AlgoTrendTraders Weekly Report - December 22, 2025

Disciplined, Rules-Based Trading

AlgoTrendTraders Weekly Report

Thomas Meyer, Editor | December 22, 2025

Email: algotrendtraders@gmail.com | X: @AlgoTrendTrade1

IMPORTANT DISCLAIMER: The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.

Executive Summary

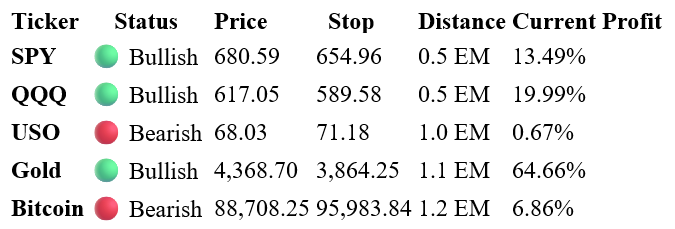

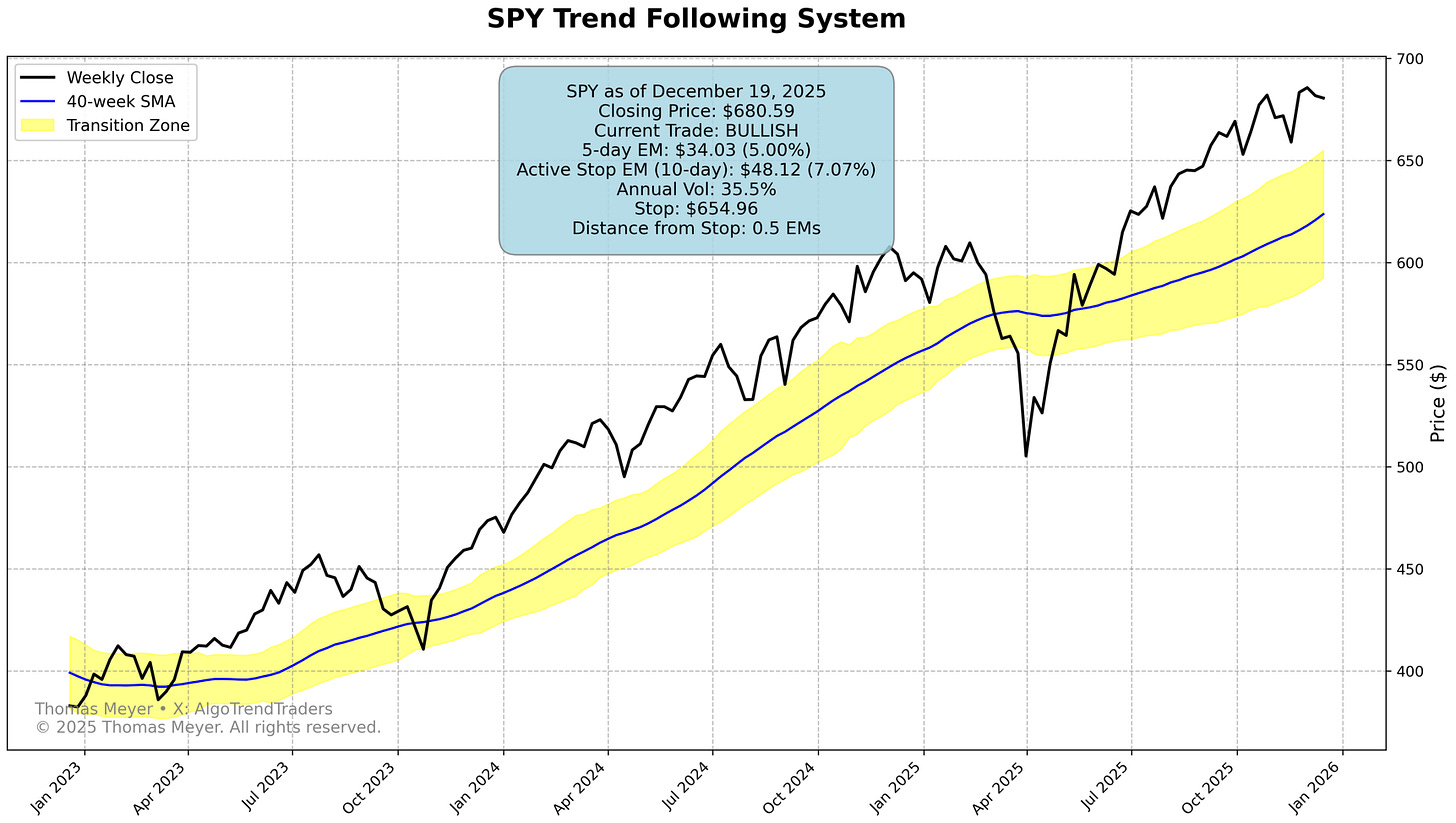

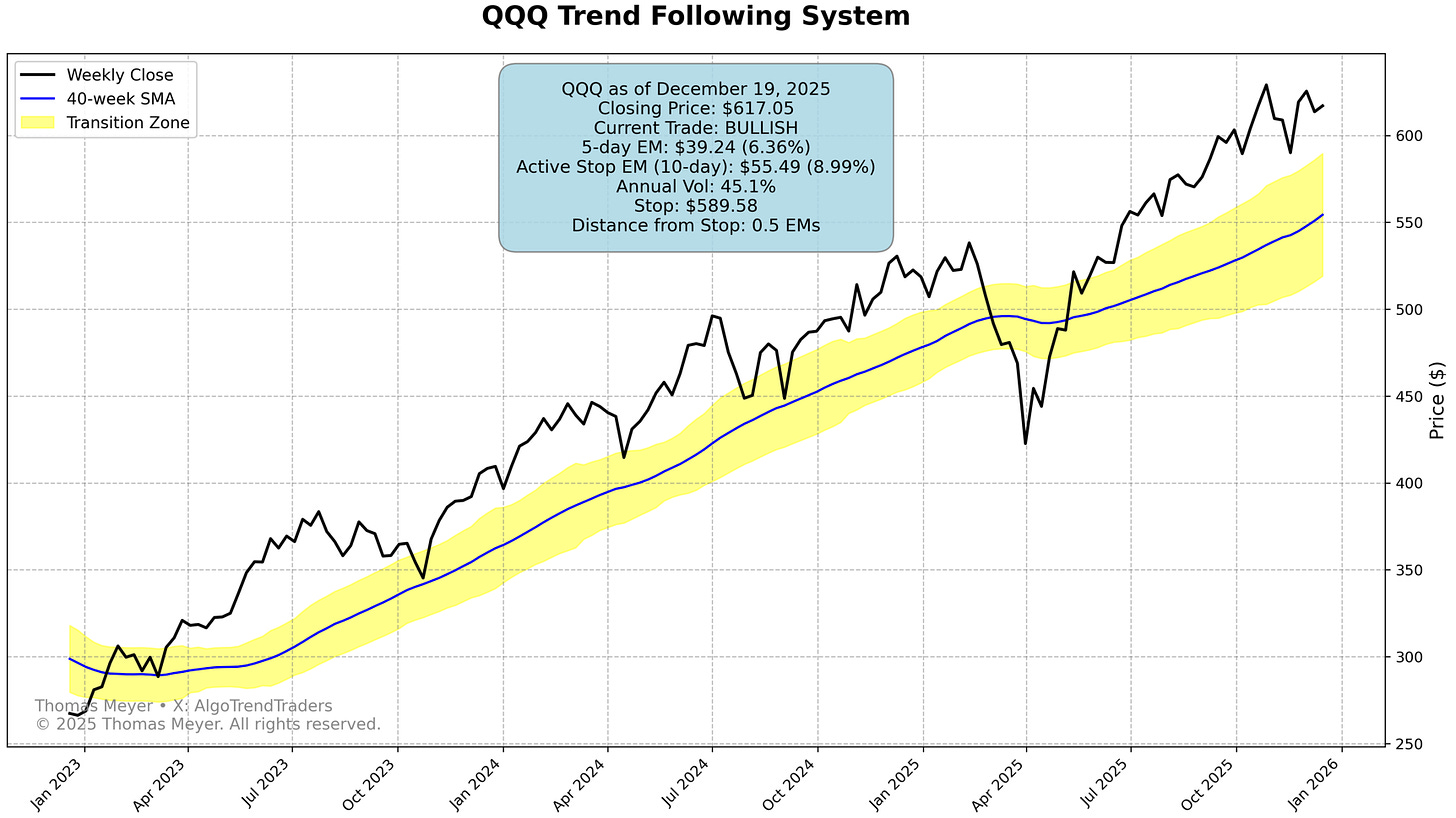

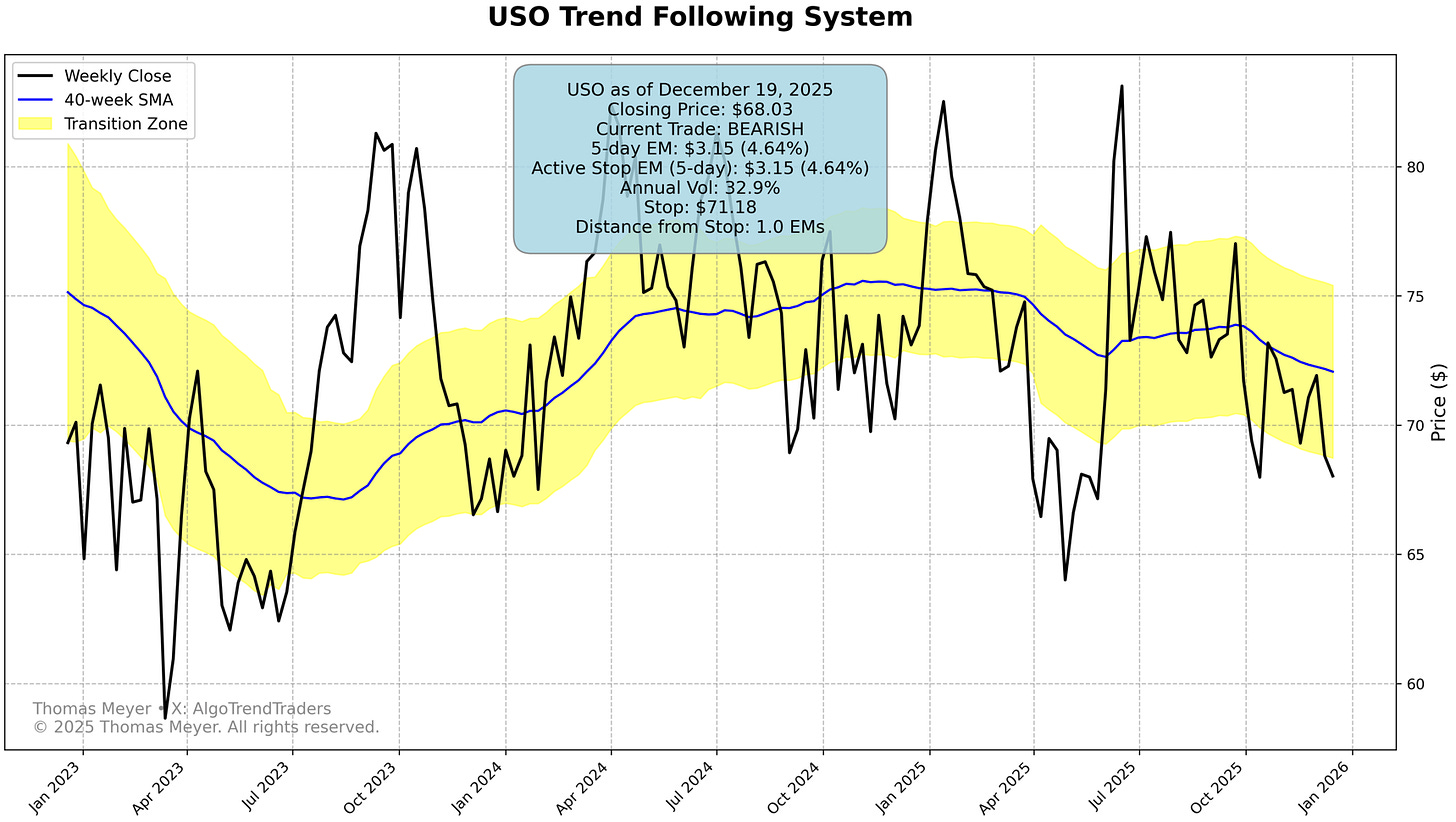

Markets closed mostly unchanged this week with SPY and QQQ both sitting at just 0.5 EM from their stops - exits need to be in place before Monday’s open. USO bearish trade confirmed after last week’s tentative trigger. Gold continues exceptional performance at 64.66% profit. Bitcoin bearish trade holding with 6.86% profit.

Tom’s Musings

Backtesting is one of the most useful tools available to investors — and one of the most seductive. Like the “siren song” of mythology, it tempts us with smooth