AlgoTrendTraders Weekly Report

Thomas Meyer, Editor | September 15, 2025

Email: algotrendtraders@gmail.com | X: @AlgoTrendTrade1

IMPORTANT DISCLAIMER: The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you're considering investing.

Executive Summary

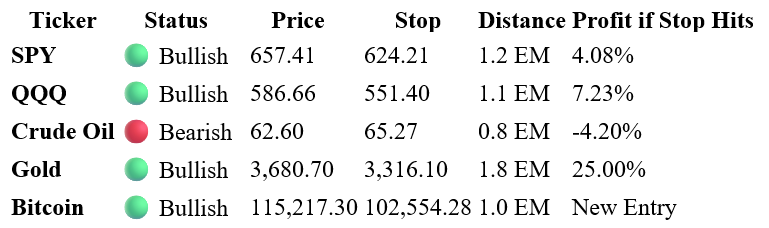

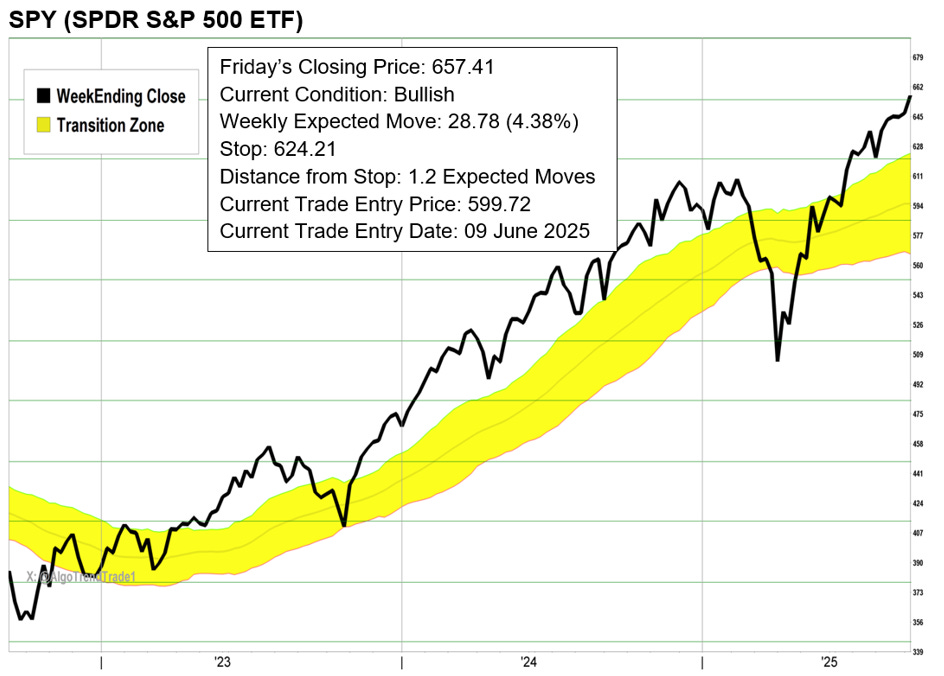

