AlgoTrendTraders Weekly Report - December 29, 2025

Disciplined, Rules-Based Trading

AlgoTrendTraders Weekly Report

Thomas Meyer, Editor | December 29, 2025

Email: algotrendtraders@gmail.com | X: @AlgoTrendTrade1

IMPORTANT DISCLAIMER: The information published in this newsletter should not be used to make personal investment decisions. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.

Executive Summary

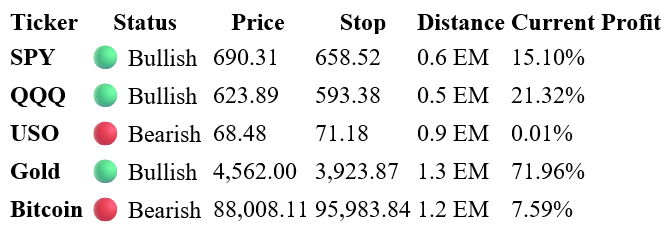

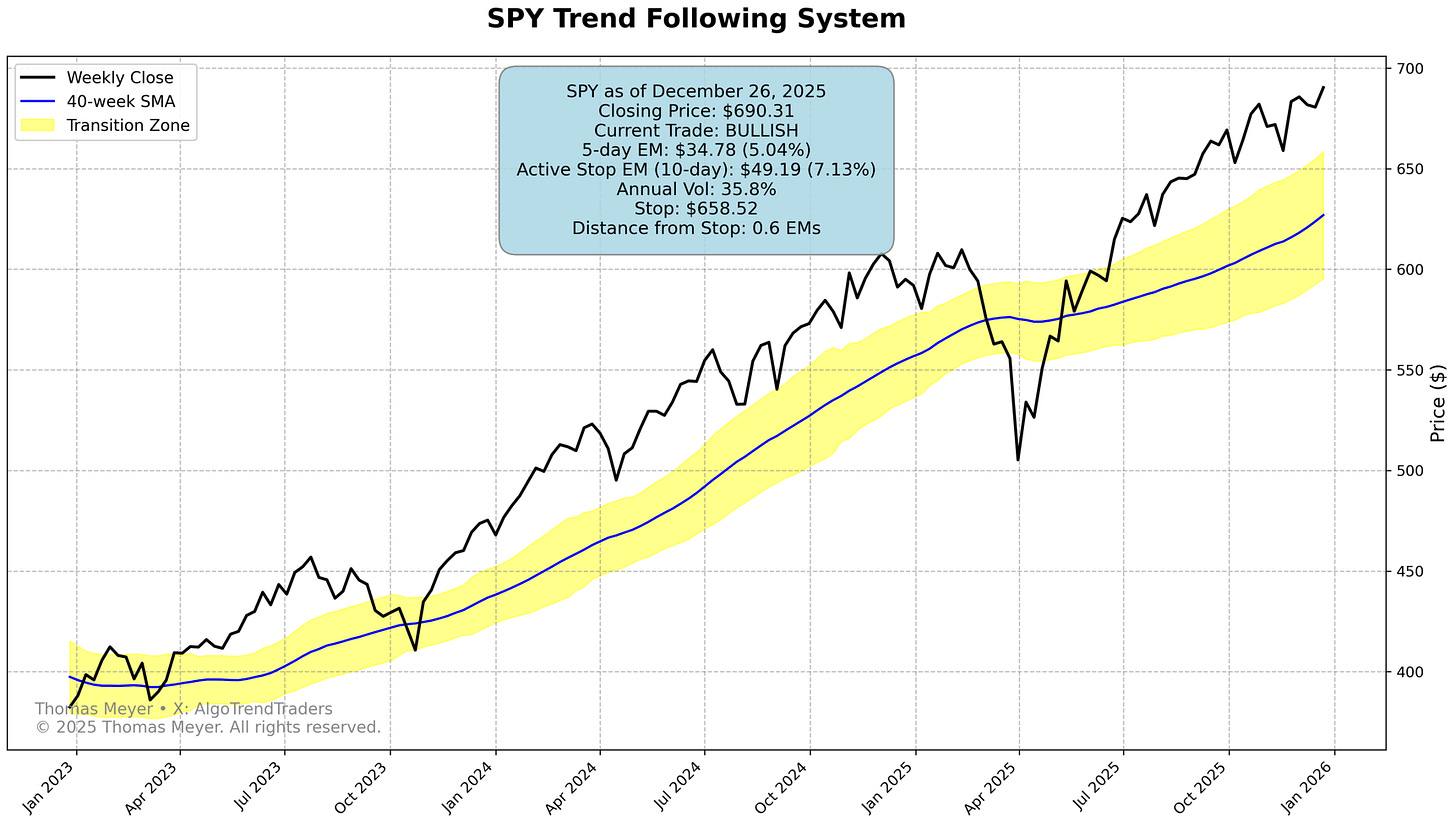

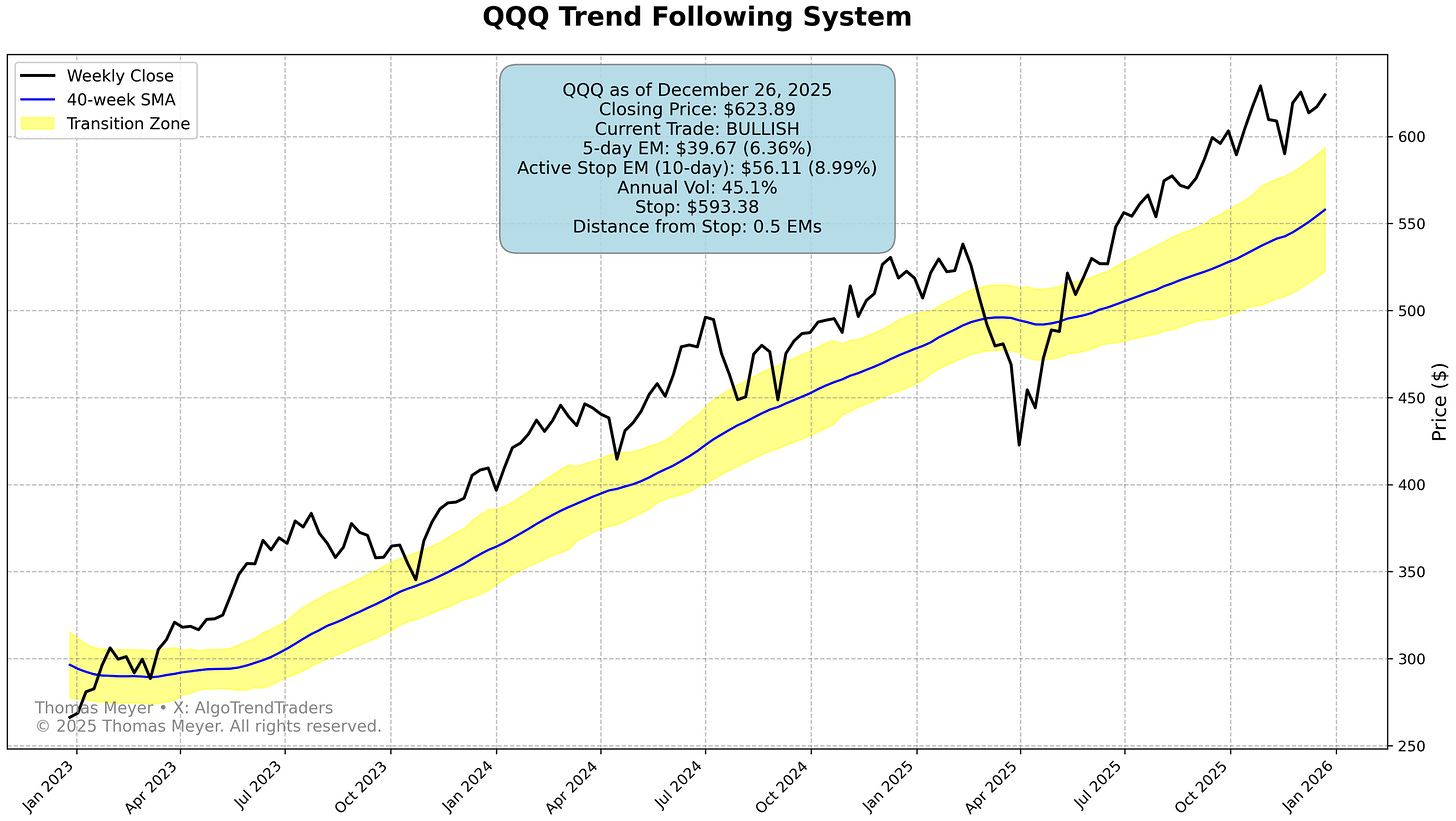

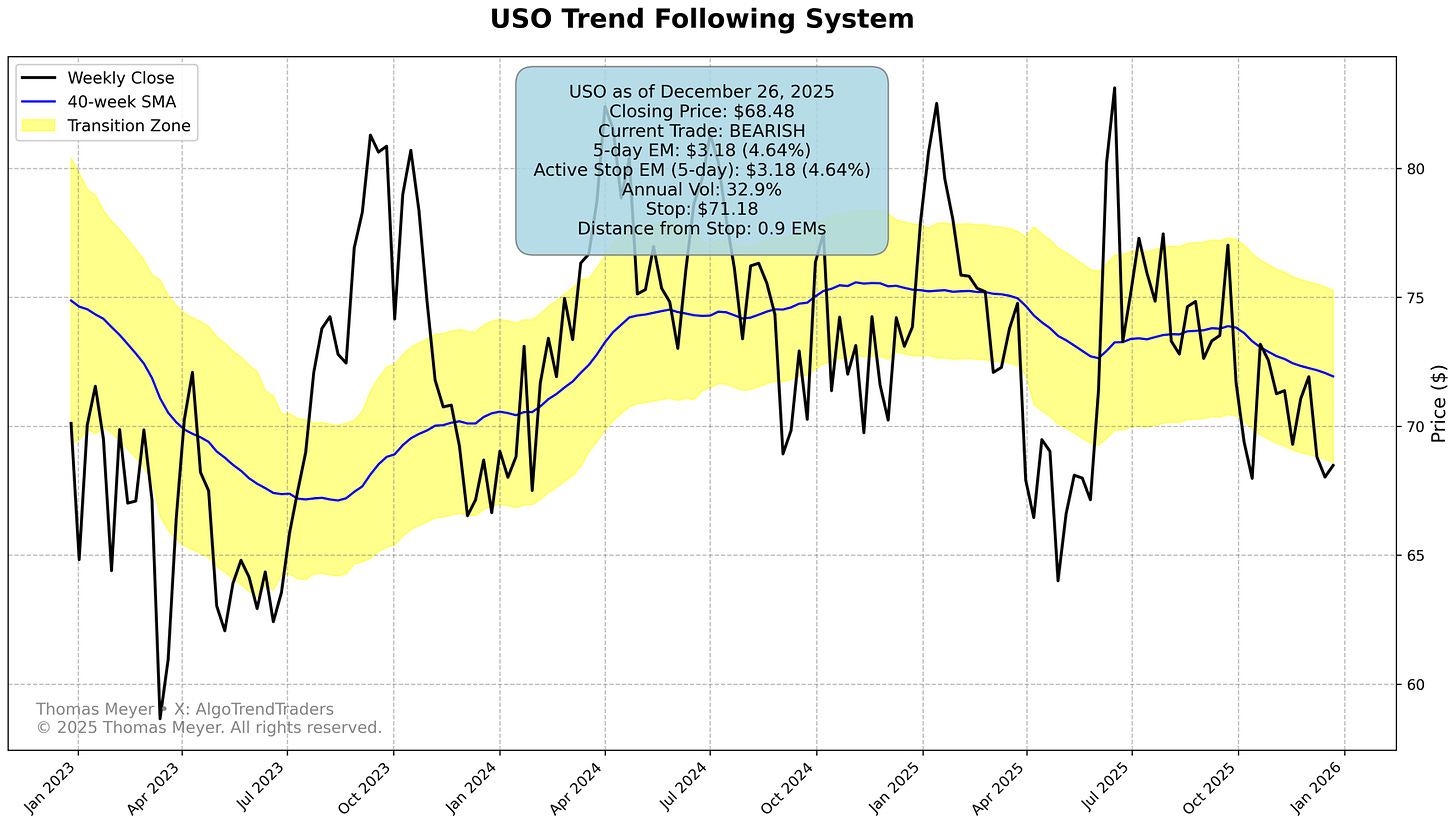

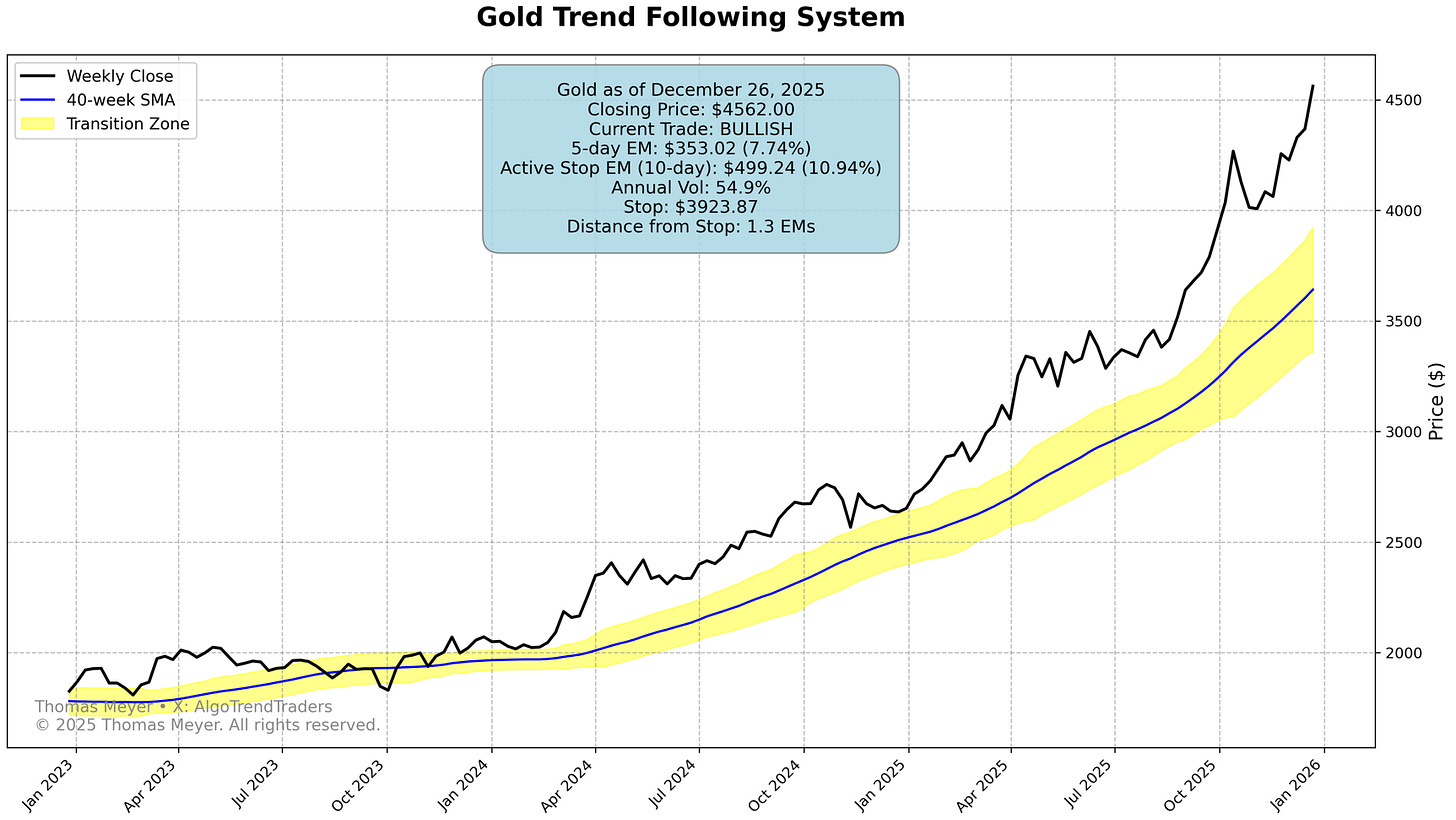