equity curves and the illusion of control. One parameter is adjusted, one filter refined, and the results improve. Encouraged by the numbers, it becomes easy to keep optimizing.

At some point, however, improvement stops coming from better signals and starts coming from fitting “noise”. The system doesn’t become smarter — it becomes more fragile. That fragility is usually invisible until real-time trading begins, when markets inevitably behave differently than the historical script we optimized against.

With that risk firmly in mind, I recently made a deliberate change to my trend-following system by introducing an asymmetric, adaptive volatility framework. Instead of using the same 5-day volatility measure for both bullish and bearish trades, I tested a 10-day volatility window on the long side while keeping bearish trades at 5 days.

The rationale is straightforward. Markets are structurally bullish far more often than they are bearish. Allowing more room for short-term noise on the upside helps reduce whipsaws and keeps the system aligned with longer-lasting uptrends, while the shorter volatility window on the downside preserves responsiveness when risk accelerates.

Importantly, extending the volatility window on the long side does not mean taking twice the risk. At present, 5-day volatility on SPY is roughly 5%, while 10-day volatility is about 7.1% — an increase of approximately 40%, not 100%. That modest increase in tolerated volatility buys meaningfully more time for bullish trades to develop, allowing trends to breathe without abandoning risk discipline.

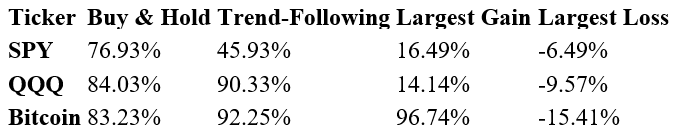

Over a 25-year backtest, the results were encouraging — roughly 25% better for SPY and 31% better for QQQ compared to the original version of the strategy. The asymmetric framework also produced fewer total trades across both markets, consistent with the goal of avoiding unnecessary exits caused by short-term noise.

Taken together, these results suggest that a longer volatility window on the long side better aligned with how markets have behaved in the past — rewarding patience on the upside more than hyper-responsiveness. Still, this is where skepticism is essential.

Markets evolve, regimes change, and no backtest can validate a strategy for the future. This adjustment is not a promise of outperformance. It is a thoughtful refinement that now has to prove itself in real time — where the siren song of backtesting no longer smooths the path, and discipline matters most.

Current Market Status

Active Trades & Exits

Key Developments

📉 SPY & QQQ At Critical Stops: Both indices closed the week essentially unchanged, but as expected, stops rose with the moving average. Both are now just 0.5 EM from their exits - SPY at 654.96, QQQ at 589.58. Both trades remain nicely profitable at 13.49% and 19.99% respectively, but there’s minimal cushion. Be absolutely certain your exit strategies are in place before Monday’s open.

