AlgoTrendTraders Weekly Report - Stopped Out By a Penny... Ouch!

Disciplined, Rules-Based Trading

Thomas Meyer, Editor | January 26, 2026

Email: algotrendtraders@gmail.com | X: @AlgoTrendTrade1

Welcome to this week’s AlgoTrendTraders report. We hope you’re enjoying and learning something that helps you in these newsletters. We want you to understand how you can control your risk more effectively.

The data and charts shown in this report are not meant to be recommendations and no buy/sell information is inferred. Please read the disclaimer underneath the charts.

Tom’s Musings

Greetings from icy Central Texas. Yes, we were recipients of the massive snow and ice storm that hit the country this weekend. We had ice, snow, then a little more ice. For most of us here, this has been an inconvenience and not life-threatening for which we’re grateful.

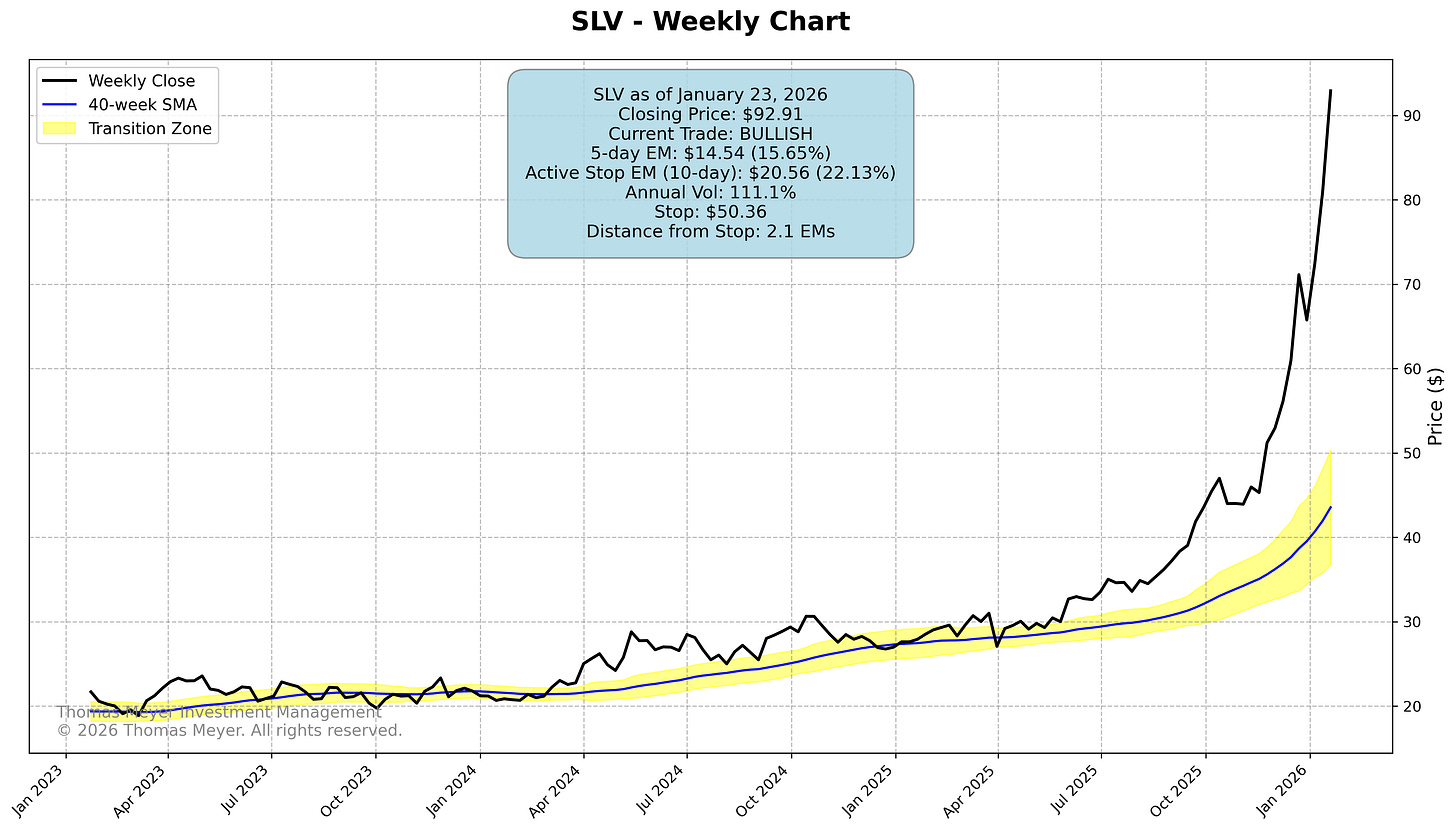

How can we look at the price of silver and not have our jaws drop? This is the textbook definition of parabolic!

