Thomas Meyer, Editor

June 23, 2025

Email: algotrendtraders@gmail.com

X: @AlgoTrendTrade1

Welcome to this week’s AlgoTrendTraders report. Before getting into this week’s report, be sure to follow me on X: @AlgoTrendTrade1

I’ll post updates throughout the week as needed.

The data and charts shown in this report are not meant to be recommendations and no buy/sell information is inferred. Please read the disclaimer underneath the charts.

Will the Trends Hold?

That’s what we all want to know. Last week, both SPY and QQQ closed mostly unchanged (SPY was down by less than 0.5% when taking into account the ex-dividend on Friday and QQQ was down by a few pennies). They’re each trading at less than 1.0 Expected Moves from their respective exits.

The overnight futures markets dropped almost 1%, but they’re now trading down less than 0.5%. What’s going to happen? We certainly don’t know as the markets are more news-driven right now than normal. News-driven and rumor-driven.

Ultimately, this is the reason we use trend-following strategies. The one thing we know is that we’re taking small risks in each trade. If we get stopped out, it doesn’t blow up our trading portfolio. We have enough to get into the next trades. At some point, there will be trends that move in our favor.

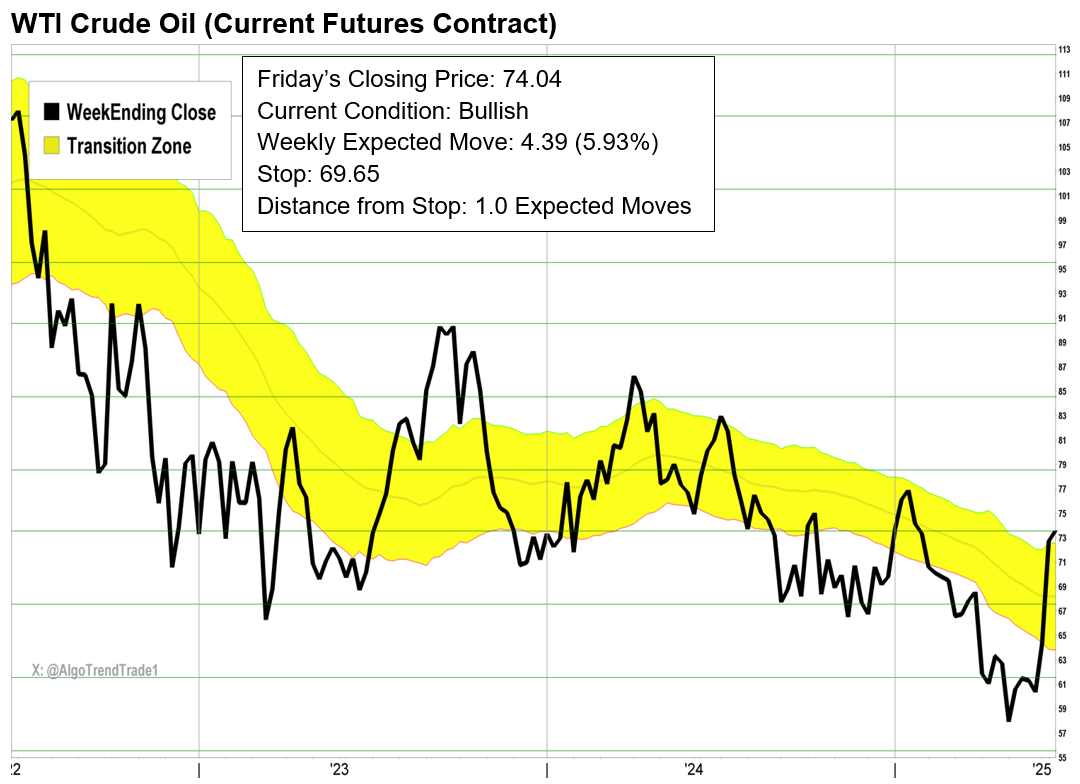

New Bullish Trade in Oil

WTI Crude Oil closed above the yellow channel Transition Zone (TZ) and is now in a bullish condition. Oil is fluctuating this evening, but it remains above the TZ. If oil opens the trading day below 73.03, there is no new trade.