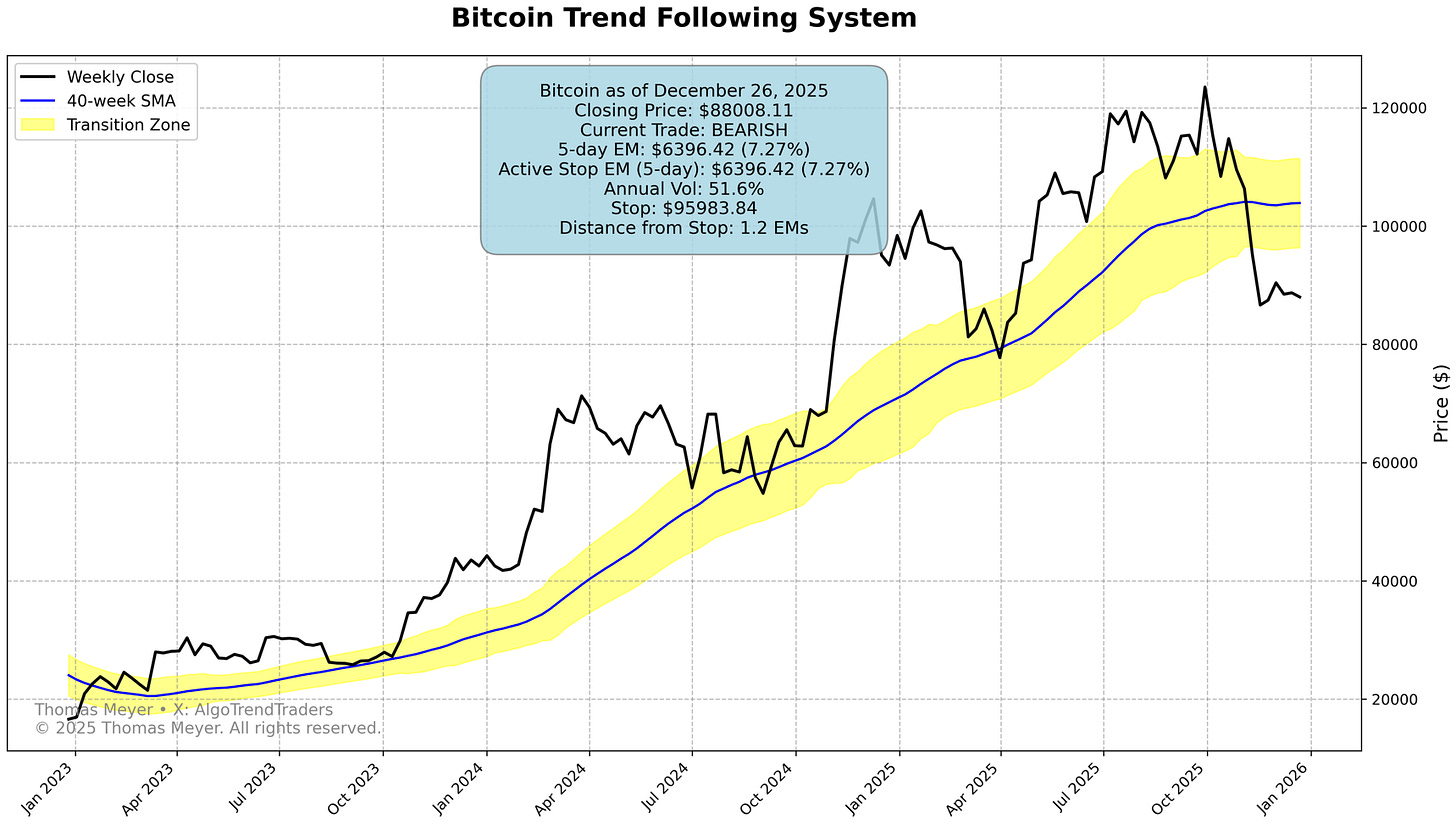

Markets edge higher with SPY touching record highs and moving to 690.31. Both major indices remain profitable but still within striking distance of stops - SPY at 0.6 EM, QQQ at 0.5 EM. Gold surges to 4,562.00 with exceptional 71.96% profit. Bitcoin trades in narrow range. No sector changes - maintaining 7 bullish, 3 neutral, 1 bearish as we close out 2025.

Tom’s Musings

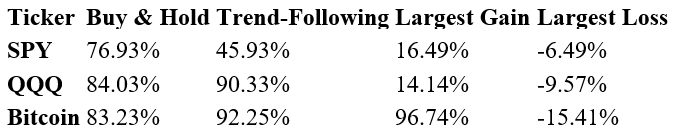

With just a few days to go in 2025, we’re going to end up the year underperforming the stock market in both SPY and QQQ. The sharp move down in the spring followed by the quick rebound hurt trend-followers. We’ve been in our long trades for more than 6 months and we’ll end up the year ok, but not as well as the buy and hold crowd did. We’re at all-time highs in the stock market and it looks like there’s no end in sight.

So why consider moving into a trend-following strategy when it has underperformed?