This is the chart of the silver ETF SLV. For those of you who are fortunate enough to be in this trade, I have a question for you… what’s your exit strategy? As you can see, the current stop is just above $50. I’m sure you’re not willing to give up that much profit (if it is profit, I’m guessing many have gotten into the trade at a much higher price). The 5-day Expected Move (EM) is $14.54 and the 10-day EM is $20.56.

My system considers a ticker to be overbought or oversold at 3.75 EM from the listed stop. It doesn’t happen often and you can see it’s not even close to being overbought from that perspective right now.

A trailing stop might be useful here. You’d continue to capture gains if SLV keeps moving explosively higher and you’d have an exit locked in when (not if) the sharp reversal happens. Consider what dollar amount you’re willing to lose from here and then use that as your trailing stop.

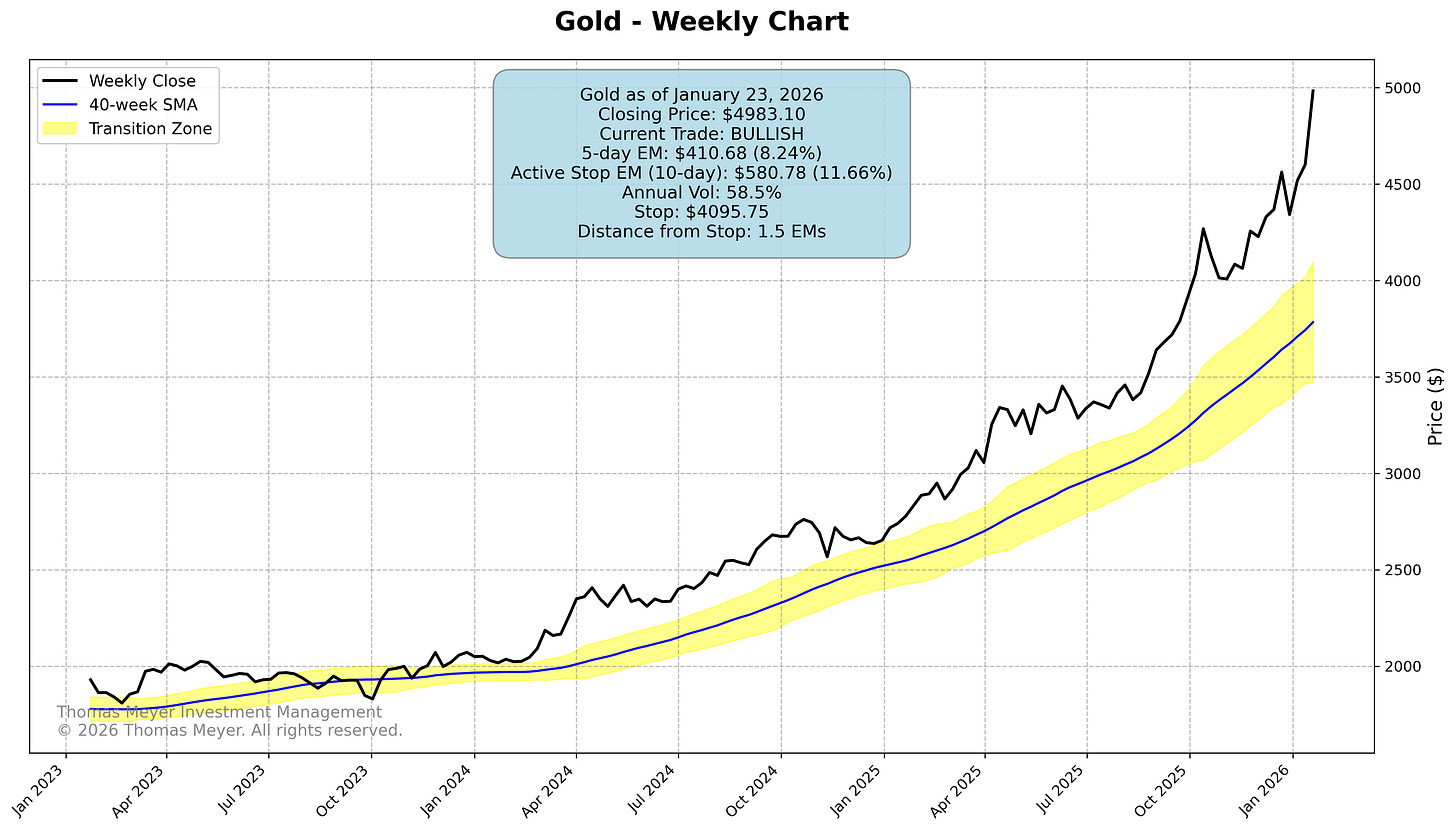

The trade in gold and silver is a classic “greed” trade. Take advantage of it while it’s moving in your favor. Just understand that it’s not going to continue to move straight up every day. At some point, there will be a “take profit” move that could send both down 20% or more very quickly. Make your exit decision now when there’s no emotional struggle or questioning.

