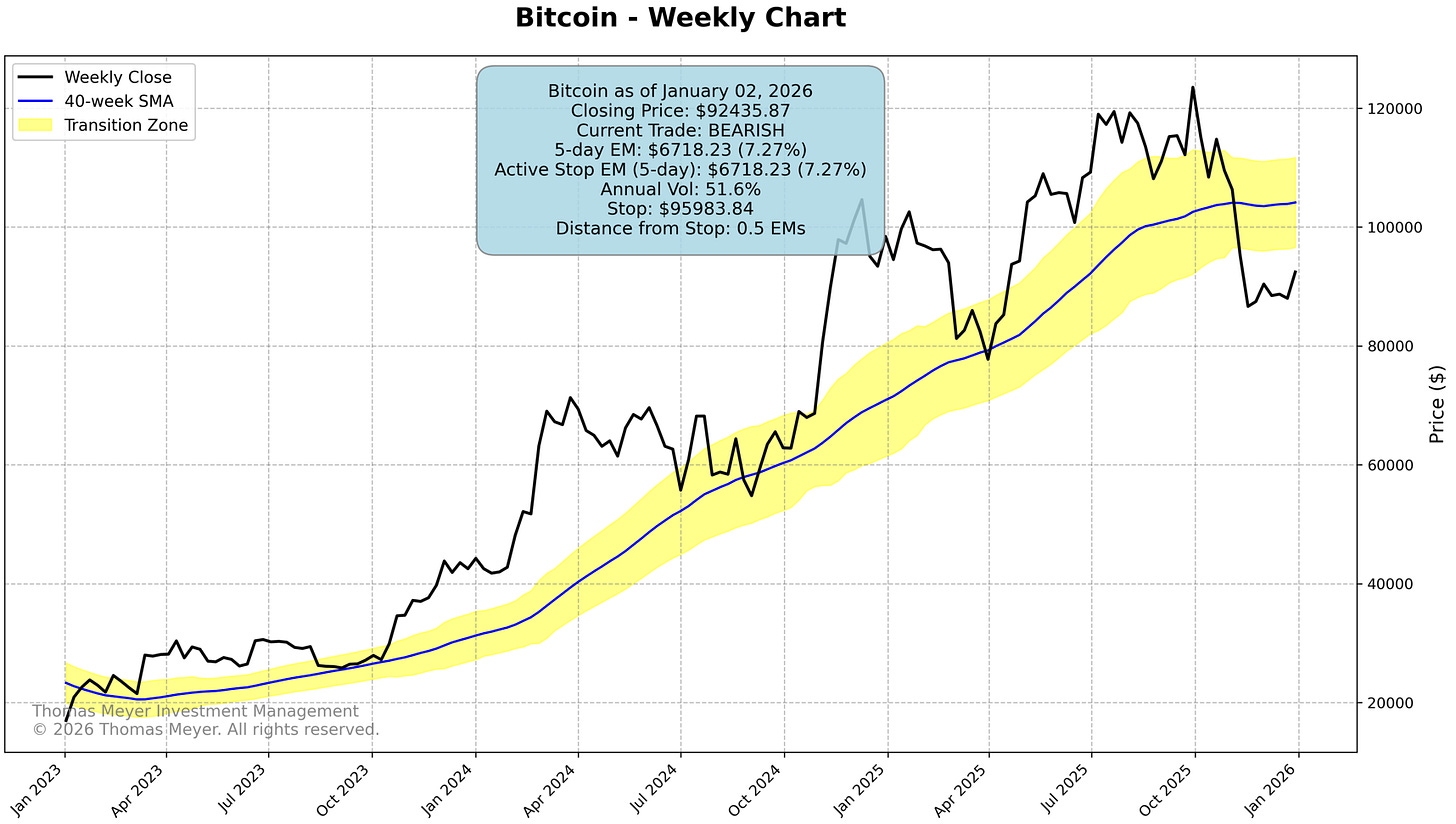

This week the markets moved sideways, with both SPY and QQQ staying profitable but getting uncomfortably close to their exits—both are now less than half an Expected Move from their stops. If you’re following these trades, your exit orders need to be in place before Monday’s open. Gold continues its exceptional run with over 60% profit since last January. The Bitcoin and crude oil bearish trades are both less than an Expected Move from hitting their exits.

Current Conditions for January 5, 2026

Always have your exit strategies prepared before you enter into any trade.

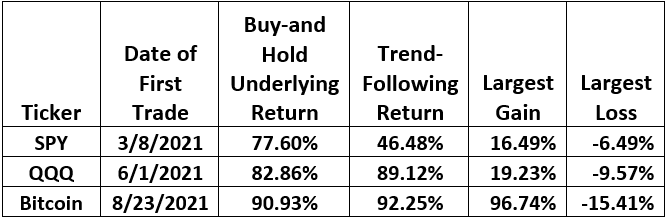

Historical Results For SPY, QQQ, Bitcoin

The trend-following approach I use has a decade-long track record across multiple newsletters in three countries. Here are the results for SPY, QQQ, and Bitcoin since I started publishing on Substack:

Be Sure to Read the Disclaimer at the End of This Report

Here are the latest charts…

Disclaimer:

The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.