AlgoTrendTraders Weekly Commodity Report - November 15, 2021

Disciplined, Rules-Based Trading

Thomas Meyer, Editor

November 15, 2021

Twitter: @AlgoTrendTrade1

Email: algotrendtraders@gmail.com

Welcome to this week’s AlgoTrendTraders Weekly Commodity report. Before we get into this week’s report, be sure to follow us on Twitter.

The Weekly Commodity Report will be free through November before transitioning to a paid newsletter on Substack. If you have any comments or questions, please contact us via the email address listed above.

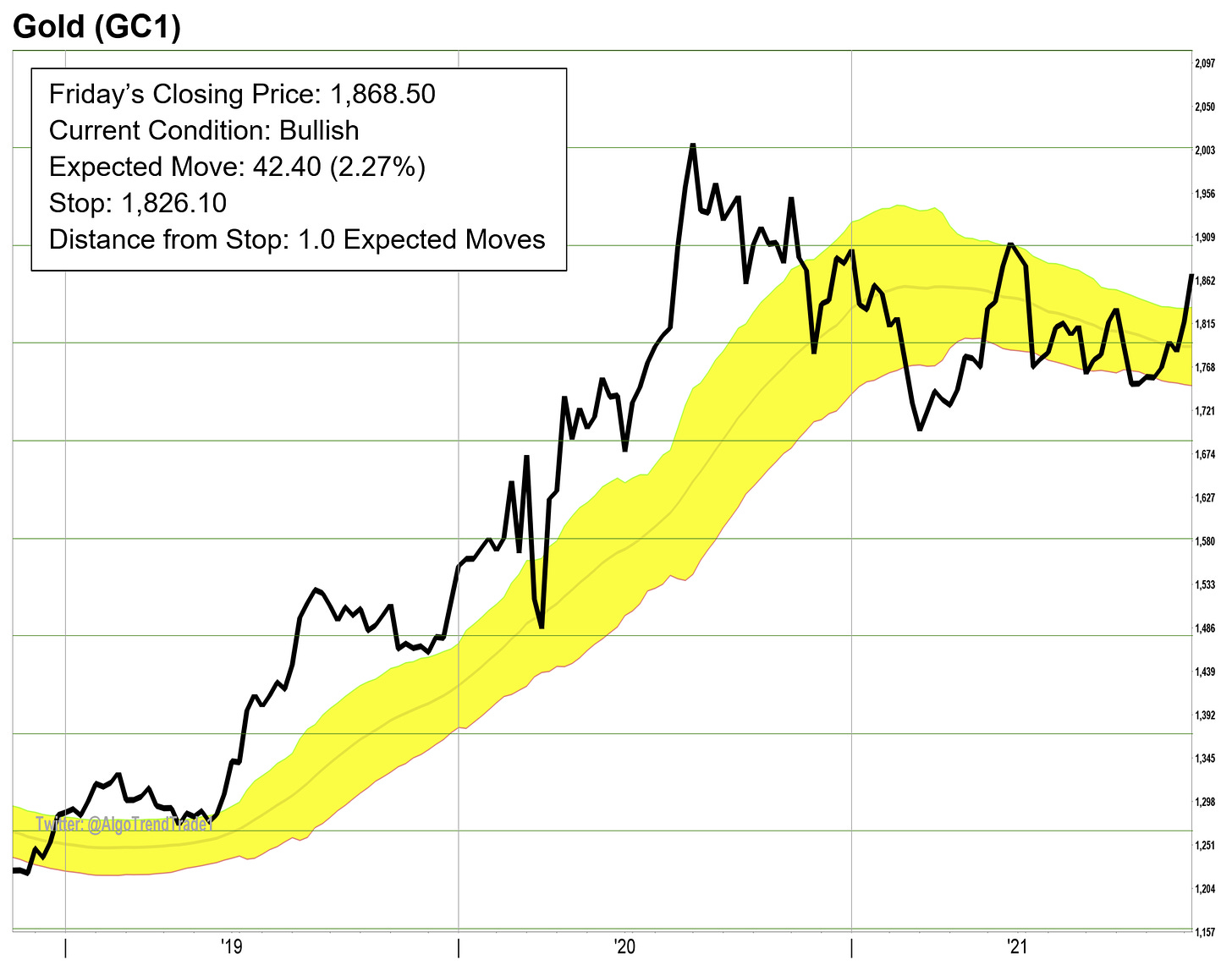

Gold Triggered a Bullish Condition and a New Bullish Trade

Last week’s news showing strong inflation caused gold to move sharply higher and move into a new Bullish condition. The details of the new bullish trade are listed in the Composite Table and commentary underneath.

