AlgoTrendTraders Weekly Report for November 3, 2025

Disciplined, Rules-Based Trading

Thomas Meyer, Editor | November 3, 2025

Email: algotrendtraders@gmail.com | X: @AlgoTrendTrade1

IMPORTANT DISCLAIMER: The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.

Executive Summary

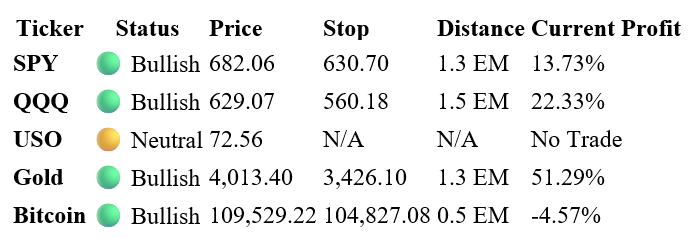

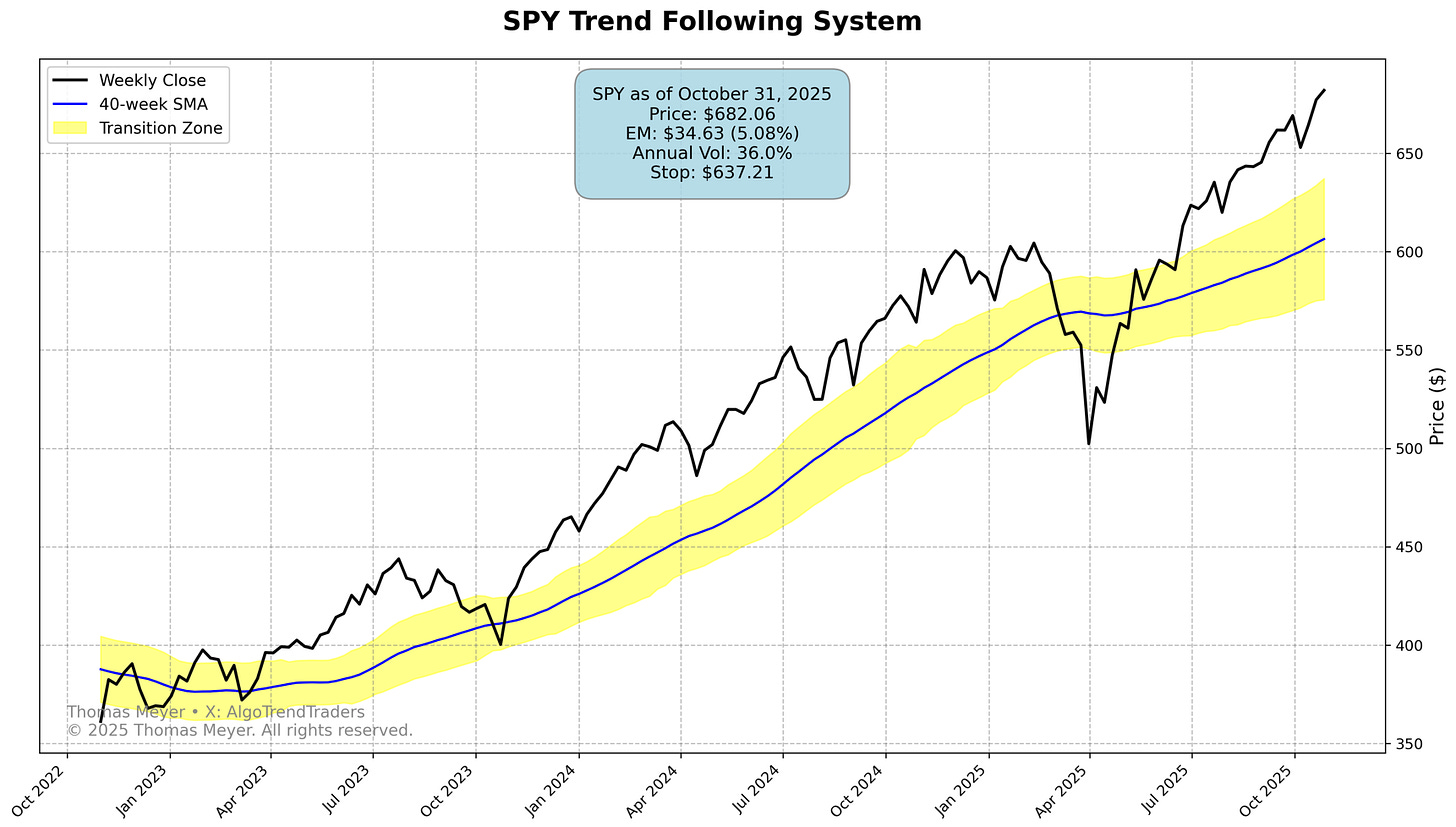

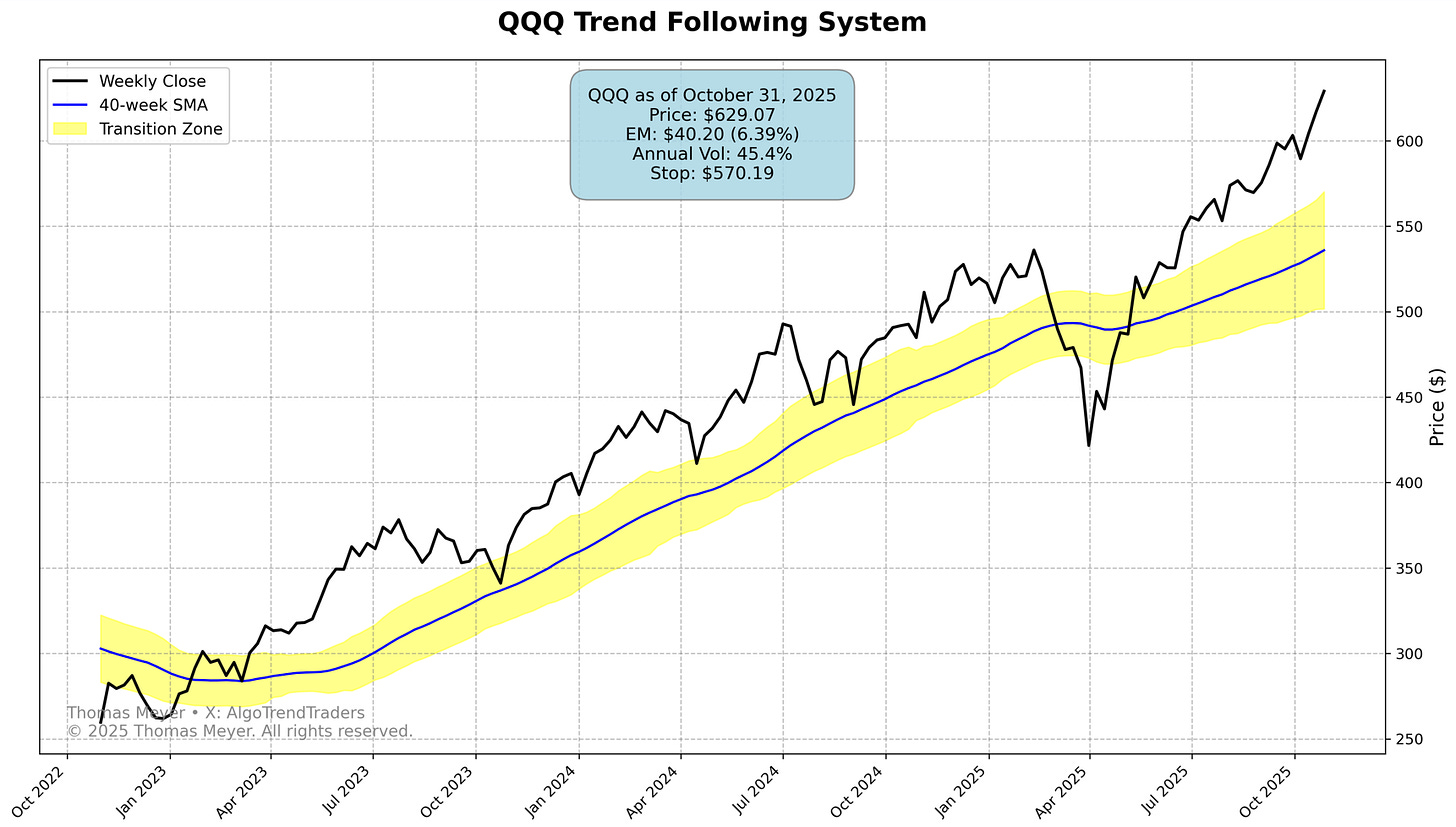

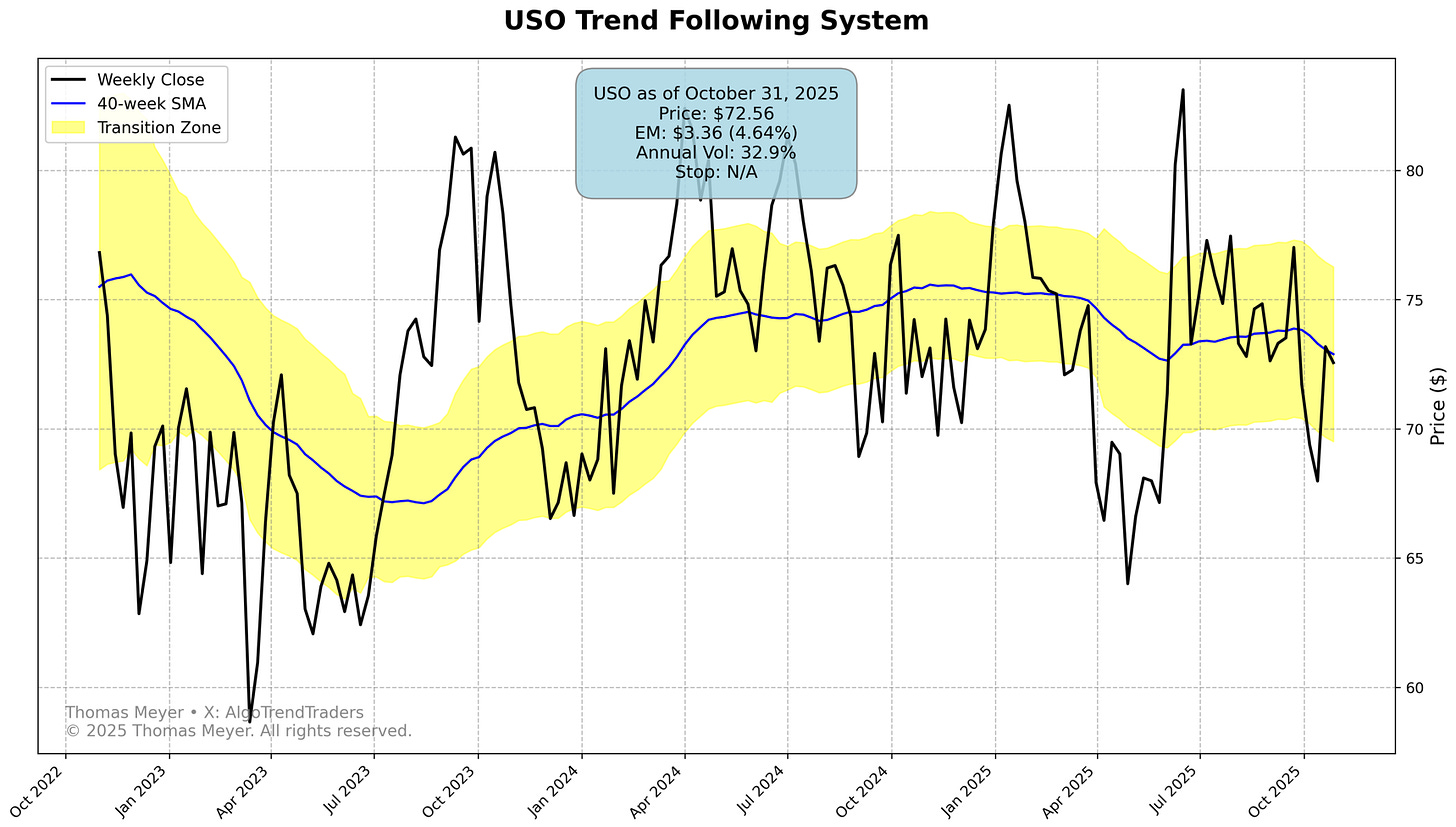

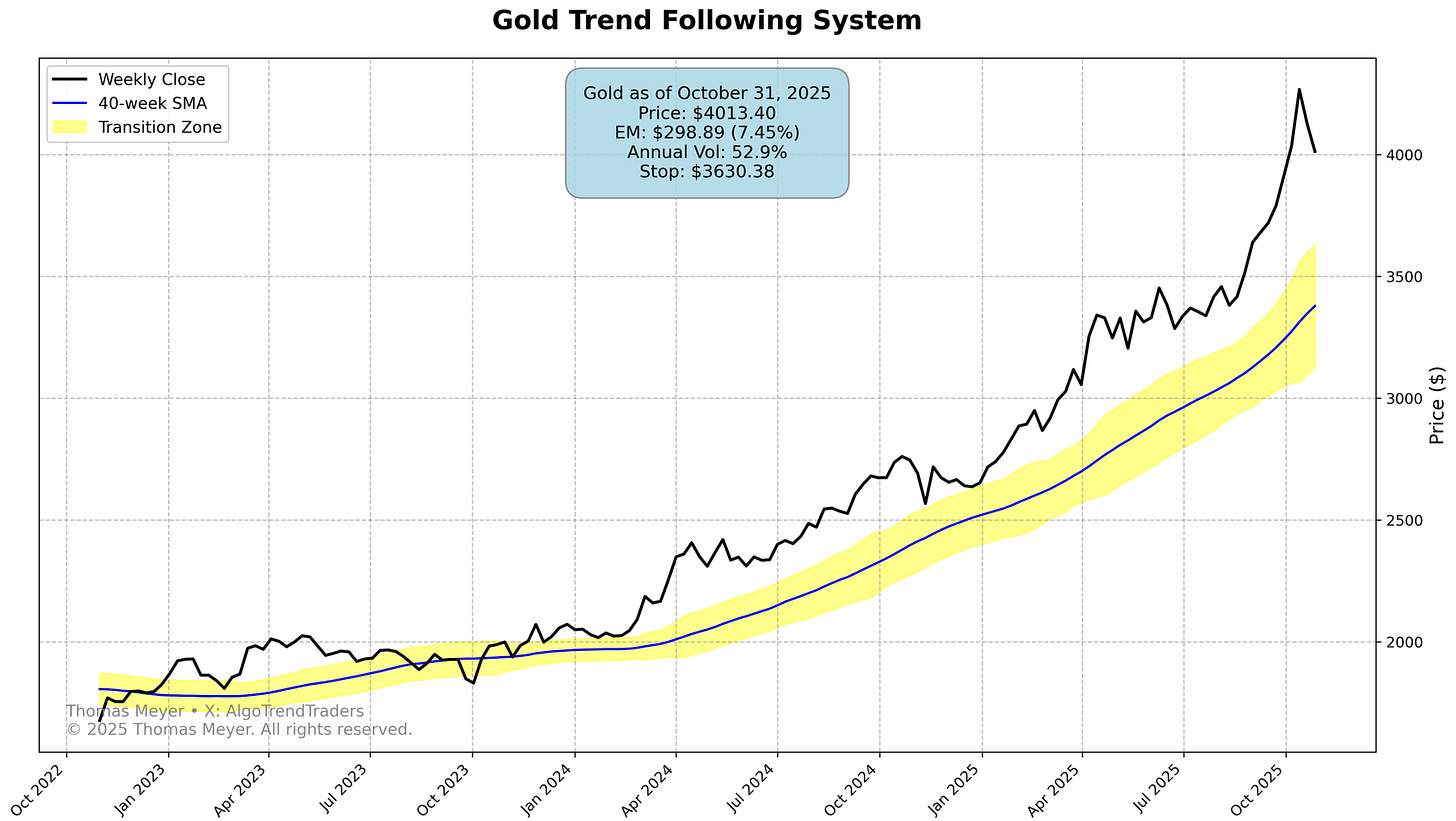

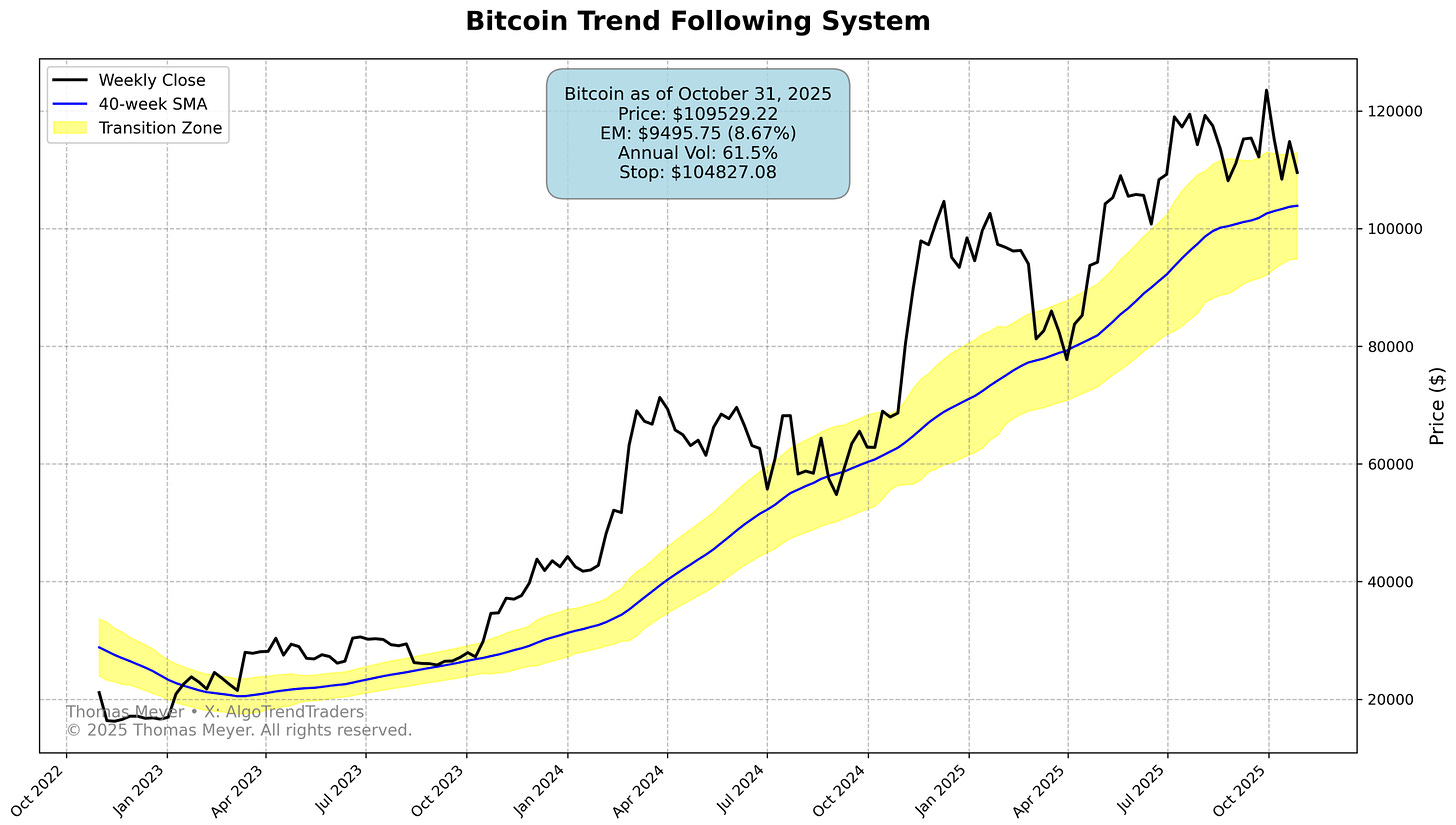

Markets push to new record highs with SPY reaching 682.06 and QQQ surging to 629.07 - both extending recent breakouts. Gold moved under the 4000.00 level, but closed at 4,013.40 maintaining strong uptrend. Bitcoin pulls back to 109,529.22, now slightly above stop level. No new trade signals this week. Sector deterioration emerges despite strong indices - Financials retreat to neutral, Staples drop back to bearish.

Tom’s Musings

I had a great email from a reader last week. “P” asked me, “...would you ever feature a relevant expert in a future post?”

I loved that question! As humans striving to make money in the stock markets, we’re always looking to get as much information as possible. Here was my response:

“In my world, the charts are the experts. I tend to live in a world with blinders on. I think price action is everything. I don’t really follow fundamentals or traditional technical analysis closely. I try to be like a robot and operate unemotionally. The charts make all the decisions.

