AlgoTrendTraders Weekly Report - The VP Who Turned 8 Figures into Nothing

Disciplined, Rules-Based Trading

The VP Who Turned 8 Figures into Nothing

Thomas Meyer, Editor | January 12, 2026

Email: algotrendtraders@gmail.com

Welcome to this week’s AlgoTrendTraders report. We hope you’re enjoying and learning something that helps you in these newsletters. We want you to understand how you can control your risk more effectively.

The data and charts shown in this report are not meant to be recommendations and no buy/sell information is inferred. Please read the disclaimer underneath the charts.

Tom’s Musings

I haven’t told this story often. When I was building my business in the mid to late 1990s, I did a lot of syndicate business. You might know this as initial public offerings and secondary offerings. In the late 1990s, the dot com IPOs were spectacular and of course everyone wanted to participate. Why not… it was easy money!

There was a company here in Austin that did a highly anticipated IPO in 1999. I got to know one of the VPs from the company and we began doing business together. The IPO hit and it was spectacular. The headlines were splashy and the stock went from $19 at the IPO price and closed the first day at almost $50. It got as high as $297 in March 2000. He made life-changing money. 8 figure money. I told him he should sell most of the stock, put half into a diversified portfolio of stocks and ¼ into municipal bonds yielding around 5% at the time. He could still have several million dollars to invest however he wanted (tech stocks).

He told me he didn’t have enough money. The president of the company had over $100 million and that was his goal. I tried to tell him that it’s not a competition. He had plenty for himself, his kids, and his future grandkids.

But he wouldn’t listen. So he fired me and decided to trade on his own. In 2002, the stock was down to $1. He had called me various times after the March 2000 dot com bubble burst to tell me how he was tracking the market and that it was very similar to the 1929 crash. I didn’t hear from him after 2002. I don’t know for sure, but I’m pretty sure he lost almost all his money.

The most dangerous words when you’re investing is “this time it’s different”. What makes anyone think that the AI bubble won’t burst one day? I don’t know when it will happen, nobody does. But it will happen someday. There will probably be a lot of money made between now and then. There will definitely be a lot of money lost when it happens.

If you’re sitting on huge gains in some of your stocks right now, have an exit plan. Make that plan now, when your stocks are going up, don’t try to make it when the prices are crashing down and the emotions are high. If you have a question, check with your advisor. Don’t turn a large amount of money into nothing.

Thomas Meyer Investment Management

Exiting a trade is the hardest part of investing. If you’re not comfortable doing this on your own, and you’d like some help, there’s a simple solution. Let me do it for you! Anyone wanting to learn more about my investment management can check out the website for more information. Be sure to click on the “Let’s Connect” tab, fill it out, and we can discuss the next steps for me to manage a portion of your investable assets. By the way, I never actually hold your monies, they remain in your name, and the funds are custodied at Charles Schwab on the institutional side. Here’s my website: www.tminvestmentmanagement.com