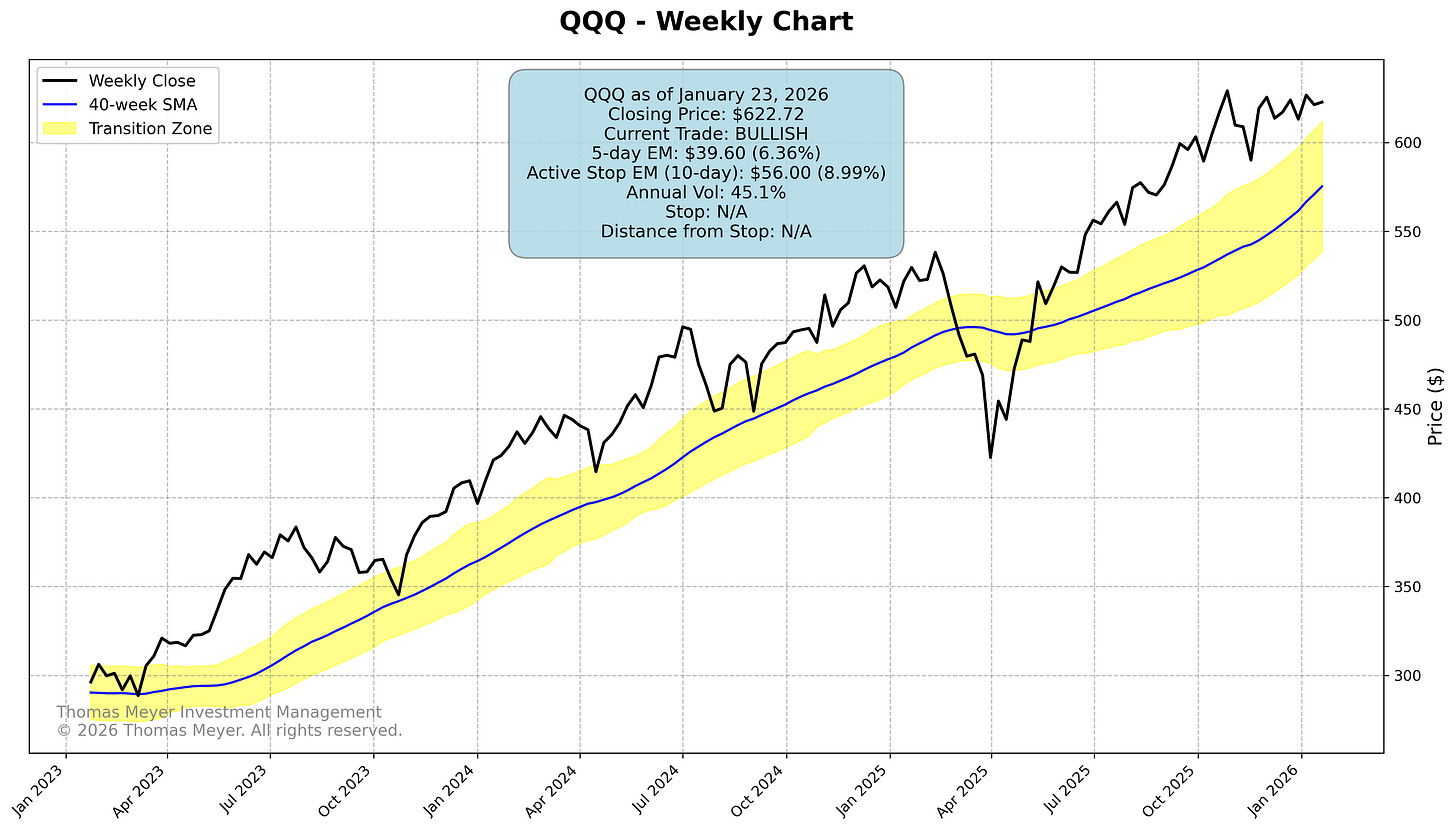

Stopped Out By a Penny – Our QQQ Trade

We stopped out of our QQQ trade last week by a penny! Ugh, that’s painful. Of course, the pain is knowing that last week’s exit was the actual weekly bottom and QQQ has moved higher since then. But, that’s the nature of trading. The trade lasted over 8 months, and we netted a gain of a little over 18%. That’s a really strong result!

We have to be out of the trade a week before we can get back in. It feels frustrating watching it move higher, but our discipline is much more important than the feeling. If you’re in it for the long run, this is just a small bump in the journey.

Thomas Meyer Investment Management

If you’re not comfortable doing this on your own, and you’d like some help, there’s a simple solution. Let me do it for you! Anyone wanting to learn more about my investment management can check out the website for more information. Be sure to click on the “Let’s Connect” tab, fill it out, and we can discuss the next steps for me to manage a portion of your investable assets. By the way, I never actually hold your monies, they remain in your name, and the funds are custodied at Charles Schwab on the institutional side. Here’s my website: www.tminvestmentmanagement.com