🛢️ USO Bearish Trade Confirmed: Last week’s tentative bearish signal in crude oil has been confirmed. After triggering by just 2 cents last week, USO opened lower and the trade is now active at 68.49 entry. The position closed at 68.03 with a stop at 71.18, giving us 1.0 EM of cushion. However, oil showed volatility this week - dropping early then rallying later - so watch for potential whipsaws.

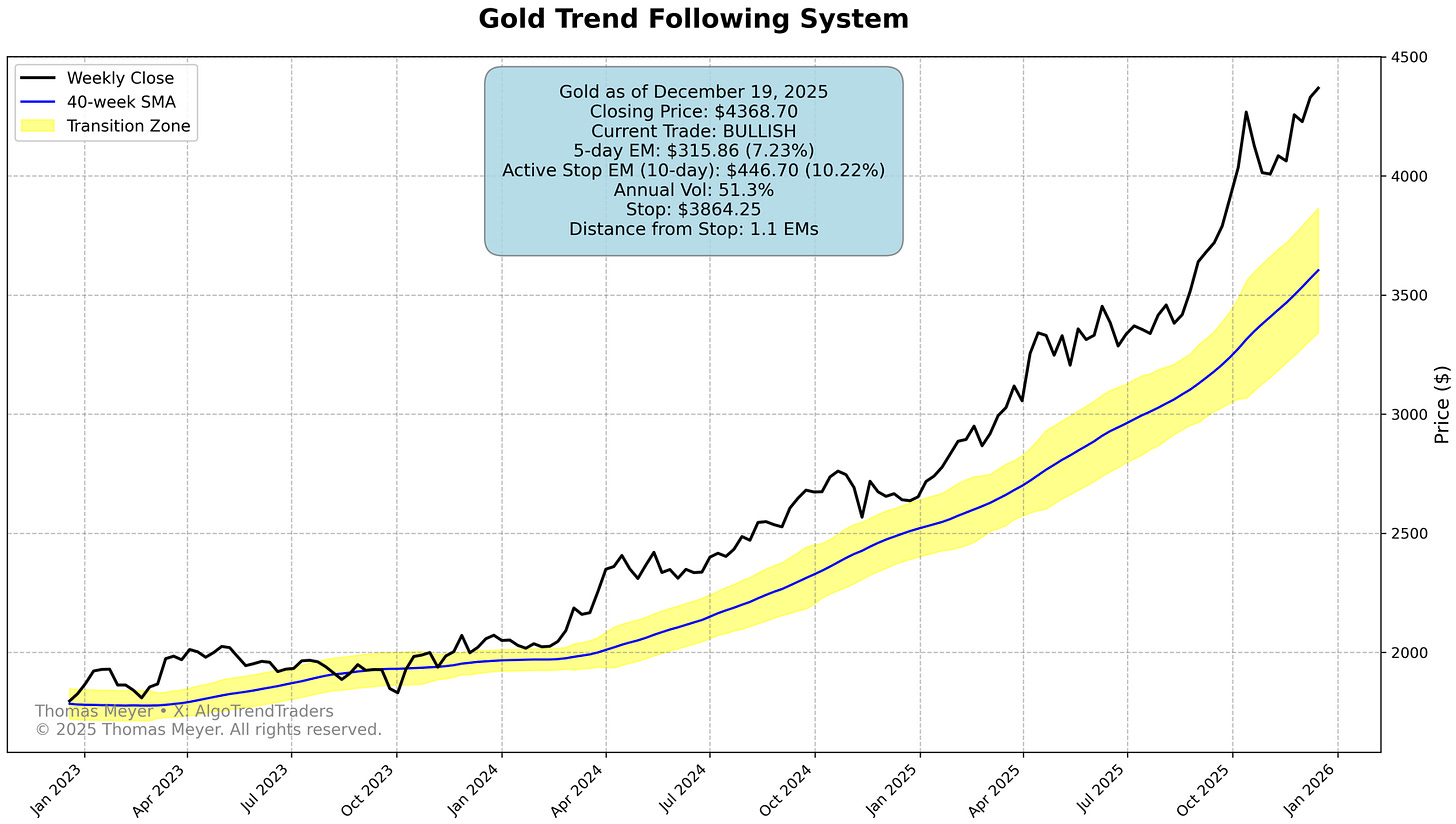

🥇 Gold Continues Exceptional Run: Gold pushed higher to 4,368.70, extending our best-performing position with 64.66% profit since the January entry. The distance from stop remains comfortable at 1.1 EM, unchanged from last week. This trade continues to demonstrate the power of letting winning positions run.