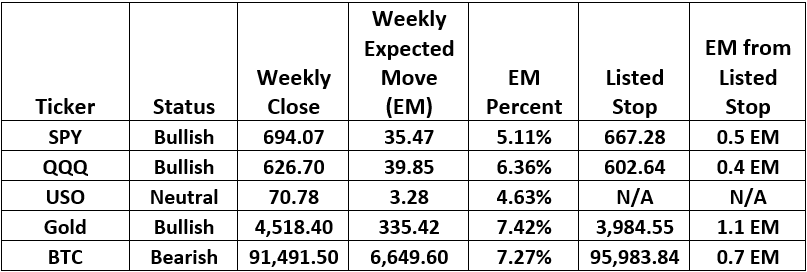

Market Overview

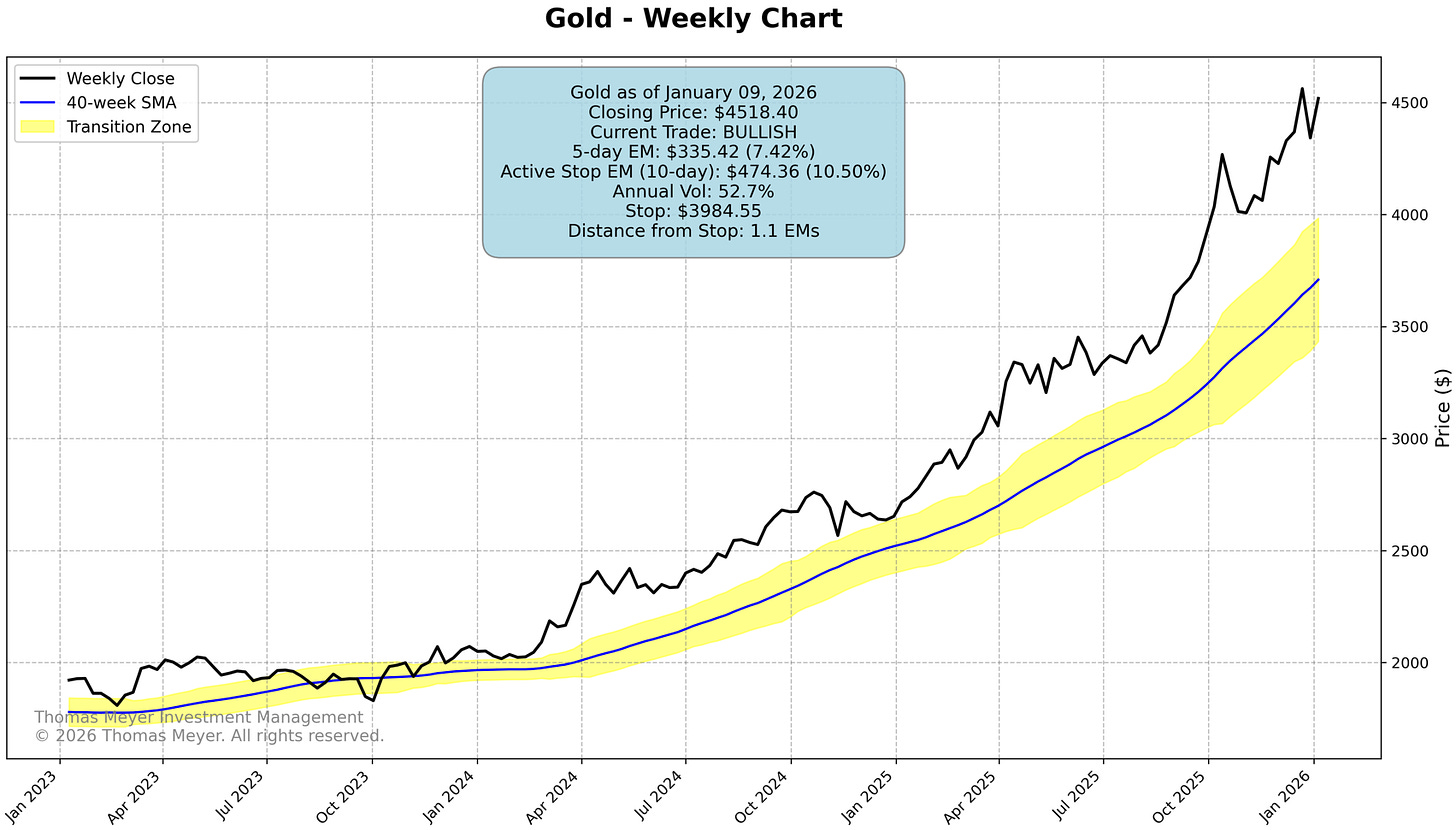

The markets had a strong week, with SPY, QQQ, and Gold all moving higher. Both stock indices are still within one Expected Move of their exits—close enough that you need to keep those stop orders in place. Gold pushed further away from its stop and is now sitting with over 70% profit since we entered last January. This is what letting winners run looks like. We’re now into the second year of this bullish trend.