In the past, whenever we have had new trades in Oil, Gold, or Bitcoin, I have used the opening prices. Those prices occur on Sunday evening at 5pm, 5pm, and 7pm respectively. Nobody can actually get filled at those prices since the newsletter doesn’t come out for another 12+ hours.

Going forward, if the newsletter is sent out before the market open, the trades will be priced at 8:30am Central Time. If it’s sent out after the market open, the trades will be priced at the nearest 15 minute mark after distribution. This way, everyone can get in at the “opening” price.

I’m considering dropping TLT as a part of newsletter. If you have a suggestion for a replacement, please send an email to the address above and let me know your thoughts.

Bitcoin Hit Its Exit

Sunday afternoon, the cryptocurrency markets dropped sharply, and Bitcoin hit its listed exit. We ended up with a decent gain of 5% in a little less than 2 months. If it closes higher next week than this evening’s close, we could see another new long trade.

DeepStreet.io

I’m running 2 portfolios on DeepStreet.io. It was an honor to be chosen as one of their first expert contributors. This new platform is built for serious do-it-yourself investors – and my strategies are now live.

I have 2 offerings on DeepStreet. The first is a free portfolio focusing on the major market indices including SPY, QQQ, DIA, and IWM. The second is a paid portfolio that focuses on the individual sector ETFs. The difference from what you see here is that the trades will all have exit strategies which I don’t publish here. Accessing the first 2 weeks is free, so you can sign up and cancel if you choose not to continue.

Exit Strategies Updated

All the stops have been updated for the current trades. Be sure to update your exits according to the rules you use.

Thomas Meyer Investment Management

If you are not comfortable managing these trades on your own, there’s a simple solution. Let me do it for you! Anyone wanting to learn more about my management can check out the website for more information. Be sure to click on the “Let’s Connect” tab, fill it out, and we can discuss the next steps for me to manage a portion of your investable assets. By the way, I never actually hold your monies, they remain in your name and are custodied at Charles Schwab on the institutional side. Here’s my website: tminvestmentmanagement.com

An X-Ray of the S&P 500 Sectors

Heading into the trading week, there are now we are now at 3 bullish sectors, 7 neutral sectors, and 1 bearish sector.

(Note: If you follow this section closely, you’ll notice that there seem to be a lot of changes each week. The scope of this newsletter doesn’t allow me to show you the charts on a weekly basis nor are we giving buy/sell signals. If we were trading these tickers, there would be far fewer changes. The purpose of showing you these is to give you a “snapshot” of where the charts closed trading on Friday.)

I will have updated trades later today on DeepStreet.io with entries and exits. The sectors give a much greater view of where the markets are than just the individual indices. The trades use the normal AlgoTrendTrader methodology. The exit strategies and commentaries will be updated shortly after the market opens.

XLB (Materials) – Neutral Condition

XLC (Communications) – Bullish Condition

XLE (Energy) – Neutral Condition

XLF (Financials) – Neutral Condition

XLI (Industrials) – Bullish Condition

XLK (Technology) – Bullish Condition

XLP (Staples) – Neutral Condition

XLRE (Real Estate) – Neutral Condition

XLU (Utilities) – Neutral Condition

XLV (Healthcare) – Bearish Condition

XLY (Discretionary) – Neutral Condition

Historical Results Are Underneath the Charts

The updated historical results for the tickers we follow in AlgoTrendTraders are listed underneath the charts. They are currently showing the trades with closing prices through June 22nd.

AI Answers About Trend-Following

For those new to AlgoTrendTraders, we have a list of questions we asked ChatGPT to answer about trend-trading and its advantages. Be sure to read those to better your understanding of what we’re doing here.

For those wanting to know more about Trend-Trading

The overview of the AlgoTrendTraders system is underneath the charts. Those familiar with our methodology can get right to the trades. If you’re new to trend-trading, be sure to read the introductory section. This will help you understand the concept of trend-trading and why it is so powerful.

Always have your exit strategies prepared before you enter into any trade.