For those wanting to know more about Trend-Trading

The overview of the AlgoTrendTraders system is underneath the charts. Those familiar with our methodology can get right to the trades. If you’re new to trend-trading, be sure to read this introductory section. This will help you understand the concept of trend-trading and why it’s so powerful.

Each week, we show you the Composite Table that has the week-ending price, current volatility, and the updated exit strategy for each of the commodities.

We say this a lot because it’s the most important element for successful investing… Always have your exit strategies prepared before you enter into any trade.

The Composite Table for November 15, 2021

WTI Crude Oil moved lower again last week and has now dropped for 3 weeks in a row. Oil remains above the $80 level and is still in a Bullish condition. The listed stop for the trade is 73.63 which is 0.8 Expected Move (EM) from Friday’s closing price.

Natural Gas closed sharply lower last week, but it remains in a Bullish condition. The listed stop for this trade is 4.37 which is 0.6 EM from the weekly close.

Gold moved higher last week and triggered a new Bullish condition. The initial stop on this trade is 1,826.10 which is 1.0 EM from Friday’s close.

Silver moved strongly higher last week and the bearish trade hit its stop. The trade closes with a small loss of -4.90%. Silver is inside the Transition Zone (TZ) and in a Neutral condition. There is no trade in silver this week

Copper moved slightly higher last week and remains in a Neutral condition. There is no trade in Copper this week.