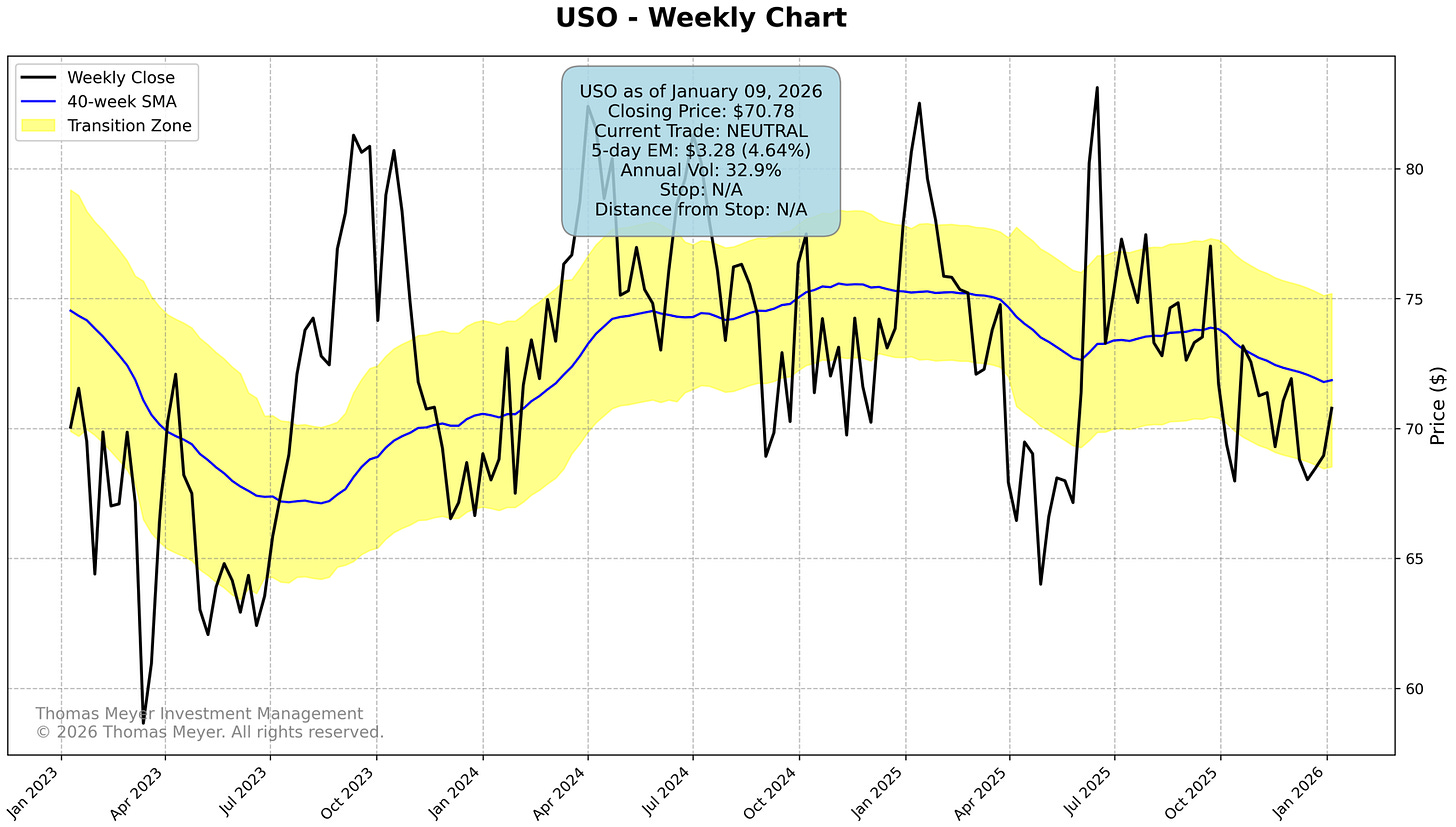

Our bearish crude oil trade (USO) hit its exit on Friday for a small 3.93% loss. This is exactly what the system is designed to do—take small, controlled losses when trades don’t work out.

