AlgoTrendTraders Weekly Report - Sunday Night Changes Everything

Disciplined, Rules-Based Trading

Thomas Meyer, Editor | February 2, 2026

Email: algotrendtraders@gmail.com | X: @AlgoTrendTrade1

Welcome to this week’s AlgoTrendTraders report. We hope you’re enjoying and learning something that helps you in these newsletters. We want you to understand how you can control your risk more effectively.

The data and charts shown in this report are not meant to be recommendations and no buy/sell information is inferred. Please read the disclaimer underneath the charts.

Tom’s Musings

There’s a lot going on in the markets this Sunday evening before the open in NY on Monday morning. Let’s look at what’s happening and how it affects our trades.

The markets look to open substantially lower. This affects the following trades:

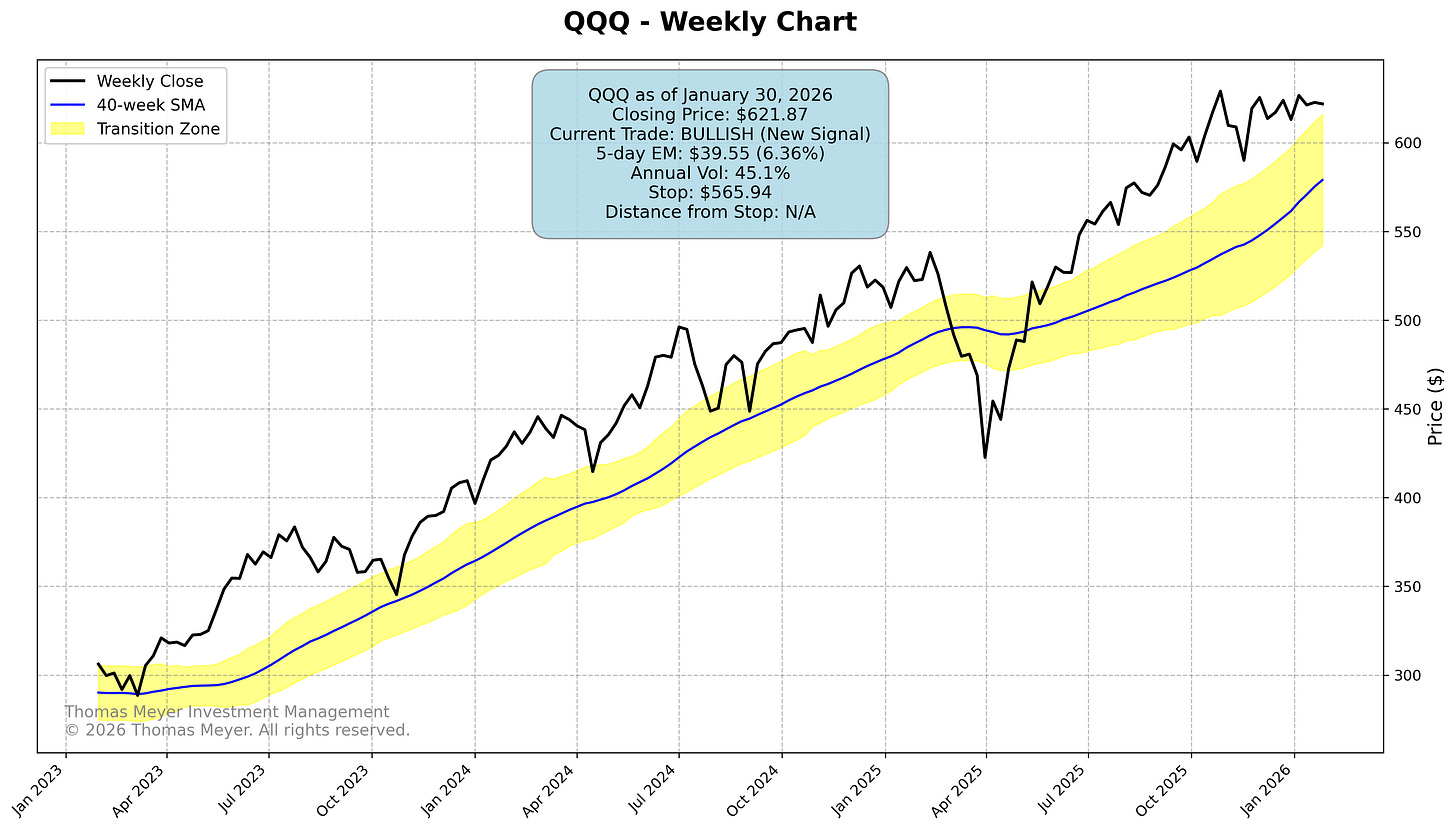

· The Nasdaq 100 is down 2% so far tonight. The new bullish trade in QQQ is cancelled if the opening trade is $615.79 or lower. In overnight trading, QQQ is at about $612.79 which, if this were the opening price, would cancel the new trade.

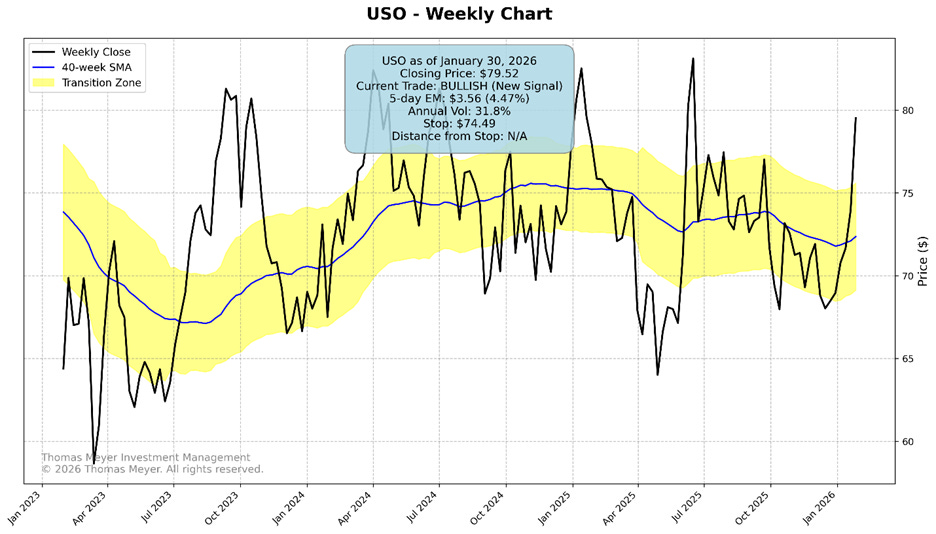

· Crude Oil is down almost 5%. The new bullish trade in USO is cancelled if USO opens below $75.60. In current overnight trading, USO is at about $75.15 which, if this were the opening price, would cancel the new trade.