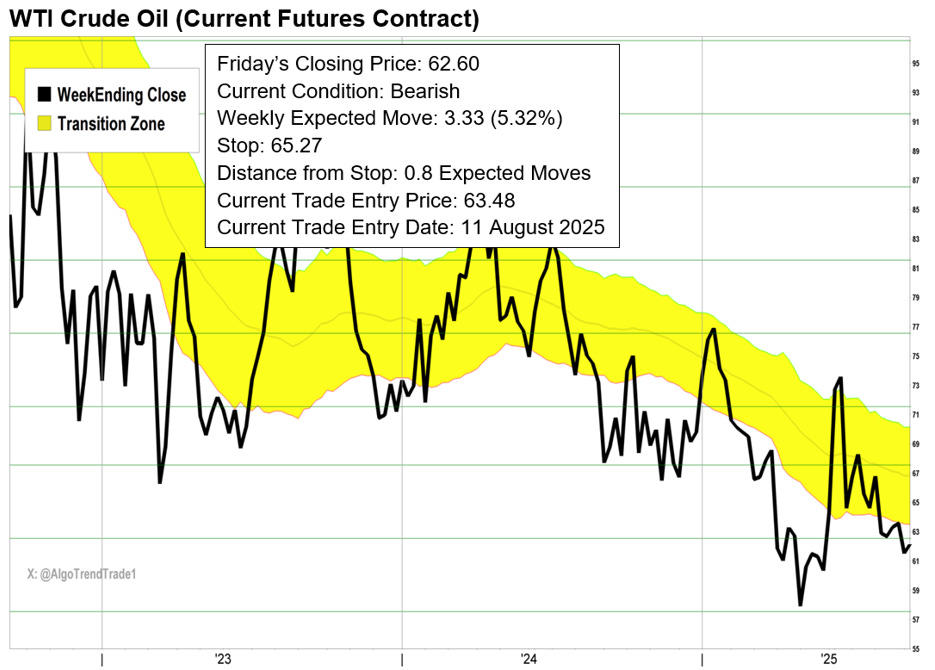

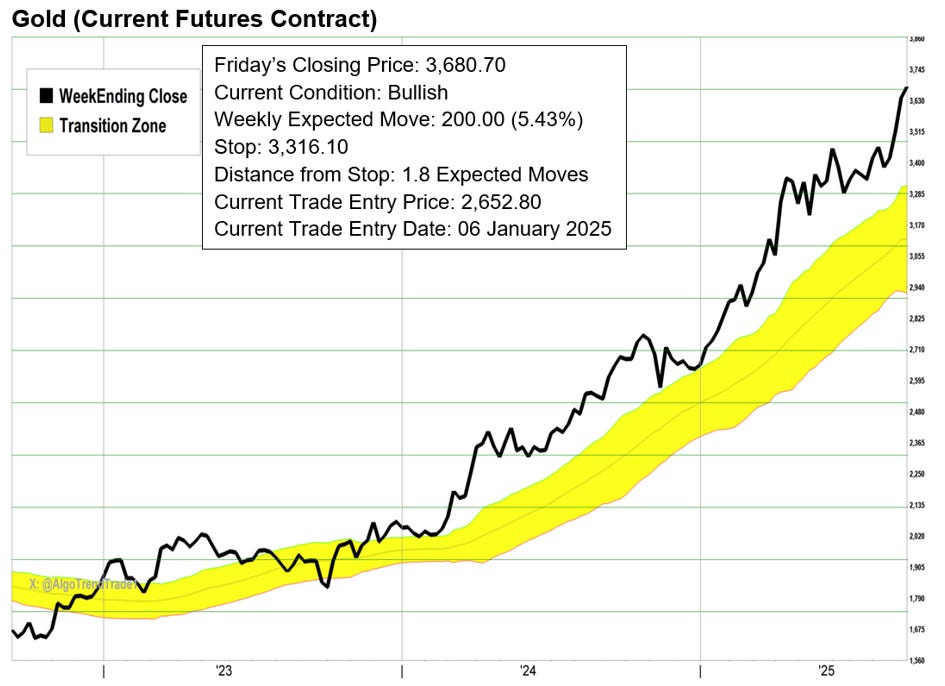

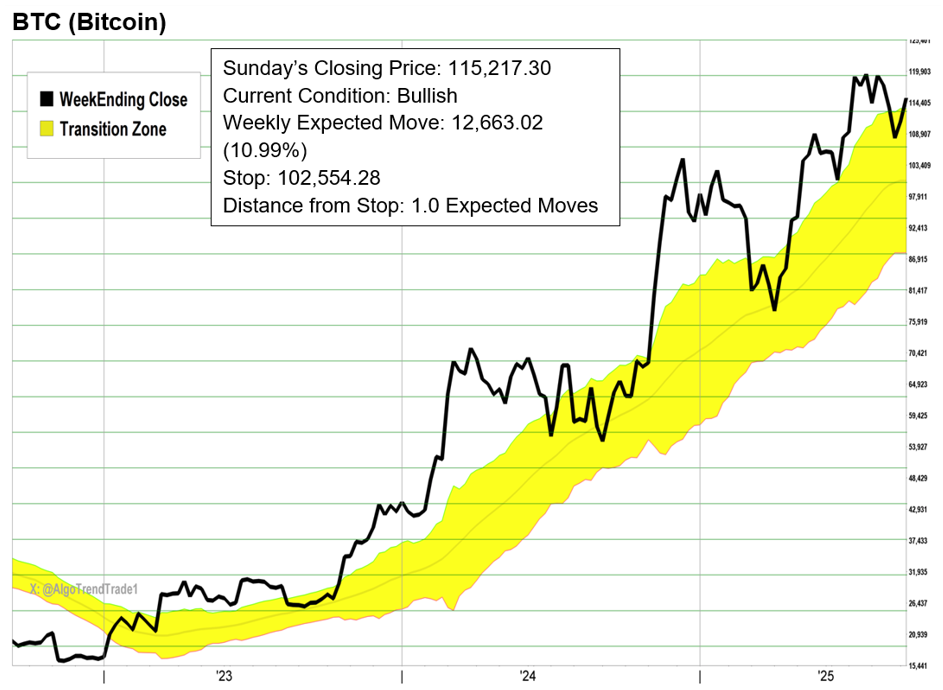

Gold extends breakout with another new all-time high after 8+ month bullish run. Bitcoin joins the party with new bullish signal above transition zone. SPY and QQQ continue building profit cushions as stops rise with new highs.