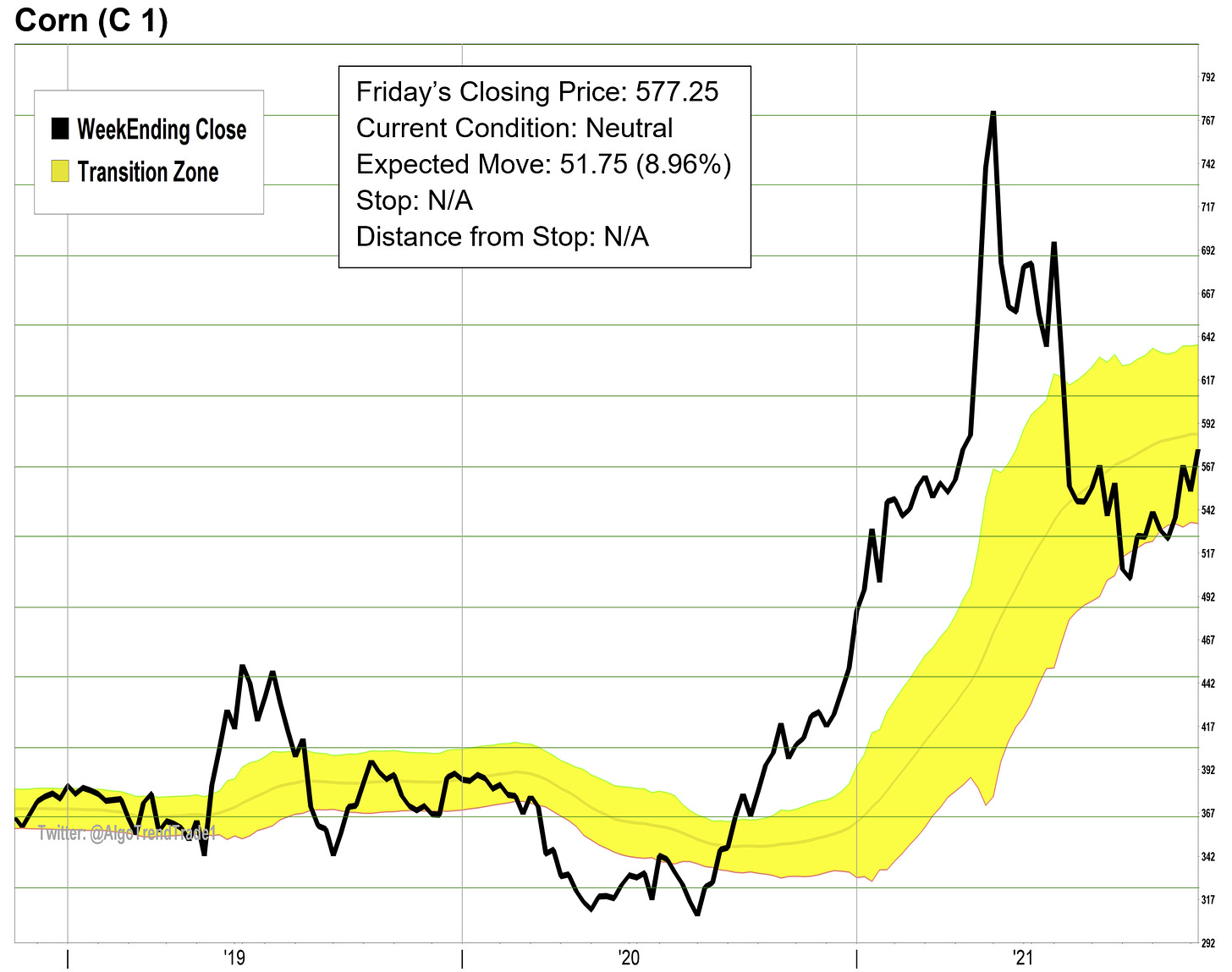

Corn moved higher last week, but it is still trading in the bottom half of the TZ in a Neutral condition. There is no trade this week in Corn.

Soybeans moved higher last week, but remains in a Bearish condition. The listed stop is 1,270.75 which is 0.5 EM from the weekly closing price.

Wheat closed strongly higher last week and it remains in a Bullish condition. The listed stop is 732.50 which is 1.9 EM from Friday’s closing price.

Be Sure to Read the Disclaimer at the End of This Report

Here are the latest charts…

Trend-Trading Overview

In this weekly report, we give you the trading signals for eight of the most liquid traded commodities. The signals are based on trend-following principles. Very simply, commodities, like stocks, stay in trends until they don’t. Trends can last a short time or they can last for months and even years at a time.

This is not a “get-rich-quick” scheme

If you’re looking to make a ton of money in a short time, you’re going to be disappointed. Trend-trading is not fancy; it’s boring, and takes time to be successful. This is a system that relies on a historically-proven process to generate solid returns on winning trades and avoid large losses on losing trades. We’re definitely the tortoise, not the hare.

Trend-following systems don’t try to guess what the next move in the markets might be. Instead, we measure the markets each week and use our algorithms to determine the current trend and the exit strategy for the current trades.

The key to the winning trades greatly outperforming the losing trades is the risk management system. If a trade moves against us, we’ll get out of the trade with a small loss. But if a trade trends higher for months at a time, we have the ability to build up substantial profits.

AlgoTrendTraders uses both trend and momentum to generate the trading signals. The yellow channel you see in the center of the charts is called the “Transition Zone”. When a commodity is above the yellow channel, it’s in a Bullish condition. When it’s below the yellow channel, it’s in a Bearish condition. When it’s in the middle of the channel, it’s in a Neutral condition and there is no trade.

Selling is More Important Than Buying

Every trade has a pre-determined exit strategy. This is based on the normal volatility of the underlying ticker. Each commodity has its own unique volatility. And volatility is dynamic. It’s constantly changing. Each week, we look at the previous 52 weeks of price movement to come up with its normal weekly volatility. This is called the “Expected Move”. The Expected Move equals one week of the normal volatility of the stock or ETF being measured. Every week, the exit strategy for each ticker is updated.

The system is based on the weekly closes of the underlying tickers. All trading information and volatility calculations are based on weekly volatility. By using weekly calculations, the system ignores the day-to-day noise in the markets and is able to give better signals.

It’s easy to see the periods of time that volatility increases and decreases. As the yellow channel Transition Zone widens on the charts, the volatility is increasing. The opposite is true; when the Transition Zone narrows on the charts, the volatility is decreasing.

The best time to enter a trade is when a new signal is given. This gives you the greatest opportunity to get into a trend that could last a long time. Though it’s possible to get into a trade after a trend has been in place for a while, the risk in that trade is elevated. Consider using 1/2 or 1/3 of your normal investment for these situations.

Commodity trading is for experienced investors who understand leverage and trading on margin. It’s possible to lose more than your initial investment even with a stop in place.

Disclaimer:

The information published in this newsletter should not be used to make personal investment decisions. We are not licensed by any federal or state entity to give investment advice. We do not know your personal financial situation. Investments should be made only after consulting with your professional investment advisor and only after reviewing the prospectuses or financial statements of the companies in which you’re considering investing.