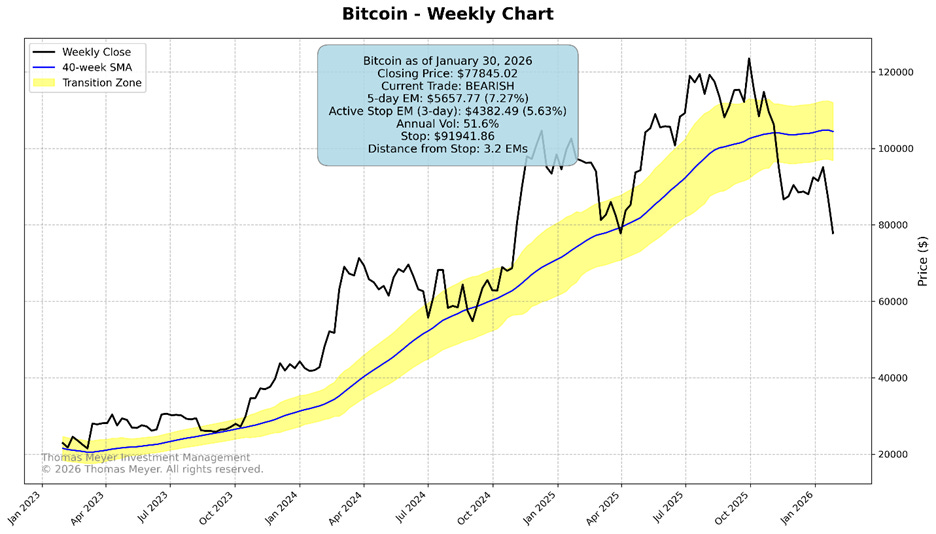

· Bitcoin continues to drop sharply, which is positive for our bearish trade. It has dropped almost $3000 overnight and is trading near $75,000. Consider using a trailing stop of 1.5 Expected Moves (EM) which is about $8500. Remember, our goal is to make as much as we can with each trade, but we don’t want to turn a winning trade into a losing trade.