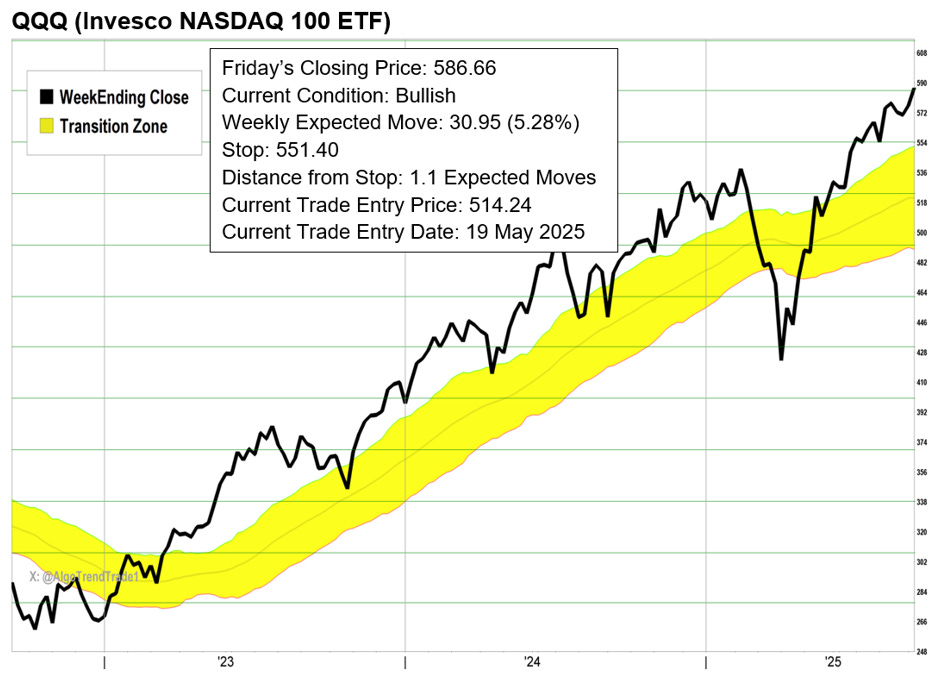

Current Market Status

Active Trades & Exits

Key Developments

🚀 Gold Momentum: Another new all-time high extends the remarkable 8+ month bullish trend from January entry. Previous bullish run lasted February through mid-December 2024.

₿ Bitcoin Breakout: Closed above yellow transition zone, triggering new bullish signal. Catches up to recent strength in Solana and other large cryptos.

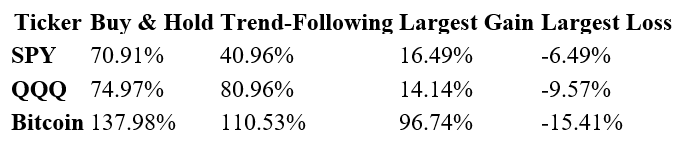

📈 Major Indices: SPY and QQQ make new all-time highs, widening Expected Moves slightly and raising stops. Profit buffers continue expanding.

⚡ Volatility Expansion: Gold's Expected Move widens to 5.43%, Bitcoin at elevated 10.99% reflecting crypto volatility.

S&P 500 Sectors At-a-Glance

🟢 Bullish (7): Materials (XLB), Communications (XLC), Financials (XLF), Industrials (XLI), Technology (XLK), Utilities (XLU), Discretionary (XLY)

🟡 Neutral (4): Energy (XLE), Staples (XLP), Real Estate (XLRE), Healthcare (XLV)

🔴 Bearish (0): None

No sector condition changes - broad market strength persists

Portfolio Services

DeepStreet.io Portfolios

I run two strategies on this growing platform for serious DIY investors:

Free Portfolio: Major indices (SPY, QQQ, DIA, IWM) with same signals as here

Paid Strategy: All 11 sector ETFs with defined exits (2 weeks free trial)

Advantage: Weekly email updates sent before online posting

Sign up: DeepStreet.io

Thomas Meyer Investment Management

Not comfortable managing trades yourself? I can handle it for you. Funds stay in your name at Charles Schwab institutional.

Learn more: tminvestmentmanagement.com

Always have your exit strategies prepared before you enter into any trade.

Here are the latest charts…

System Performance Through September 14, 2025

Why Trend-Following Works

The Problem with Buy-and-Hold: When you need your money (retirement, medical, education), a 30-50% loss at the wrong time can derail your plans forever.

The Solution: Disciplined exit strategies. Every trade has a predetermined stop-loss based on the security's normal volatility. Small losses, big wins.

Key Principles:

Follow trends until they break

Weekly closes eliminate daily noise

Risk management is more important than being right

Boring but historically effective

Trading Methodology

The Yellow Channel System:

Above yellow zone = 🟢 Bullish (go long)

In yellow zone = 🟡 Neutral (no trade)

Below yellow zone = 🔴 Bearish (go short)

Exit Strategy: Based on each security's 52-week volatility ("Expected Move"). Stops move up with profitable trades but never down.

Best Entry: When new signals trigger. Late entries carry higher risk - consider smaller position sizes.

Remember: Always have your exit strategy prepared before entering any trade.

This is not a "get-rich-quick" scheme. Trend-trading requires discipline, patience, and proper risk management. Past performance does not guarantee future results.