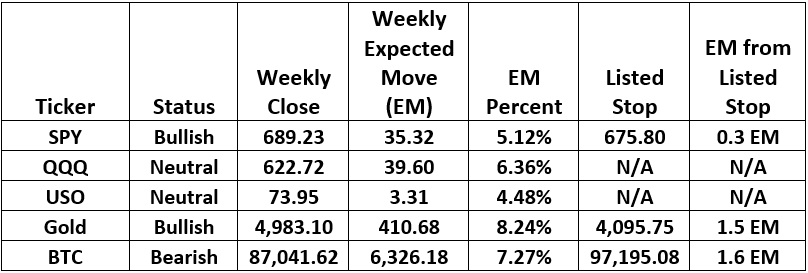

Market Overview

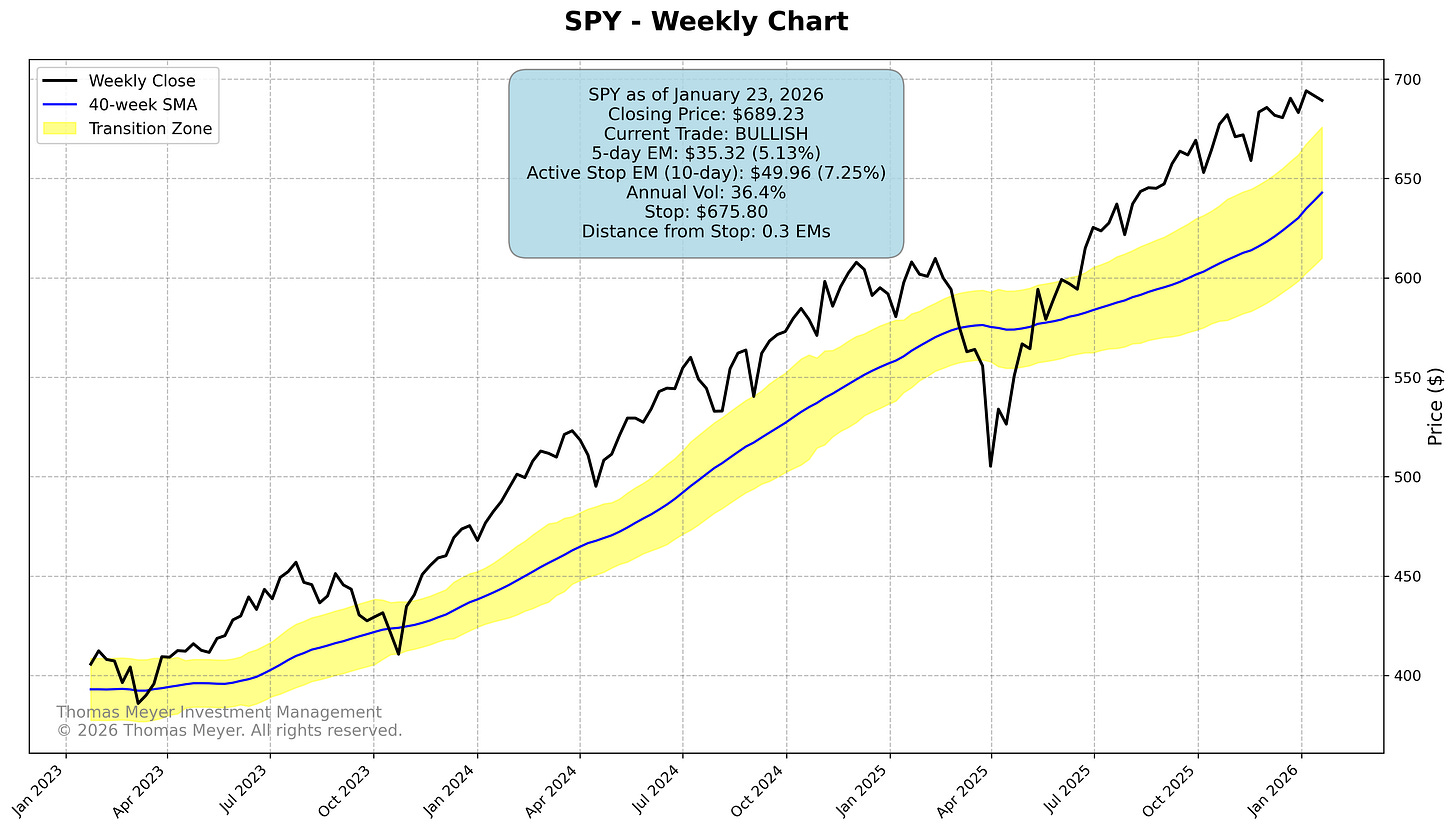

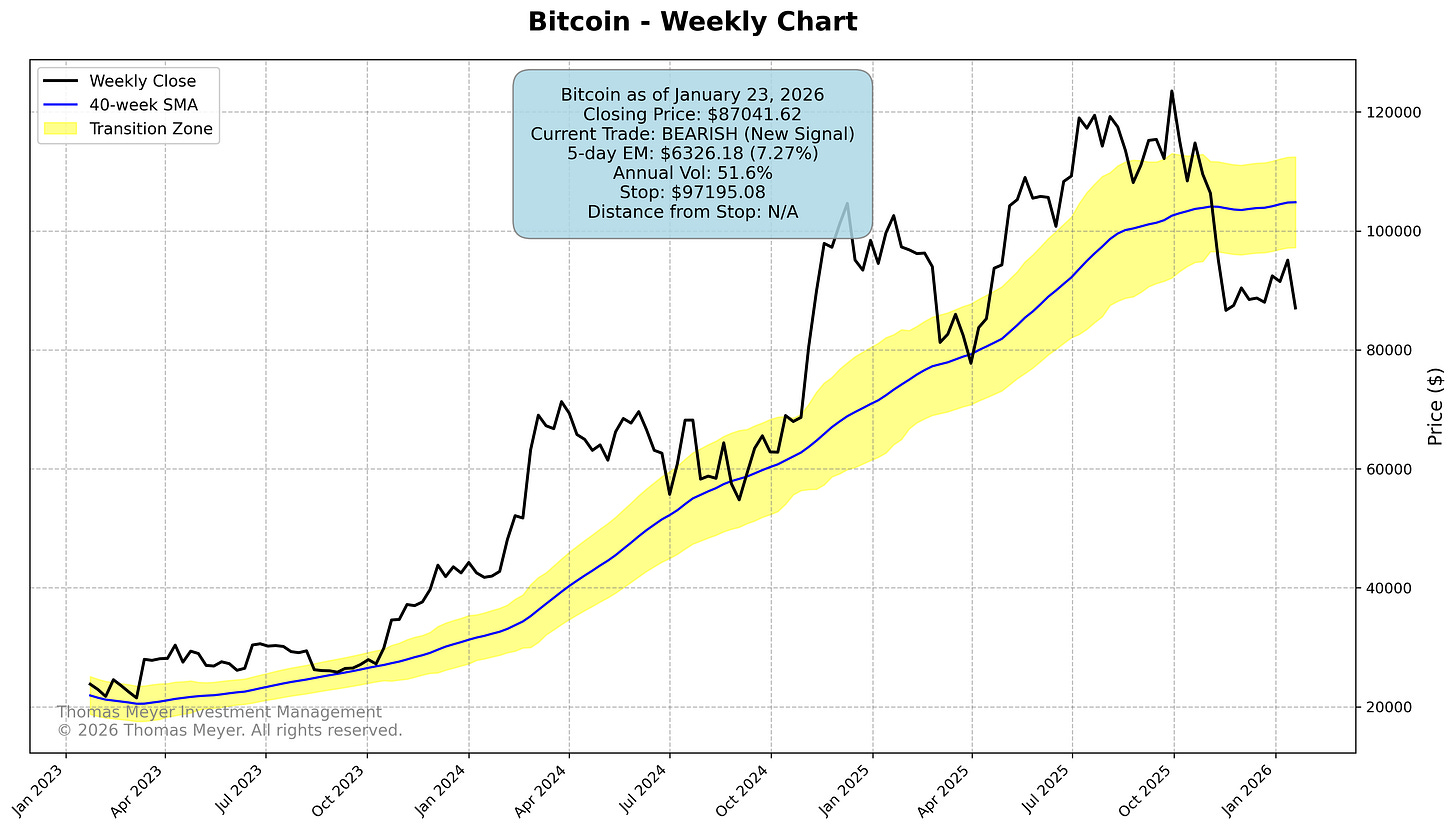

SPY closed slightly lower this week but remains bullish—though it’s getting uncomfortably close to the exit at just 0.3 Expected Moves away. QQQ bounced back after stopping us out last week by a penny (yes, that still stings), but our cooldown rule keeps us on the sidelines for one more week. Sometimes the most disciplined thing you can do is nothing. Bitcoin triggered a fresh bearish trade after satisfying its cooldown period.