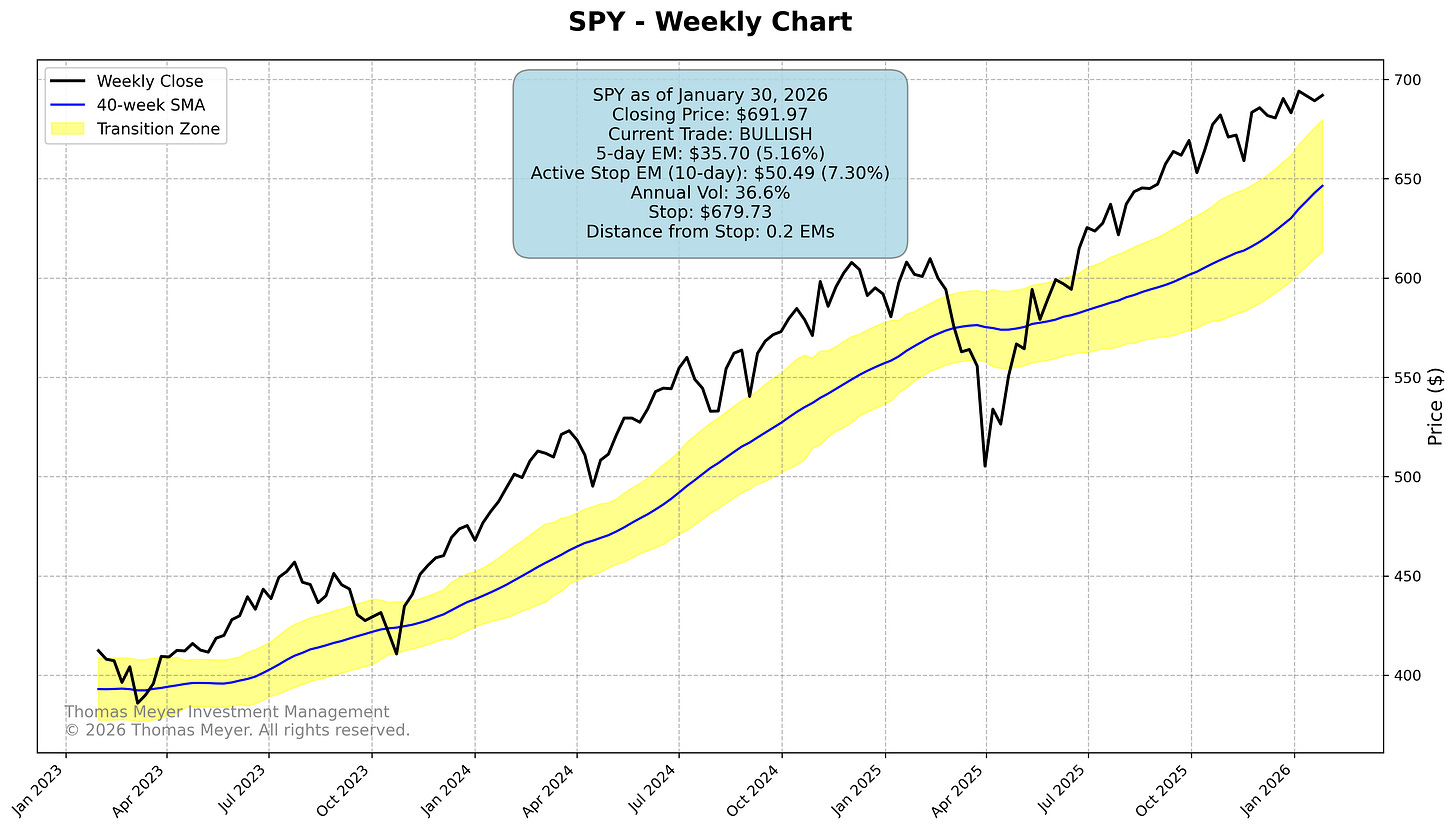

· SPY is less than $4.00 from hitting its exit in overnight trading. This trade has been in place for more than 7 months. If the stop is hit this week, it will result in a closed trade with more than 13% profit.

· Following up on last week’s commentary on the price of silver, had you used the 10-day EM of about $21, you would now be on the sidelines after exiting the trade around $88 last week. That’s about $16 better than where SLV is currently trading overnight.

I’m sure long-time readers aren’t surprised by my constant rants about understanding risk and knowing where your exits are. It’s always best to make these decisions when there’s no stress and the markets are acting favorably.

Right now, the markets are more difficult than they had been in the past several months. There is a lot of speculation about why, but ultimately the reasons don’t matter. What matters is for traders to know what their exits are going to be and why they’ve made those decisions.

You don’t have to use my exits. They’re what I’m comfortable with, but they might not be right for you. What is important is that you have a plan in place and the discipline to stick to your trading plan.

Thomas Meyer Investment Management

If you’re not comfortable doing this on your own, and you’d like some help, there’s a simple solution. Let me do it for you! Anyone wanting to learn more about my investment management can check out the website for more information. Be sure to click on the “Let’s Connect” tab, fill it out, and we can discuss the next steps for me to manage a portion of your investable assets. By the way, I never actually hold your monies, they remain in your name, and the funds are custodied at Charles Schwab on the institutional side. Here’s my website: www.tminvestmentmanagement.com

Market Overview

Last week closed relatively quiet—SPY slightly higher, QQQ slightly lower, USO pushing into new bullish territory. But Sunday night tells a different story entirely.

As I write this, futures are sharply lower. SPY is just $4 from its exit, which would lock in over 13% profit from a 7-month trade. Both new bullish trades that triggered Friday (QQQ and USO) are likely to be cancelled at Monday’s open based on current overnight levels. Bitcoin’s bearish trade is working beautifully—down nearly $3,000 and approaching 3.2 Expected Moves from the stop.

This is exactly why having predetermined exits matters. When markets gap down at the open, there’s no time to think. You either have a plan, or you don’t.