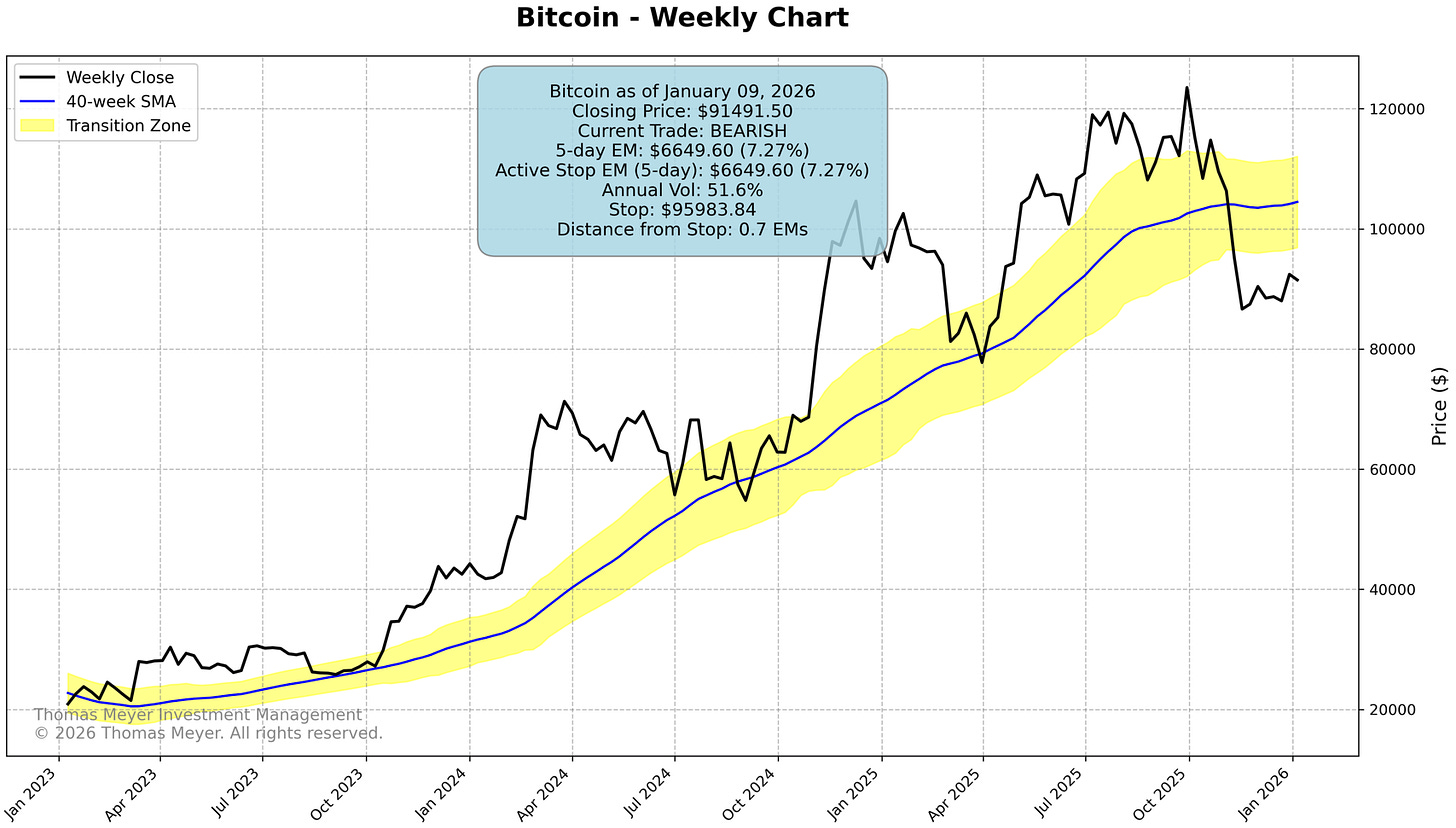

Bitcoin continues its bearish trade, it is still about 0.7 Expected Moves away from the exit.

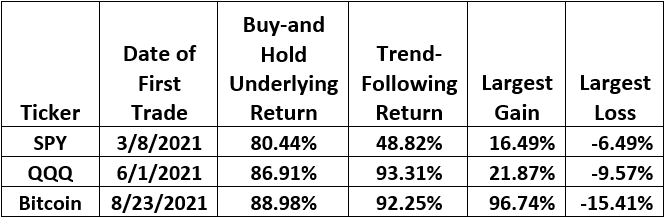

Historical Results For SPY, QQQ, Bitcoin

The trend-following approach I use has a decade-long track record across multiple newsletters in three countries. Here are the results for SPY, QQQ, and Bitcoin since I started publishing on Substack:

Always have your exit strategies prepared before you enter into any trade.