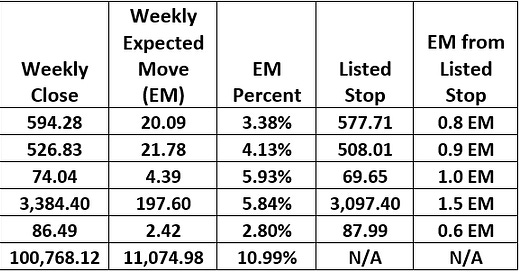

Composite Table for June 23, 2025

Be Sure to Read the Disclaimer at the End of This Report

Here are the latest charts…

Disclaimer:

The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.

Trend-Trading Overview

The long/short signals are based on trend-following principles. Very simply, stocks and commodities stay in trends… until they don’t. Trends can last a short time, or they can last for months and even years at a time.

This is not a “get-rich-quick” scheme

If you’re looking to make a ton of money in a short time, you’re going to be disappointed. Trend-trading is not fancy; it’s boring, and takes time to be successful. This is a system that relies on a historically proven process to generate solid returns on winning trades and avoid large losses on losing trades. We’re definitely the tortoise, not the hare.

Trend-following systems don’t try to guess what the next move in the markets might be. Instead, we measure the markets each week and use our algorithms to determine the current trend and the exit strategy for the current trades.

The key to the winning trades greatly outperforming the losing trades is the risk management system. If a trade moves against us, we’ll get out of the trade with a small loss. But if a trade trends higher for months at a time, we have the ability to build up substantial profits.

AlgoTrendTraders uses both trend and momentum to generate the trading signals. The yellow channel you see in the center of the charts is called the “Transition Zone”. When a stock is above the yellow channel, it’s in a Bullish condition. When it’s below the yellow channel, it’s in a Bearish condition. When it’s in the middle of the channel, it’s in a Neutral condition and there is no trade.

Selling is More Important Than Buying

Every trade has a pre-determined exit strategy. This is based on the normal volatility of the underlying ticker. Each stock has its own unique volatility. And, volatility is dynamic. It’s constantly changing. Each week, we look at the previous 52 weeks of price movement to come up with its normal weekly volatility. This is called the “Expected Move”. The Expected Move equals one week of the normal volatility of the stock or ETF being measured. Every week, the exit strategy for each ticker is updated.

The system is based on the weekly closes of the underlying tickers. All trading information and volatility calculations are based on weekly volatility. By using weekly calculations, the system ignores the day-to-day noise in the markets and is able to give better signals.

It’s easy to see the periods of time that volatility increases and decreases. As the yellow channel Transition Zone widens on the charts, the volatility is increasing. The opposite is true; when the Transition Zone narrows on the charts, the volatility is decreasing.

The best time to enter a trade is when a new signal is given. This gives you the greatest opportunity to get into a trend that could last a long time. Though it’s possible to get into a trade after a trend has been in place for a while, the risk in that trade is elevated. Consider using 1/2 or 1/3 of your normal investment for these situations.

This report gives signals that can be followed by both novice and more experienced investors. Novice investors can use these signals to help them manage their 401(k) and retirement plans by adjusting the signals for SPY and QQQ to match the mutual funds in their plans. Though you won’t be able to short these indices when they become bearish, you can move to cash and avoid the devastating losses from bear markets.

Experienced and sophisticated investors can use leverage or options, but the risk is substantially greater. Never risk more money than you can afford to lose.

Returns of AlgoTrendTraders Trading Signals Through June 22, 2025

ChatGPT Questions and Answers About Trend-Trading

What are the advantages of trend-trading in the financial markets?

“Trend trading is a popular strategy used by traders in financial markets, and it involves identifying and following the direction of market trends in order to profit from them. Here are some advantages of trend-trading in the financial markets:

1. Potential for High Returns: Trend trading can offer high returns in a short period of time. This is because traders can enter a trade at the beginning of a trend and exit it at the end, capturing a significant portion of the trend's movement.

2. Reduced Risk: Trend trading allows traders to reduce their risk by avoiding counter-trend trades. By following the trend, traders can avoid the pitfalls of trying to predict market reversals and can stay in profitable trades for longer periods of time.