Gold continues its spectacular run, now pushing toward $5,000 and sitting 1.5 Expected Moves from the stop. That’s 88% profit since we entered in January 2025—this is what trend-following is designed to capture.

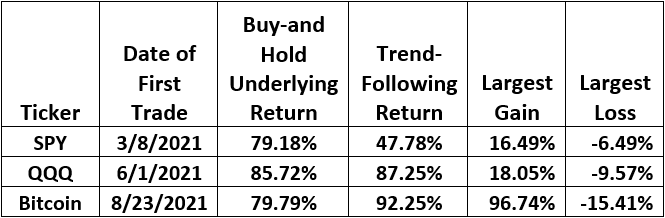

Historical Results For SPY, QQQ, Bitcoin

The trend-following approach I use has a decade-long track record across multiple newsletters in three countries. Here are the results for SPY, QQQ, and Bitcoin since I started publishing on Substack:

Always have your exit strategies prepared before you enter into any trade.

Current Conditions for January 26, 2026

Be Sure to Read the Disclaimer at the End of This Report

Here are the latest charts…

SPY (SPDR S&P 500 ETF)

Friday’s Closing Price: 689.23

Current Condition: Bullish

Weekly Expected Move: 35.32 (5.12%)

Stop: 675.80

Distance from Stop: 0.3 Expected Moves

Current Trade Entry Price: 599.72

Current Trade Entry Date: 09 June 2025

QQQ (Invesco NASDAQ 100 ETF)

Friday’s Closing Price: 622.72

Current Condition: Bullish

Weekly Expected Move: 39.60 (6.36%)