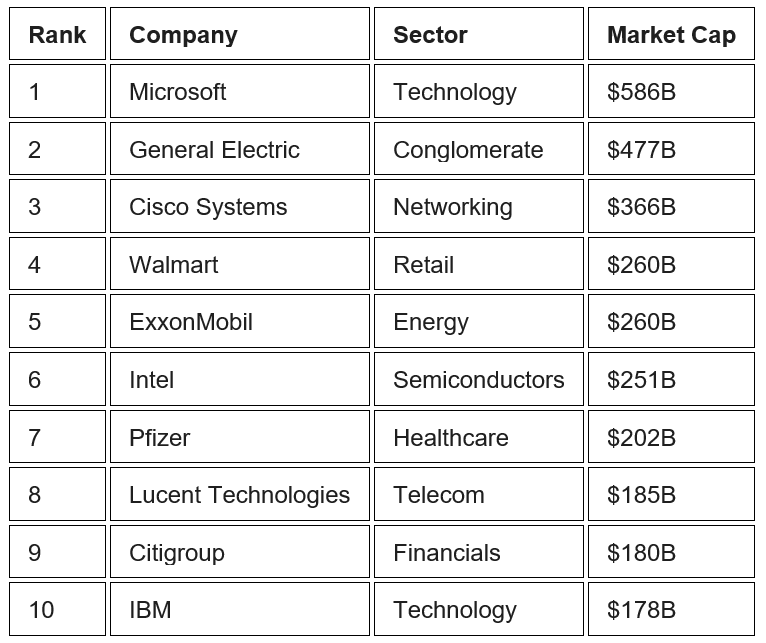

Let me show you a list of stocks for your consideration. These were the top 10 stocks in the stock market at the beginning of the year 2000.

Top 10 S&P 500 Companies by Market Cap (March 2000)

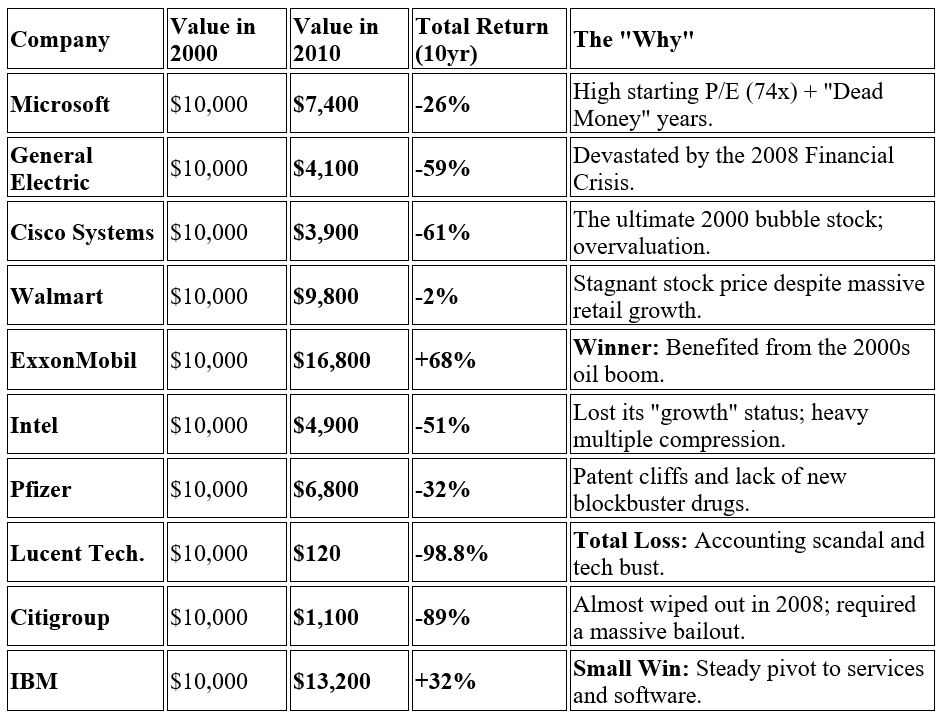

I’m sure you know what’s coming next… for many of these stocks, it wasn’t pretty. Here’s what happened to them 10 years later. Let’s assume we invested $10,000 in each and reinvested all the dividends.

The S&P 500 Top 10: 2000 vs. 2010

You would have gotten crushed. The markets don’t stay the same. The leading AI stocks today will likely not be the leaders 10 years from now.

There’s a lot of talk about valuations in the market today. We’ve heard a number of pundits suggest that the forward earnings for the S&P are near or at all-time highs. When this happens, the returns for the next decade tend to be lower than average.