3. Simplified Trading: Trend trading is a relatively simple strategy to implement. Traders only need to identify the trend direction and enter trades in the same direction, making it easier to execute and manage compared to other trading strategies.

4. Objective Decision Making: Trend trading is based on objective technical analysis, which takes emotions out of the decision-making process. This helps traders to avoid making impulsive decisions based on fear or greed and stick to a disciplined approach.

5. Wide Range of Markets: Trend trading can be applied to a wide range of financial markets, including stocks, commodities, currencies, and bonds, allowing traders to diversify their portfolio and find opportunities in different markets.

However, it is important to note that trend trading is not foolproof and carries some risks, including false breakouts and sudden trend reversals. It is important to manage risk by using proper stop-loss orders and position sizing techniques.”

What limits the widespread adoption of trend-trading?

“Despite its advantages, there are several factors that limit the widespread adoption of trend trading in the financial markets. Here are a few:

1. False Breakouts: False breakouts can occur when a market appears to be trending in a particular direction, but then suddenly changes direction, resulting in a loss for the trader. These false signals can cause traders to lose confidence in the trend trading strategy and abandon it altogether.

2. Emotional Bias: Even though trend trading is based on objective technical analysis, traders can still be affected by emotional biases such as fear, greed, and overconfidence. These biases can lead to impulsive trading decisions, which can result in losses.

3. High Volatility: Markets can be volatile, and sudden price movements can trigger stop-loss orders, resulting in traders being stopped out of their positions. This can happen even if the overall trend remains intact, leading to missed opportunities.

4. Time-Consuming: Trend trading requires constant monitoring of market trends and technical indicators, which can be time-consuming. This can be a challenge for traders who have limited time or resources.

5. Limited Returns: While trend trading can offer high returns, it is not a get-rich-quick strategy. The returns are often gradual, and it may take time to build a profitable trading record.

6. Unpredictable Market Conditions: The market conditions can change unexpectedly, and market trends can reverse suddenly. This unpredictability can make trend trading a challenging strategy to execute, as it requires traders to be agile and adaptable to changing market conditions.

In summary, while trend trading can be a profitable strategy, it is not without its challenges. Traders need to be disciplined, patient, and able to manage risk effectively to succeed with this strategy.”

How do you trust trend-trading algorithms?

“Trend-trading algorithms are computer programs designed to identify and follow market trends, and they are increasingly popular among traders in financial markets. Here are a few things to consider when trusting trend-trading algorithms:

1. Backtesting: Before using a trend-trading algorithm, it's important to test it thoroughly using historical data. Backtesting involves running the algorithm on past market data to see how it would have performed. This can give you an idea of how well the algorithm works and how much risk it carries.

2. Transparency: A trustworthy trend-trading algorithm should be transparent, with clear rules and parameters that can be easily understood. The algorithm should also be able to explain its trading decisions and provide a clear rationale for why it takes certain positions.

3. Performance Metrics: When evaluating a trend-trading algorithm, it's important to look at performance metrics such as Sharpe ratio, drawdown, and win rate. These metrics can give you an idea of how well the algorithm has performed in the past and how much risk it carries.

4. Independent Verification: A trustworthy trend-trading algorithm should be independently verified by a reputable third-party. This can help to confirm that the algorithm works as advertised and can be trusted.

5. Regular Monitoring: Even if a trend-trading algorithm has a good track record, it's important to regularly monitor its performance to ensure that it continues to work as expected. Traders should also be prepared to make adjustments or switch to a different algorithm if necessary.

6. Robustness: Trend-trading algorithms should be robust and able to handle unexpected market conditions, such as sudden volatility or news events. They should also be able to adapt to changing market conditions and adjust their trading strategy accordingly.

In summary, when trusting trend-trading algorithms, it's important to consider factors such as back testing, transparency, performance metrics, independent verification, regular monitoring, and robustness. By carefully evaluating these factors, traders can choose an algorithm that they can trust and rely on for their trading strategies.”

Who are some of the best trend-traders over the past 125 years?