I also realize that there are great experts out there in both fundamentals and technicals. My way is not the only way out there and there is a lot more to consider. One of my favorite analysts is Eoin Treacy who I met when I was writing for the Southbank Investment Group in London. Eoin has a great view of the world and is super knowledgeable. He has a Substack available that I highly recommend. Here’s the link, let me know what you think.”

fullertreacymoney.substack.com

Current Market Status

Active Trades & Exits

Key Developments

📊 Record Highs Continue: Major indices blast to new all-time highs. SPY showing 13.73% profit with 1.3 EM cushion, QQQ spectacular 22.33% gain with 1.5 EM distance from stop. Momentum remains strong.

🥇 Gold Rebounds: Recovers from last week’s pullback to 4,013.40, showing 51.29% profit since January entry. Distance from stop is still impressive 1.3 Expected Moves - excellent protection.

₿ Bitcoin Pullback: Week-old trade from October 27 entry at 114,777.86 showing -4.57% loss at 109,529.22. Still 0.5 Expected Moves above stop at 104,827.08. New trade experiencing early weakness but stop not threatened yet.

⚠️ Sector Weakness Warning: Despite record index closes, underlying sector deterioration emerges. XLF (Financials) retreats to neutral after brief bullish stint. XLP (Staples) drops back below transition zone to bearish. Market breadth narrows to 6 bullish sectors from 8 last week.

🔍 Divergence Alert: Strong index performance masking sector rotation and breadth deterioration - worth monitoring closely.

S&P 500 Sectors At-a-Glance

🟢 Bullish (6): Communications (XLC), Industrials (XLI), Technology (XLK), Utilities (XLU), Healthcare (XLV), Discretionary (XLY)

🟡 Neutral (4): Materials (XLB), Energy (XLE), Financials (XLF), Real Estate (XLRE)

🔴 Bearish (1): Staples (XLP)

Two sectors weaken: XLF drops from bullish to neutral; XLP falls from neutral to bearish - market breadth narrows

Portfolio Services

Thomas Meyer Investment Management

Not comfortable managing trades yourself? I can handle it for you. Funds stay in your name at Charles Schwab institutional.

Learn more: tminvestmentmanagement.com

Charts

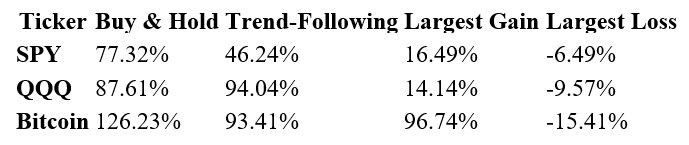

System Performance Through November 2, 2025

Why Trend-Following Works

The Problem with Buy-and-Hold: When you need your money (retirement, medical, education), a 30-50% loss at the wrong time can derail your plans forever.

The Solution: Disciplined exit strategies. Every trade has a predetermined stop-loss based on the security’s normal volatility. Small losses, big wins.

Key Principles:

Follow trends until they break

Weekly closes eliminate daily noise

Risk management is more important than being right

Boring but historically effective

Trading Methodology

The Yellow Channel System:

Above yellow zone = 🟢 Bullish (go long)

In yellow zone = 🟡 Neutral (no trade)

Below yellow zone = 🔴 Bearish (go short)

Exit Strategy: Based on each security’s 52-week volatility (”Expected Move”). Stops move up with profitable trades but never down.

Best Entry: When new signals trigger. Late entries carry higher risk - consider smaller position sizes.

Remember: Always have your exit strategy prepared before entering any trade.

This is not a “get-rich-quick” scheme. Trend-trading requires discipline, patience, and proper risk management. Past performance does not guarantee future results.

The narrowing breadth despite record highs is a classic setup for volatility ahead. When XLF and XLP start weakening while indices make new highs, it often signals that the rally is running on fewer cylinders. That 1.5 EM cushion on QQQ might get teste sooner than expected if this sector rotation accelerates.

Great comment R&C, thank you. The XLF move below the top of the Transition Zone was just by a few pennies... but that's where it moved. I agree with you that we might see a test on QQQ and SPY soon. These trends have lasted since May and early June respectively so there's good profit that's built-in, even if we get a reversal.

I appreciate your taking the time to read and comment. Cheers!