Nvidia is trading at 52x earnings, which seems high, but 25 years ago, Cisco was trading at 200x earnings, which is almost unbelievable in retrospect. I don’t know if we’re headed for a downturn in 2026 or not. I’m sure there will be difficult times that we can’t know about.

Here’s what I do know… trend-following has the potential to benefit from a falling market. It also has the potential to benefit from a rising market which we’ve seen this year. For me, trend-following does 2 things.

Trend-following is a strategy that historically has performed well. It limits losses on individual trades while allowing investors to stay in trends that last a long time.

It’s a discipline that forces you to take small losses that don’t turn into large losses.

It’s not a perfect strategy; there’s no such thing if you’re investing in the stock market. But it is an intelligent, disciplined strategy that can perform well, especially during bear markets. It would make sense to consider putting at least a portion of your investible assets into a trend-following system.

After all, who knows what’s going to happen in the next 10 years? In March 2000, nobody expected a “Lost Decade”. They only saw an endless horizon. Trend-following is for those who realize that the horizon eventually turns into a cliff.

Current Market Status

Active Trades & Exits

Key Developments

📈 SPY & QQQ Continue Higher: The markets moved a little higher last week with the S&P 500 touching a record high at 690.31. The best news for us is that the stops continue to move higher each week, a little at a time. Even if the exits are hit this week, we’ll exit with nice profits. Both ETFs remain less than 1 Expected Move from hitting their stops - be sure you have your exits in place before the market opens this week.

🥇 Gold Extends Exceptional Run: Gold continues its remarkable year, pushing to 4,562.00 and extending our profit to nearly 72% since the January entry. Distance from stop improved to 1.3 EM, providing even more cushion. This trade exemplifies the power of letting winners run - many investors would have exited long ago with 20-30% gains, missing the bulk of this extraordinary move.

🛢️ USO Holding Pattern: Crude oil remains essentially flat at the entry price of 68.48, providing minimal profit on the bearish trade. Distance from stop at 0.9 EM suggests this position needs monitoring - oil could whipsaw in either direction.

₿ Bitcoin Narrow Range: Bitcoin closed a little lower this week at 88,008.11, but traded in a very narrow range of less than 5% from last week’s close. Because of this lower volatility, the Transition Zone is flat and not trending either way. The bearish trade continues working with 7.59% profit and comfortable 1.2 EM cushion.

📊 Sector Stability: No changes this week in any of the sectors. We enter the last week of the year with consistent positioning - 7 bullish, 3 neutral, 1 bearish.

S&P 500 Sectors At-a-Glance

🟢 Bullish (7): Materials (XLB), Communications (XLC), Financials (XLF), Industrials (XLI), Technology (XLK), Healthcare (XLV), Discretionary (XLY)

🟡 Neutral (3): Energy (XLE), Real Estate (XLRE), Utilities (XLU)

🔴 Bearish (1): Staples (XLP)

No changes this week - stable sector positioning as 2025 closes

Portfolio Services

Thomas Meyer Investment Management

Not comfortable managing trades yourself? I can handle it for you. Funds stay in your name at Charles Schwab institutional.

Learn more: tminvestmentmanagement.com

New From AlgoTrendTraders

Beginning next week, I will be introducing a more aggressive strategy focused on higher volatility mid-cap stocks that have broken through into new bullish conditions. This will be for investors looking for momentum stocks with high upside potential. I’ll be sending the first issue out next weekend.

Charts

System Performance Through December 28, 2025

Why Trend-Following Works

The Problem with Buy-and-Hold: When you need your money (retirement, medical, education), a 30-50% loss at the wrong time can derail your plans forever.

The Solution: Disciplined exit strategies. Every trade has a predetermined stop-loss based on the security’s normal volatility. Small losses, big wins.

Key Principles:

Follow trends until they break

Weekly closes eliminate daily noise

Risk management is more important than being right

Boring but historically effective

Trading Methodology

The Yellow Channel System:

Above yellow zone = 🟢 Bullish (go long)

In yellow zone = 🟡 Neutral (no trade)

Below yellow zone = 🔴 Bearish (go short)

Exit Strategy: Based on each security’s 52-week volatility (”Expected Move”). Stops move up with profitable trades but never down.

Adaptive Approach: Now using 10-day EM for bullish trades (wider stops, fewer whipsaws) and 5-day EM for bearish trades (tighter risk control). Backtesting shows ~25% improved returns on SPY and ~31% improved returns on QQQ.

Best Entry: When new signals trigger. Late entries carry higher risk - consider smaller position sizes.