Current Conditions for January 12, 2026

Be Sure to Read the Disclaimer at the End of This Report

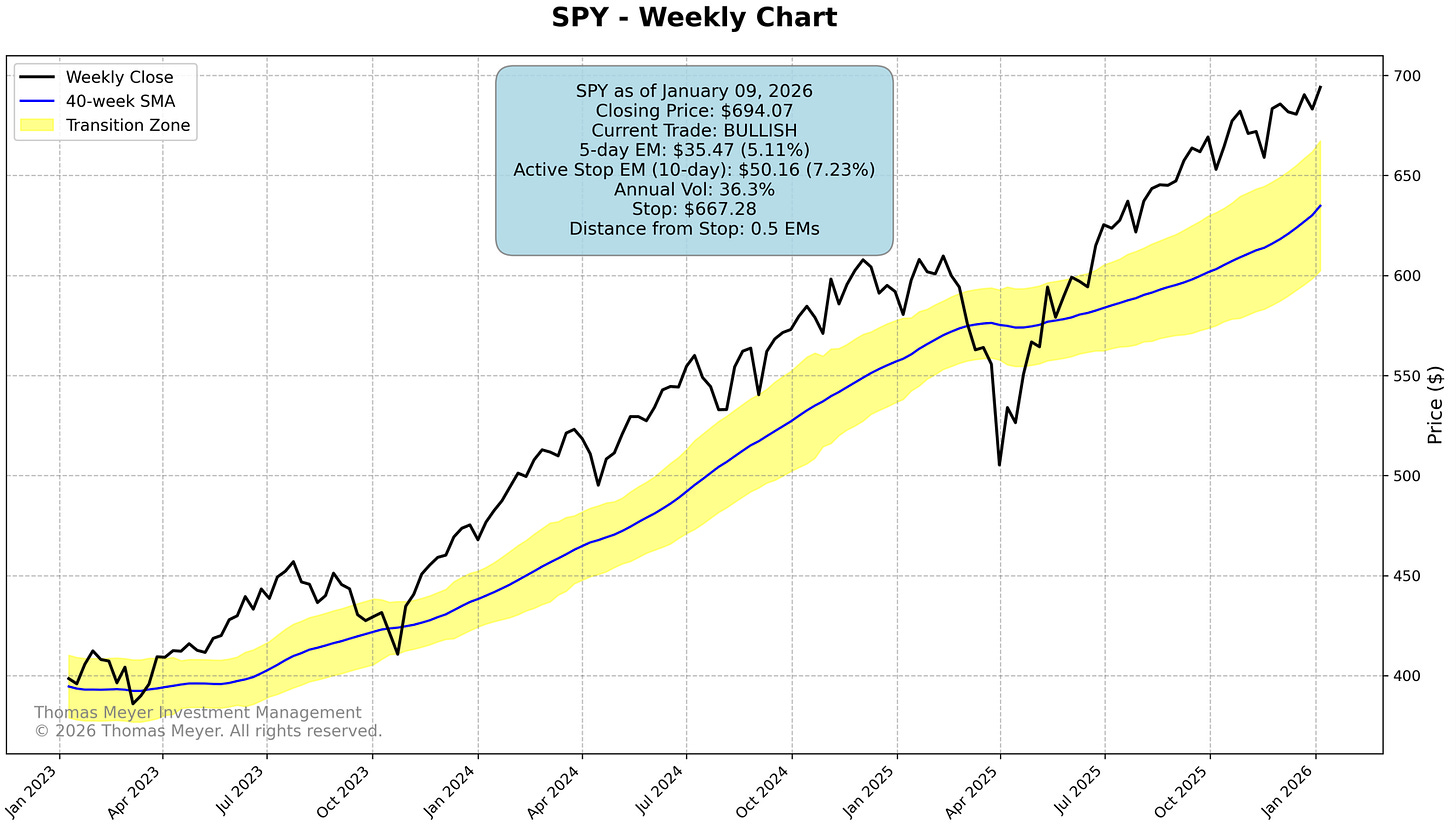

Here are the latest charts…

SPY (SPDR S&P 500 ETF)

Friday’s Closing Price: 694.07

Current Condition: Bullish

Weekly Expected Move: 35.47 (5.11%)