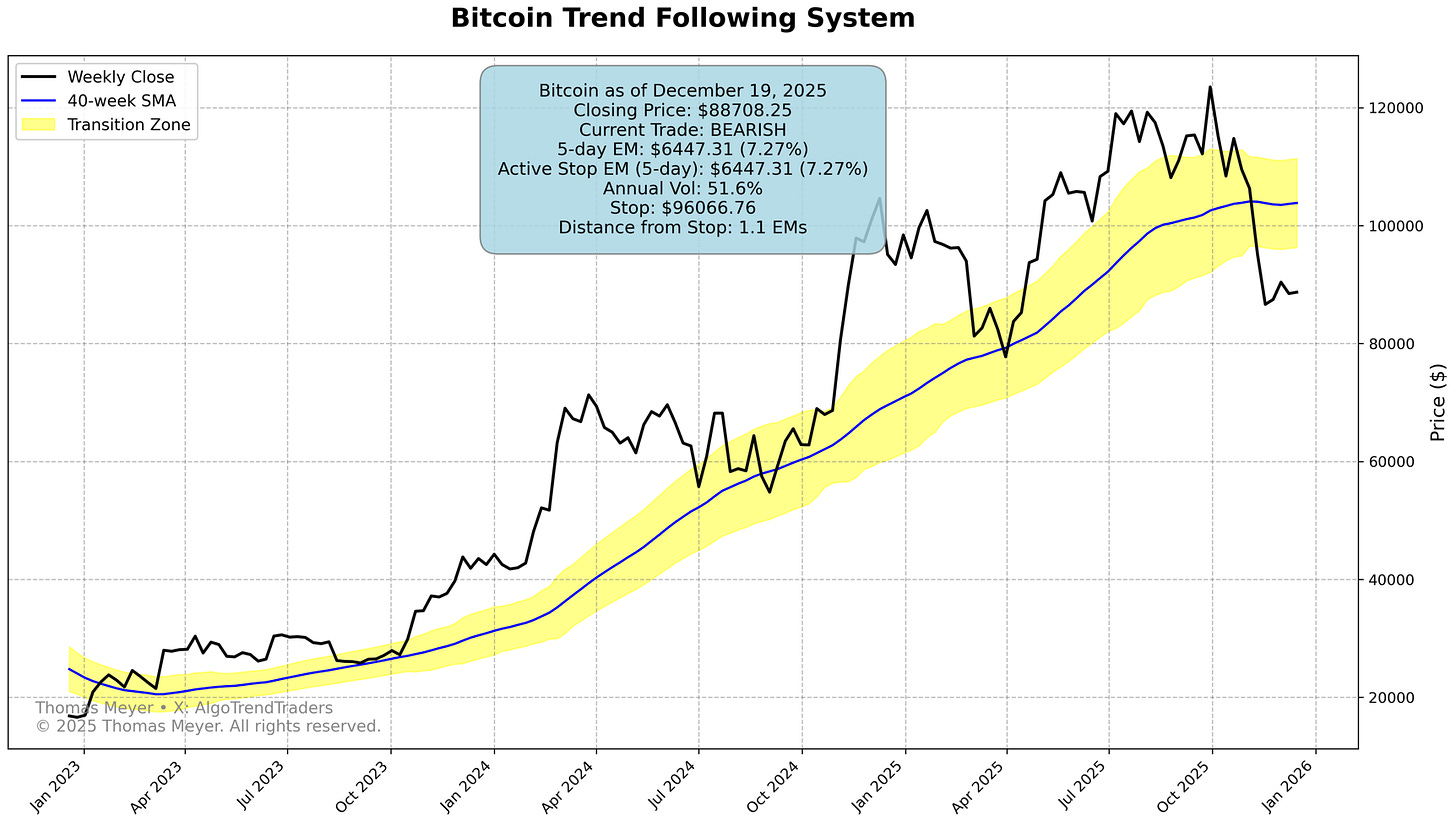

₿ Bitcoin Trade Holding: The bearish trade continues working with 6.86% profit as price moved slightly higher to 88,708.25. Distance from stop improved to 1.2 EM from last week’s tighter cushion. The 40-week moving average has been essentially flat for several weeks, keeping the stop unchanged. When Bitcoin continues its decline, the moving average will start dropping, which will improve the exit strategy favorably.

📊 Sector Activity Mixed: Three changes this week show a mixed picture. XLB (Materials) moved from neutral to bullish - a positive sign. However, XLE (Energy) followed oil’s weakness into neutral territory, and XLP (Staples) dropped back to bearish. Net result: 7 bullish sectors (down from 8), 3 neutral (up from 4), and 1 bearish (up from 0). Sector breadth shows slight deterioration alongside index pressure.

S&P 500 Sectors At-a-Glance

🟢 Bullish (7): Materials (XLB), Communications (XLC), Financials (XLF), Industrials (XLI), Technology (XLK), Healthcare (XLV), Discretionary (XLY)

🟡 Neutral (3): Energy (XLE), Real Estate (XLRE), Utilities (XLU)

🔴 Bearish (1): Staples (XLP)

XLB moves to bullish, XLE moves to neutral, XLP moves to bearish

Portfolio Services

Thomas Meyer Investment Management

Not comfortable managing trades yourself? I can handle it for you. Funds stay in your name at Charles Schwab Institutional.

Learn more: tminvestmentmanagement.com

Merry Christmas!

My wife Terry and I wish you and your family a very Merry Christmas and a joyful holiday season. I hope the coming days bring time to slow down, reflect, and enjoy what matters most — family, friends, and a bit of well-earned rest. Thank you for your trust and engagement throughout the year. I look forward to continuing the journey together in the year ahead.