Remember: Always have your exit strategy prepared before entering any trade.

Understanding Trend-Following: Why This Approach Might Be Right for You

If you’re reading this newsletter, you probably fall into one of two categories: either you’re tired of watching your portfolio swing wildly with every market correction, or you’ve been fortunate enough to ride the bull market higher but have that nagging feeling in the back of your mind - “what happens when this ends?”

Trend-following isn’t about predicting the future. It’s about having a plan for whatever the future brings.

The Human Challenge of Investing

Here’s the uncomfortable truth about buy-and-hold investing: it works beautifully... until it doesn’t. And the “doesn’t” part usually happens at exactly the wrong time - when you’re close to retirement, when you need to pay for college, when medical bills arrive. The 2000-2012 “Lost Decade” wasn’t just a historical footnote - it derailed retirement plans, delayed dreams, and forced difficult choices on thousands of people who thought they were doing everything right.

The real challenge isn’t just market losses - it’s the emotional roller coaster that comes with them. Can you really sit through a 40% or 50% decline knowing you might need that money in a few years? Most people can’t. They panic and sell at the bottom, turning a temporary loss into a permanent one.

What Trend-Following Actually Does

Think of trend-following as a disciplined friend who holds you accountable. The system does two critical things that most investors struggle to do themselves:

First, it forces you to cut losses early. When a trade moves against us by more than one Expected Move (the normal weekly volatility), we exit. No emotions, no hoping it comes back, no rationalizing why “this time is different.” It’s a small, manageable loss that won’t derail your financial plans.

Second, it lets winners run. Look at our Gold trade - we entered in January at $2,652 and it’s now at $4,562. That’s 72% profit because the system kept us in the trade as long as the trend remained intact. Most investors would have sold when they were up 20% or 30%, leaving huge gains on the table.

The Yellow Channel: Simple Visual Discipline

The yellow channel you see on our charts (the “Transition Zone”) is built from the 40-week moving average - a time-tested measure of long-term trend direction. When price breaks above this zone, the market is telling us it’s in a bullish trend. When it breaks below, the trend has turned bearish. When it’s inside the yellow zone, the market is neutral and we sit in cash.

This isn’t complicated mathematics or AI wizardry. It’s a simple, visual system based on principles that have worked for decades. The late Curtiss Dahl wrote about this approach in the 1950s. Jesse Livermore used similar principles to profit during the 1929 crash and subsequent recovery.

The Discipline Part is Harder Than the Strategy

Here’s what separates successful trend-followers from those who abandon the strategy: discipline.

You have to be willing to:

Take small losses without feeling like a failure

Sit in cash during neutral periods while others are making money

Enter bearish trades when everyone on CNBC is bullish

Let profits run when every instinct screams “take your gains now!”

This newsletter gives you the signals. You have to supply the discipline.

Who This Works For

Retirement account investors: You can use these SPY and QQQ signals to manage your 401(k) or IRA. When the system turns bearish, move to cash or money market funds. You can’t short in most retirement accounts, but you can avoid the catastrophic losses that derail retirement plans.

Experienced traders: If you’re comfortable with options or leverage, you can follow both bullish and bearish signals for potentially higher returns (with correspondingly higher risk).

Anyone who remembers 2000-2002 or 2007-2009: If you lived through a bear market and swore you’d never let it happen again - this is the systematic approach that could have protected you.

The Boring Truth

Trend-following is not exciting. There are no hot stock tips, no cryptocurrencies that might 10x, no insider knowledge. It’s the tortoise, not the hare. Some years (like 2025) we’ll underperform a raging bull market. Other years - especially when markets turn choppy or bearish - this approach shines.

The goal isn’t to beat the market every single year. The goal is to capture most of the upside during bull markets while avoiding the catastrophic losses during bear markets. Over full market cycles, that’s a strategy that lets you sleep at night and keep your retirement plans on track.

Remember This

In March 2000, the top 10 companies looked invincible. Ten years later, most investors in those companies were crushed. The market you see today - with AI darlings trading at stratospheric valuations - won’t be the same market ten years from now. It never is.

Trend-following is for investors who understand that the horizon eventually becomes a cliff, and having a plan for that moment matters more than chasing the last few percentage points of a bull market.

It’s not perfect. It requires patience and discipline. But it’s a rational, time-tested approach to protecting wealth while still participating in market gains.

And that might be exactly what you need.