“There have been many successful trend-traders over the past 125 years, but here are a few notable examples:

1. Jesse Livermore: Jesse Livermore was a legendary trader who made a fortune by following trends in the stock market in the early 20th century. He was famous for his ability to read the market and his patience in waiting for the right opportunity to make a trade.

2. Richard Dennis: Richard Dennis was a trend trader who became famous in the 1980s for his Turtle Trading experiment. He recruited a group of novice traders, taught them his trend-following strategy, and they went on to make millions of dollars in the financial markets.

3. Ed Seykota: Ed Seykota is a trend trader who is known for his technical analysis skills and his ability to develop trading systems that follow trends. He is also known for his philosophy of "ride the trend" and letting profits run.

4. Paul Tudor Jones: Paul Tudor Jones is a hedge fund manager who has made billions of dollars by following trends in the financial markets. He is known for his macro trading strategies and his ability to anticipate market trends before they happen.

5. Stanley Druckenmiller: Stanley Druckenmiller is a billionaire investor who made his fortune by following trends in the financial markets. He is known for his macro trading strategies and his ability to anticipate changes in economic trends before they happen.

These trend traders have different styles and approaches, but they all share a common philosophy of following market trends and letting their profits run. They have shown that trend trading can be a profitable strategy when executed with discipline, patience, and risk management.”

A Personal Note – Why I’m Doing This Newsletter

There are a few reasons. One, preparing the charts every week helps me with my own personal investments. Two, creating the newsletter forces me to be disciplined as there’s a deadline that has to be met.

And here’s the biggest reason…. I have over 30 years’ experience as an investment professional. I’ve seen a lot, made just about every mistake there is, and have come to the realization that many individual investors are misled by the big Wall Street firms.

I’m sure you’ve all heard from the ivory tower financial “gurus” that buy-and-hold is the best way to make money in the stock market. And just looking at the numbers over a long period of time, the results of buy-and-hold are good. But there’s a big problem that’s not addressed.

Unless you’re very wealthy, at some point in time, you’re going to need to access your investments to live. Retirement, medical issues, college for children and grandchildren, vacations, donations to causes important to you. We all have a timeline that’s going to end one day. We don’t know when that will happen. If you practice buy-and-hold, there will come a time that you could lose 30%, 40%, 50% or more. It’s happened in the past and will definitely happen again (maybe really soon).

If you lose a large amount of money, what happens to the things you need and want your investments for? I’ve seen it happen with many people over my 3-decade career. People getting ready to retire, they relied on buy-and-hold, and then the bear market hit and their portfolio value drops substantially. They’ve now got 2 choices…. they can still retire, but the amount of income they could count on would drop dramatically… for the rest of their life! Or they could go back to work for 4 or 5 years and then retire. Neither choice is a good one to have to make.

I first learned about trend-following almost 20 years ago. It was right after the dot-com bear market and people lost a ton of money. The biggest reason for the losses was they didn’t have exit strategies set in place. At the time, I was a financial advisor for one of the big firms. I saw my clients lose a lot and all I could do was parrot what had been told to me… “Don’t worry, the market always comes back.” It was a pretty helpless feeling. And I knew there had to be a better way.

Trend-following is not perfect. You’re not going to have 100% winning trades. It requires discipline and patience. It’s boring. And there are a lot of times you’ll be in cash waiting for the next trend.

My experience is that trend-following gives investors the best opportunity in the long-run to make a good return in the market and still control downside risk. It took a long time to learn and I’m still learning. Most importantly, I’m in better control of my investments. I know what the exit is on every trade before I get into the trade. I’m more disciplined. I don’t have to guess what I’m going to do.

So why give it away? Because I want to see people help themselves become successful! Trading SPY and QQQ isn’t exciting, but so far, the trades in these ETFs have been good over the past few years. It has the potential to be good going forward.

Nobody knows what will happen in the future and if this system will be profitable or not. You have to believe in the system and have the discipline to stick to it. If the market whipsaws higher and lower for the next period of time, trend-following will probably lose money. But if a few trends turn out to be long and last months at a time, the opportunity to profit from the trends should be there.