Stop: 667.28

Distance from Stop: 0.5 Expected Moves

Current Trade Entry Price: 599.72

Current Trade Entry Date: 09 June 2025

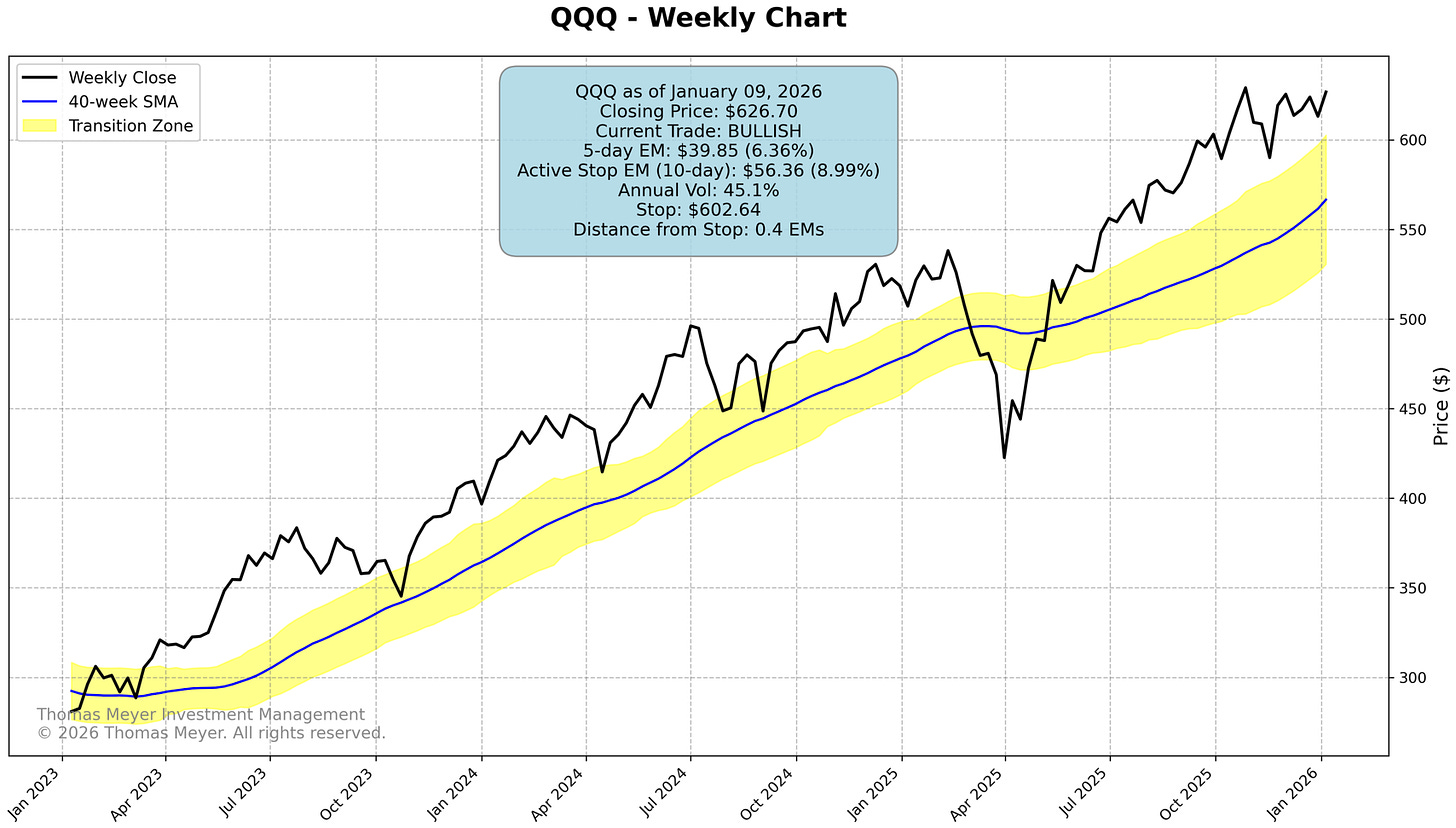

QQQ (Invesco NASDAQ 100 ETF)

Friday’s Closing Price: 626.70

Current Condition: Bullish

Weekly Expected Move: 39.85 (6.36%)

Stop: 602.64

Distance from Stop: 0.4 Expected Moves

Current Trade Entry Price: 514.24

Current Trade Entry Date: 19 May 2025

USO (USCF Crude Oil ETF)

Friday’s Closing Price: 70.78

Current Condition: Neutral

Weekly Expected Move: 3.28 (4.63%)

Stop: N/A

Distance from Stop: N/A

Gold (Current Futures Contract)

Friday’s Closing Price: 4,518.40

Current Condition: Bullish

Weekly Expected Move: 335.42 (7.42%)

Stop: 3,984.55

Distance from Stop: 1.1 Expected Moves

Current Trade Entry Price: 2,652.80

Current Trade Entry Date: 06 January 2025

BTC (Bitcoin)

Sunday’s Closing Price: 91,491.50

Current Condition: Bearish

Weekly Expected Move: 6,649.60 (7.27%)

Stop: 95,983.84

Distance from Stop: 0.7 Expected Moves

Current Trade Entry Price: 95,241.52

Current Trade Entry Date: 17 November 2025

Disclaimer

The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.