Stop: N/A

Distance from Stop: N/A

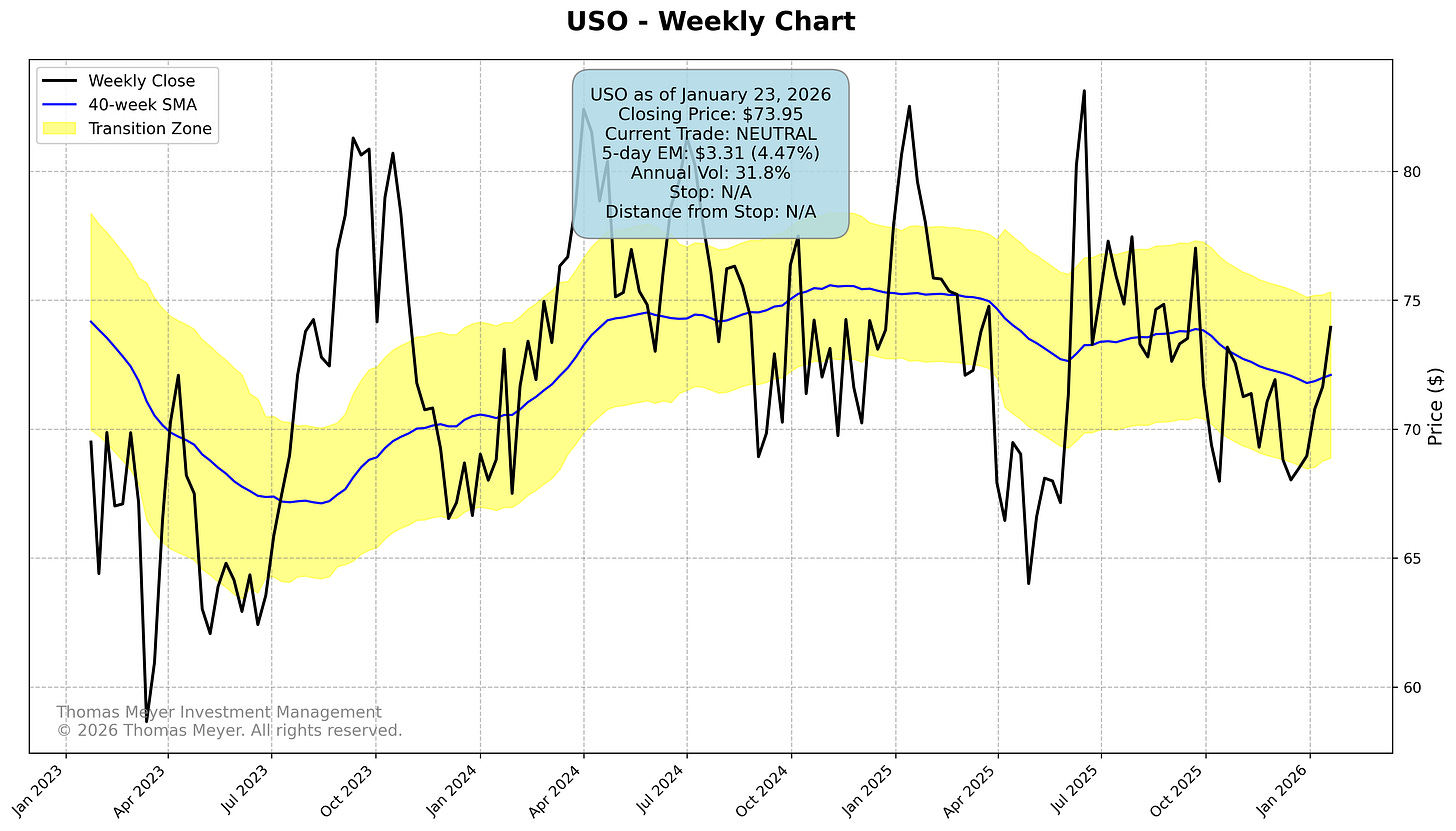

USO (USCF Crude Oil ETF)

Friday’s Closing Price: 73.95

Current Condition: Neutral

Weekly Expected Move: 3.31 (4.48%)

Stop: N/A

Distance from Stop: N/A

Gold (Current Futures Contract)

Friday’s Closing Price: 4,983.10

Current Condition: Bullish

Weekly Expected Move: 410.68 (8.24%)

Stop: 4,095.75

Distance from Stop: 1.5 Expected Moves

Current Trade Entry Price: 2,652.80

Current Trade Entry Date: 06 January 2025

BTC (Bitcoin)

Sunday’s Closing Price: 87,041.62

Current Condition: Bearish

Weekly Expected Move: 6,326.18 (7.27%)

Stop: 97,195.08

Distance from Stop: 1.6 Expected Moves

Disclaimer

The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.