Charts

System Performance Through December 21, 2025

Why Trend-Following Works

The Problem with Buy-and-Hold: When you need your money (retirement, medical, education), a 30-50% loss at the wrong time can derail your plans forever.

The Solution: Disciplined exit strategies. Every trade has a predetermined stop-loss based on the security’s normal volatility. Small losses, big wins.

Key Principles:

Follow trends until they break

Weekly closes eliminate daily noise

Risk management is more important than being right

Boring but historically effective

Trading Methodology

The Yellow Channel System:

Above yellow zone = 🟢 Bullish (go long)

In yellow zone = 🟡 Neutral (no trade)

Below yellow zone = 🔴 Bearish (go short)

Exit Strategy: Based on each security’s 52-week volatility (”Expected Move”). Stops move up with profitable trades but never down.

New Adaptive Approach: Now using 10-day EM for bullish trades (wider stops, fewer whipsaws) and 5-day EM for bearish trades (tighter risk control). Backtesting shows ~25% improved returns on SPY and ~31% improved returns on QQQ with fewer trades.

Best Entry: When new signals trigger. Late entries carry higher risk - consider smaller position sizes.

Remember: Always have your exit strategy prepared before entering any trade.

This is not a “get-rich-quick” scheme. Trend-trading requires discipline, patience, and proper risk management. Past performance does not guarantee future results.