Be Sure to Read the Disclaimer at the Bottom of This Report

Welcome to this week’s AlgoTrendTraders report. In this free report, we give you the trading signals for five of the most popular investment tickers. The signals are based on trend-following principles. Very simply, stocks stay in trends until they don’t. Trends can last a short time or they can last for months at a time.

Trend-following systems don’t try to guess what the next move in the markets might be. Instead, we measure the markets each week and use our algorithms to determine the current trend and the exit strategy for the current trade.

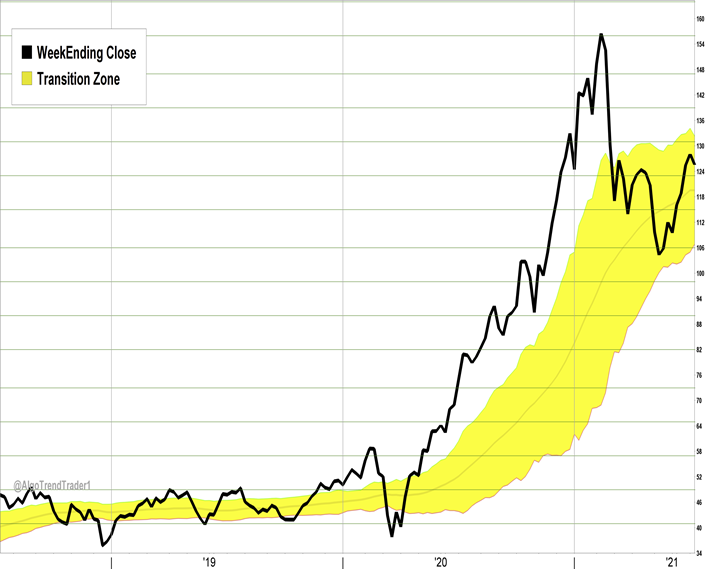

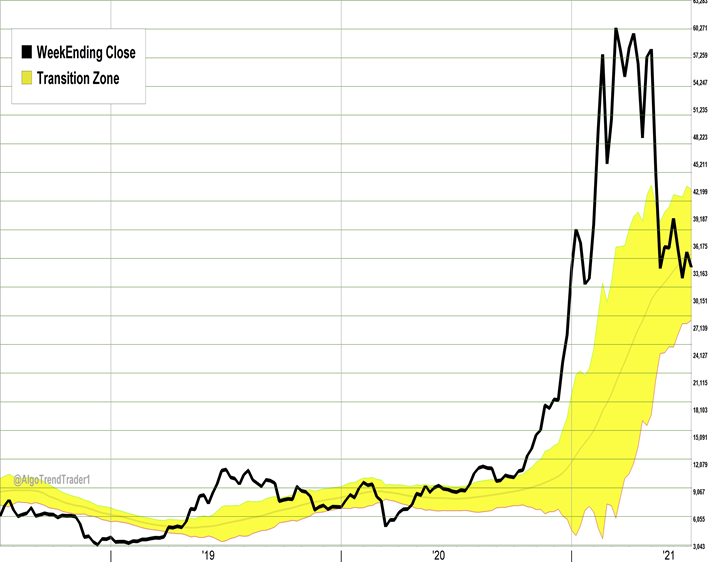

AlgoTrendTraders uses both trend and momentum to generate the trading signals. The yellow channel you see in the center of the charts is called the “Transition Zone”. When a stock is above the yellow channel, it’s in a Bullish condition. When it’s below the yellow channel, it’s in a Bearish condition. When it’s in the middle of the channel, it’s in a Neutral condition and there is no trade.

Selling is More Important Than Buying

Every trade has a pre-determined exit strategy. This is based on the normal volatility of the underlying ticker. Each week, we look at the previous 52 weeks of price movement to come up with its normal weekly volatility. This is called the “Expected Move”. Each week, the exit strategy is updated.

The system is based on the weekly closes of the underlying tickers. All trading information and volatility calculations are based on weekly volatility.

It’s easy to see the periods of time that volatility increases and decreases. As the Transition Zone widens, the volatility is increasing. The opposite is true; when the Transition Zone narrows, the volatility is decreasing.

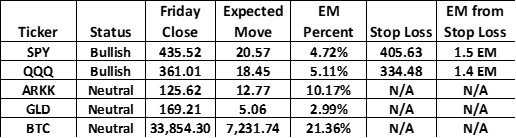

The Composite Table shows the condition of the current trades and their exit strategies. The individual charts underneath the Table shows the weekly update and when the current trade began.

The best time to enter a trade is when a new signal is given. This gives you the greatest opportunity to get on a trend that could last a long time. Though you can get into a trade after a trend has been in place for a while, the risk is elevated. Consider using 1/2 or 1/3 of your normal investment for these situations.

For this report, we give signals that can be followed by both novice and more experienced investors. Experienced and sophisticated investors can use leverage or options, but the risk is substantially greater. Never risk more money than you can afford to lose.

Be sure to prepare your exit strategies before you enter into any trade. That’s the key to successful investing.

The Composite Table for July 12, 2021

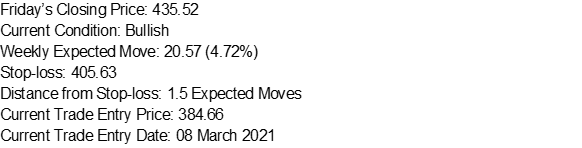

SPY set a new all-time high last week. It remains in a Bullish condition. The stop loss moved up to 405.63 which is 1.5 Expected Moves (EM) from Friday’s close.

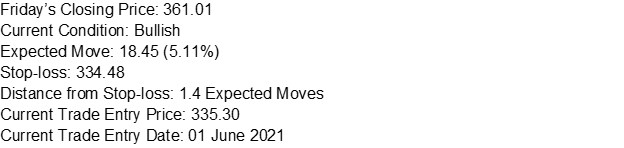

QQQ also set a new all-time high last week. It remains in a Bullish condition. The stop loss moved up to 334.48 which is 1.4 EM from Friday’s close.

ARKK moved lower for the week and it remains inside the Transition Zone (TZ) in a Neutral condition. There is no trade this week in ARKK.

GLD moved slightly higher last week and closed inside the bottom half of the TZ in a Neutral condition. There is no trade this week in GLD.

BTC (Bitcoin) ended the week lower. It is still trading within the TZ and in a Neutral condition. There is no trade in BTC this week.

Now, here are the latest charts…

SPY (SPDR S&P 500 ETF)

QQQ (Invesco NASDAQ 100 ETF)

ARKK (ARK Innovation ETF)

GLD (SPDR GOLD ETF)

BTC (Bitcoin)

Have a good trading week,

Thomas Meyer, Editor