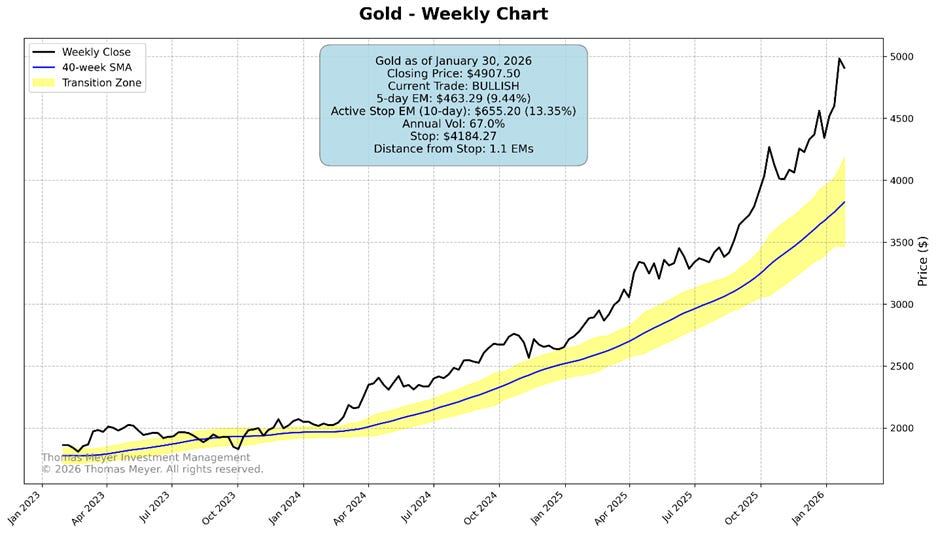

Gold pulled back from its highs but remains solidly bullish at 1.1 Expected Moves from the stop, still up 85% since January 2025.

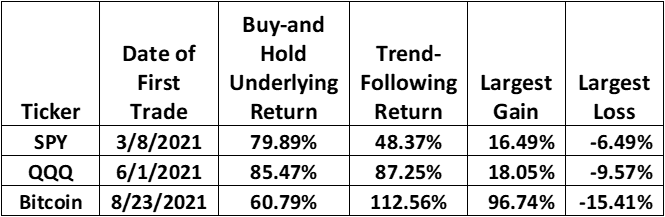

Historical Results For SPY, QQQ, Bitcoin

The trend-following approach I use has a decade-long track record across multiple newsletters in three countries. Here are the results for SPY, QQQ, and Bitcoin since I started publishing on Substack:

Always have your exit strategies prepared before you enter into any trade.

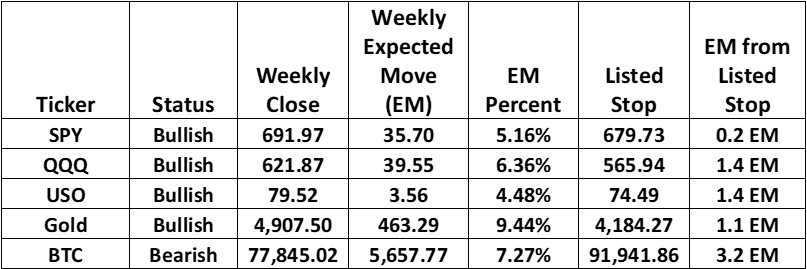

Current Conditions for February 2, 2026

Be Sure to Read the Disclaimer at the End of This Report

Here are the latest charts…

SPY (SPDR S&P 500 ETF)

Friday’s Closing Price: 691.97

Current Condition: Bullish

Weekly Expected Move: 35.70 (5.16%)

Stop: 679.73

Distance from Stop: 0.2 Expected Moves

Current Trade Entry Price: 599.72

Current Trade Entry Date: 09 June 2025

QQQ (Invesco NASDAQ 100 ETF)

Friday’s Closing Price: 621.87

Current Condition: Bullish

Weekly Expected Move: 39.55 (6.36%)

Stop: 565.94

Distance from Stop: 1.41 Expected Moves

USO (USCF Crude Oil ETF)

Friday’s Closing Price: 79.52

Current Condition: Bullish

Weekly Expected Move: 3.56 (4.48%)

Stop: 74.49

Distance from Stop: 1.4 Expected Moves

Gold (Current Futures Contract)

Friday’s Closing Price: 4,907.50

Current Condition: Bullish

Weekly Expected Move: 463.29 (9.44%)

Stop: 4,184.27

Distance from Stop: 1.1 Expected Moves

Current Trade Entry Price: 2,652.80

Current Trade Entry Date: 06 January 2025

BTC (Bitcoin)

Sunday’s Closing Price: 77,845.02

Current Condition: Bearish

Weekly Expected Move: 5,657.77 (7.27%)

Stop: 91,941.86

Distance from Stop: 3.2 Expected Moves

Current Trade Entry Price: 87,041.62

Current Trade Entry Date: 26 January 2026

Disclaimer

The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.